Gold Price Forecast: XAU/USD continues to remain sideways around $2,050 as focus turns to US job data

- Gold price is in a sideways auction around $2,050.00 ahead of the US Employment data.

- The Fed is likely to restrict itself from raising rates further amid deepening US banking crisis, and slower growth rate.

- Gold price is building a base near the demand zone plotted in a narrow range around $2,050.00.

Gold price (XAU/USD) is showing signs of volatility contraction around $2,050.00 in the Asian session. The precious metal is struggling to make a decisive move as investors are awaiting the release of the United States Nonfarm Payrolls (NFP) data for further action.

The US Dollar Index (DXY) is failing to find an intermediate cushion and is declining firmly. The USD Index has dropped to near 101.16 as the Federal Reserve (Fed) is likely to restrict itself from raising interest rates further amid deepening US banking crisis, slower growth rate, and easing US labor market conditions.

On Thursday, weekly Initial Jobless Claims for the week ending April 28 jumped to 242K vs. the consensus of 240K and the former release of 229K.

However, the street would get more clarity after the release of the US Nonfarm Payrolls (NFP) data. As per the consensus, the US labor market witnessed a fresh addition of 179K payrolls in April, which was lower than former additions of 236K. The catalyst that will hijack the attention of investors would be the Average Hourly Earnings data. The street is anticipating steady earnings numbers, however, a better-than-expected print would renew fears of recovery in inflationary pressures.

Apart from that any development on debt ceiling concerns would turn the USD Index extremely volatile.

Gold technical analysis

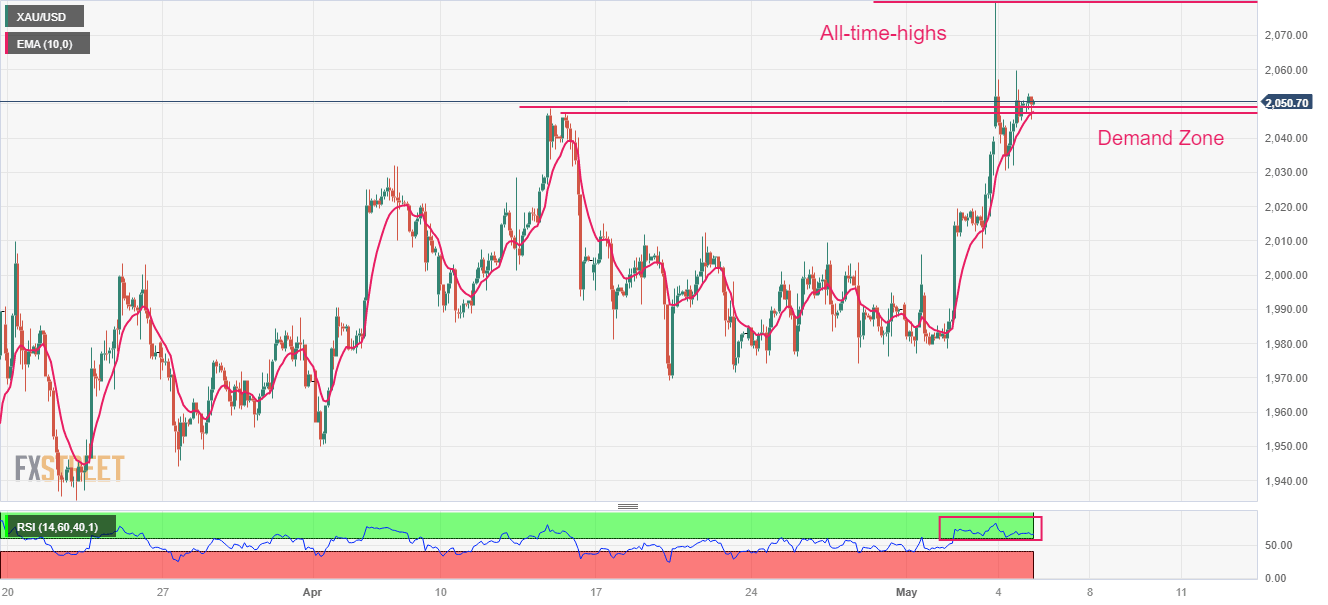

Gold price is building a base near the demand zone plotted in a narrow range around $2,050.00 on a two-hour scale. The precious metal fell sharply after printing an all-time high of $2,079.77. The 10-period Exponential Moving Average (EMA) at $2,047.00 is providing cushion to the Gold bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is still oscillating in the bullish range of 60.00-80.00, indicating that the upside bias is holding momentum.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.