Gold Price Forecast: XAU/USD recaptures 200-DMA as US dollar drops with yields

- Gold fluctuates around monthly top as bulls battle the key hurdle to the north.

- DXY seesaws amid reflation concerns, covid woes and Powell’s testimony.

- World Bank conveys fears over Asia-Pacific jabbing, accepts China’s fundamental strength.

- Fed's Chair speech 2.0, virus updates and second-tier US data will be the key.

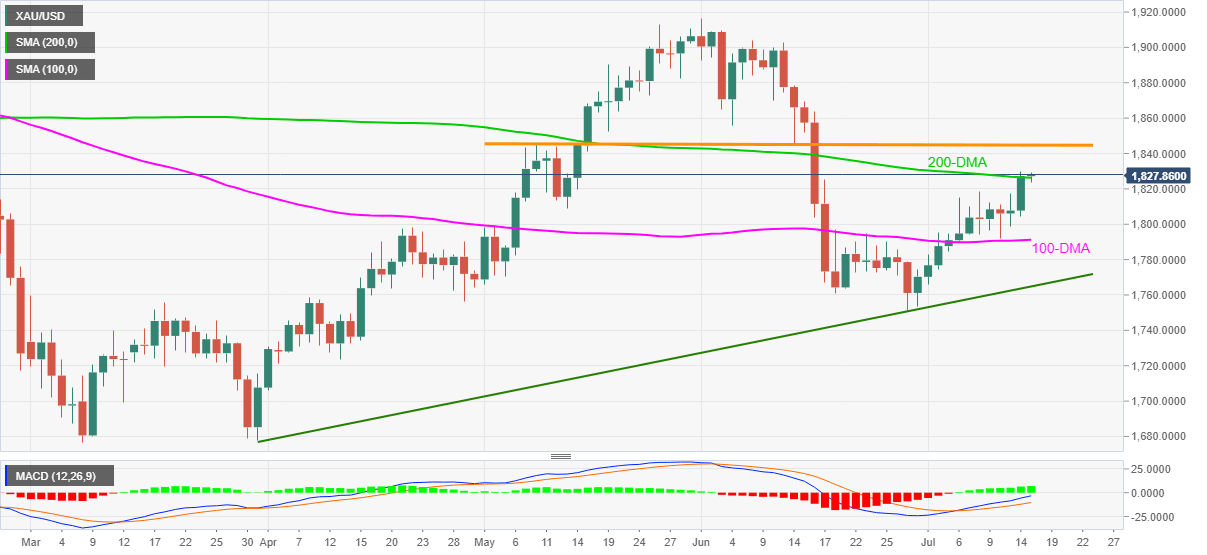

Update: The gold price is looking to extend Wednesday’s rally towards the 100-Daily Moving Average (DMA) at $1838, having found a strong foothold above the critical 200-DMA at $1826. However, a daily closing above the latter is critical to unleashing additional upside for gold price.

Fundamentally, the relentless drop in the US Treasury yields fuelled renewed weakness in the dollar, offering a fresh impetus to gold bulls. US Treasury yields are tumbling into the dovish remarks from the Fed Chair Jerome Powell during his Congressional testimony on Wednesday. Powell said that the economy is "a ways off" from the bond taper. Earlier in the Asian session, the gold price fell to a daily low of $1824 after the greenback attempted a bounce amid concerns over slowing Chinese growth and the rapid spread of the Delta covid variant on both sides of the Atlantic. Gold traders now await the US economic data and Powell’s testimony before the Senate Banking Committee later on Thursday for fresh trading momentum.

Gold (XAU/USD) bulls take a breather around $1,826 as European traders brace for Thursday’s bell. In doing so, the yellow metal clings to the key 200-DMA resistance after rising the most in six weeks to refresh the monthly high.

Gold buyers cheered the US dollar weakness the previous day after Federal Reserve (Fed) Chairman Jerome Powell rejected the need for monetary policy adjustments. The policymaker also said that the Fed would give “lots of notice” before tapering and/or rate hikes.

However, the US Dollar Index (DXY) probed bears afterward as the strong US Producer Price Index (PPI), preceded by the upbeat Consumer Price Index (CPI), pushed traders to turn blind-eyed over Powell’s remarks.

Also putting the safe-haven bid under the greenback were the COVID-19 concerns as the variants of the virus take on the developed economies and the jabbing is still slow in Asia-Pacific. This pushes the World Bank Group President David Malpass to say, per Reuters, “vaccine shortages mean many countries in East Asia and Pacific may not fully vaccinate population until 2024 even as new variants emerge.” The policymaker also trimmed East Asia-Pacific GDP growth to 4.0% versus 4.4% expected in March.

It’s worth noting that the UK registered the highest infections since January and Tokyo also marked the biggest jump in daily cases since May. Further, Indonesia, unfortunately, leads Asia on virus outbreak tally whereas, Australia has already stretched covid-led local lockdowns.

Amid the COVID-19 fears and expectations that the Fed stays on the way to tapering, S&P 500 Futures remain pressured and so does the US 10-year Treasury yield. However, the US Dollar Index retreats as traders await more clues for fresh direction.

Hence, Powell’s second-round of testimony and covid updates, not to forget weekly US Jobless Claims and Philadelphia Fed Manufacturing Index figures, will be the key for gold buyers as any further recovery of the US dollar may probe the latest uptick of the metal prices.

Technical analysis

Gold prices remain directed towards the two-month-old horizontal resistance, surrounding $1,845, as MACD adds to the bullish bias and the commodity trades successfully above 100-DMA.

It should be noted, however, that the fresh buying may wait for a clear break of $1,826, comprising 200-DMA.

Alternatively, the $1,800 threshold may offer immediate support during the quote’s pullback moves ahead of the 100-DMA level of $1,791.

Though, a daily closing below $1,791 won’t hesitate to attack an ascending support line from March-end, near $1,764.

Gold: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.