Gold Price Forecast: XAU/USD remains on the defensive near $1800 mark

- Gold snaps two-day uptrend to consolidate the biggest daily jump in a week.

- US Treasury yields recover after declining the most since mid August.

- US Inflation data fails to tame the tapering chatters despite easing in August.

- Gold Price Forecast: XAU/USD jumps above range on falling yields, eyes $1820

Update: Gold struggled to capitalize on the previous day's post-US CPI strong move up from two-week lows and faced rejection near the very important 200-day SMA on Wednesday. The modest intraday pullback dragged the XAU/USD to fresh daily lows during the early European session, though lacked follow-through below the $1,800 mark. A positive risk tone, along with a modest uptick in the US Treasury bond yields, acted as a headwind for the non-yielding yellow metal, though a combination of factors helped limit the downside.

Tuesday's sofer-than-expected US consumer inflation figures eased fears for an earlier tapering by the Fed. Apart from this, worries about the fast-spreading Delta variant and a global economic slowdown extended some support to traditional safe-haven assets, including gold. The market concerns were further fueled by Wednesday's disappointing Chinese macro data, which underscored recent signs of slackening economic momentum in the world's second-largest economy. This, in turn, warrants some caution for bearish traders.

Previous update: Gold prices stall gains near $1,800 after hitting a one-week high on Tuesday. The drop in the US benchmark US Treasury yields supported the current upside movement in the prices the previous day. The movement was primarily sponsored after the softer-than-expected rise in US Inflation data revealed yesterday, which raised the doubts over the Fed’s timeline to taper monetary stimulus.

Weaker equity market and concerns on the rapid spread of the coronavirus delta variant and its impact on the global economic recovery continue to lend support near the lower levels.

Gold takes cues from the major central bank’s views on tapering and economic stimulus. The strength of the US dollar keeps the precious metal gains under check. A higher USD valuation makes gold expansive for other currencies holders.

End of update

Gold (XAU/USD) fades the strongest run-up in a week above $1,800, down 0.15% intraday around $1,801, during Wednesday’s Asian session.

The yellow metal jumped to the week’s high, also broke the monotony surrounding $1,800, after the US Consumer Price Index (CPI) miss clouded Fed tapering concerns the previous day. Even so, a recheck of the details suggests that the inflation figures are high enough to favor Fed hawks when they meet the next week.

The US CPI dropped the most since January on monthly basis to 0.3% versus 0.4% expected and 0.5% prior. The CPI ex Food & Energy also dropped below 0.3% expected and previous readings to 0.1% during August, marking the biggest fall in six months. Fed’s readiness to accept a bit higher inflation figures, terming it ‘transitory’, seems to be at test with almost double YoY figures than the US central bank’s previous target range of near 2.0%.

Following the key data release, the US 10-year Treasury yields dropped the most in a month before recently recovering to 1.29%. It should be noted that the S&P 500 Futures print mild gains by the press time even as the Wall Street benchmarks closed in the red the previous day.

In addition to the re-think over the Fed tapering, covid woes and geopolitical tensions also weigh on the market sentiment, underpinning the safe-haven demand of the US Treasury bonds, which in turn weigh on its yields.

Although the virus numbers from the Asia-Pacific region have eased of late, slower jabbing and doubts over the Delta variant spread challenge the market sentiment. Also weighing on the risk appetite, as well as gold, are hurricanes in the US and political tension in Canada and the Middle East.

Looking forward, gold traders will keep their eyes on the more clues to confirm the next week’s tapering from the Fed. The same highlights Thursday’s Retail Sales and Friday’s Michigan Consumer Confidence. For today, risk catalysts and the US Industrial Production for August, expected to ease from 0.9% to 0.5%, could offer intermediate moves.

Technical analysis

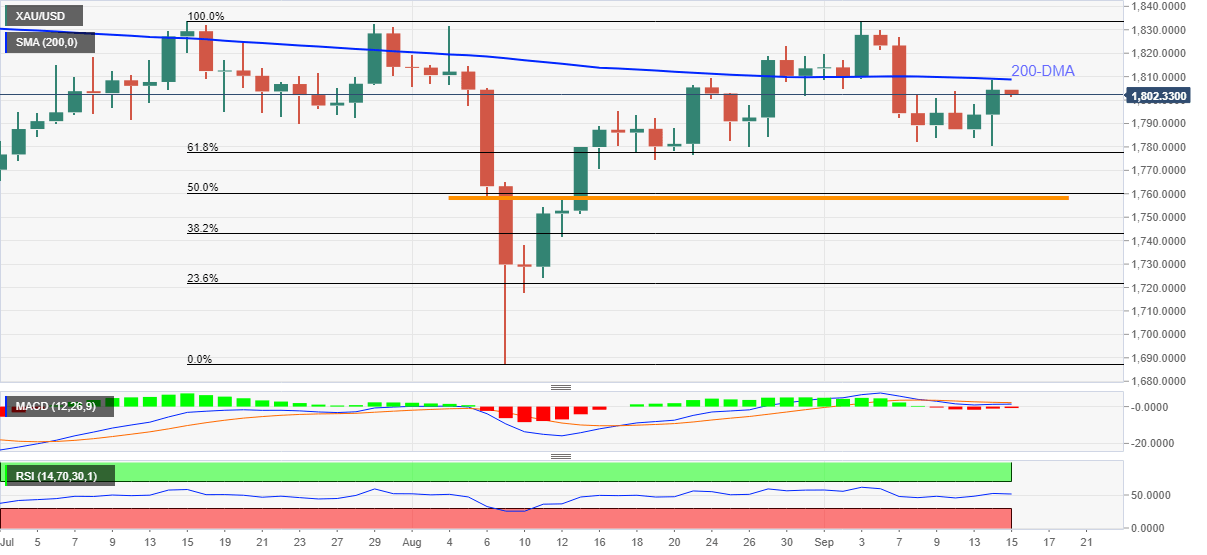

Despite crossing an immediate trading range between $1,782 and $1,804, gold prices failed to provide a daily closing beyond the 200-DMA level near $1,809.

Also challenges the gold buyer is the sluggish MACD and RSI conditions, as well as double tops surrounding $1,834.

Meanwhile, 61.8% Fibonacci retracement of July-August fall, around $1,777, adds to the downside filters, other than the multiple lows marked recently near $1,782.

It’s worth observing that five-week-old horizontal support of around $1,758 will challenge gold bears below $1,777.

Overall, gold remains firmer but needs to cross the 200-DMA for giving controls to the bulls.

Gold: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.