Gold Price Forecast: XAU/USD displays a rangebound move above $1,710, Fed Powell’s speech eyed

- Gold prices are displaying topsy-turvy moves as the focus shifts to Fed Powell’s speech.

- Softening consumption by US households has weakened the DXY.

- The Fed will continue its restrictive policy stance until it sees months of a slowdown in the inflation rate.

Gold price (XAU/USD) is displaying a lackluster performance as investors are awaiting the speech from Federal Reserve (Fed) chair Jerome Powell. The precious metal is oscillating in a range of $1,713.53-1,719.50 in the Asian session.

On Wednesday, the gold prices delivered a stellar rally after hitting a low of $1,691.46. Investors poured funds into the precious metal after oscillators turned extremely oversold on lower timeframes. Apart from that, the minutes from Fed’s Beige Book weakened the greenback. Fed banks believe that price pressures have softened the consumption pattern. The households have postponed the demand for durable goods due to higher payouts.

Meanwhile, the US dollar index (DXY) has displayed a pullback move after a vertical fall. The DXY has scaled to near 109.80 but is likely to display back-and-forth moves ahead of Fed Powell’s speech. The minutes from Beige Book dictate that price pressures have moderated in a few districts, however, the impact is far from over. Despite sensing exhaustion in inflationary pressures, the Fed will continue its restrictive policy stance until it sees months of a slowdown in the inflation rate.

Gold technical analysis

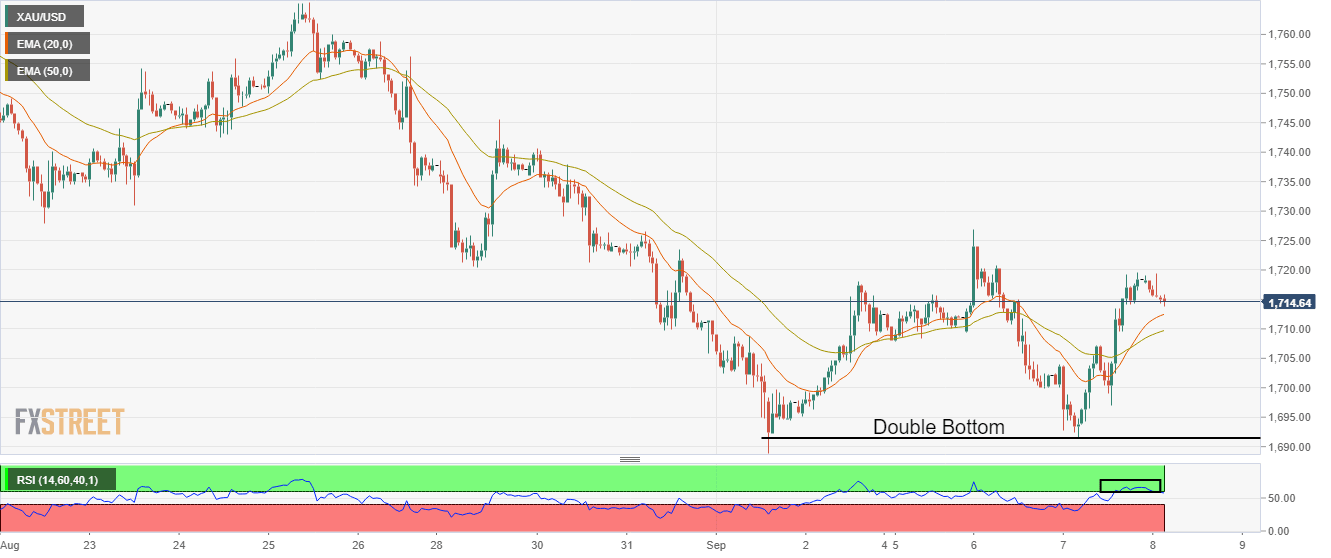

On an hourly scale, gold prices have rebounded firmly after successfully testing the previous lows near $1,690.00 with lower selling pressure. A Double Bottom formation is followed by a strong rally, which indicates a bullish reversal, and more gains are expected ahead.

The 20-and 50-period Exponential Moving Averages (EMAs) have delivered a bullish crossover at $1,707.00, which indicates more upside ahead. Also, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00, which signals a continuation of upside momentum.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.