Gold Price Forecast: XAU/USD eases towards $1,750 amid sour sentiment

- Gold picks up bids to refresh one-week high, prints three-day uptrend.

- S&P 500 Futures track Wall Street gains amid stimulus hopes, softer USD.

- Fed tapering concerning, China headlines will be the key ahead of the US NFP.

- Gold Weekly Forecast: XAU/USD appears ‘sell on bounce’ ahead of all-important NFP

Update: Gold (XAU/USD) pares intraday gains near a one-week high during early Monday, up 0.16% on a day near $1,763 by the press time.

Fresh fears concerning the US-China trade relations and the suspension of the Evergrande shares in Hong Kong probe gold buyers of late. On the same line were concerns over the US debt ceiling talks as the policymakers remain feared after Democrats had to step back from the voting on the bill on Thursday.

Even so, off in China and US President Joe Biden’s readiness to “work like hell” for the stimulus and debt ceiling solution keep buyers hopeful.

That said, the US 10-year Treasury yields remain pressured but the S&P 500 Futures print mild losses amid challenges over Evergrande.

Given the off in Beijing and indecision over US stimulus, not to forget cautious mood ahead of Friday’s US NFP, gold traders may witness a lackluster day with the US Factory Orders for August, expected 0.9% versus 0.4%, likely acting as a second-tier catalyst to watch.

End of update.

Gold (XAU/USD) stays firmer around $1,765, up 0.20% intraday, as bulls conquer a monthly hurdle during early Monday morning in Asia. In doing so, the metal extends the last week’s rebound amid hopes of stimulus and softer US dollar ahead of the key Nonfarm Payrolls (NFP).

While shrugging off the difference inside the Democratic Party, which led to pulling back the vote on the infrastructures spending bill on Thursday, US President Joe Biden said, per Reuters, that he’ll work like hell to get both an infrastructure bill and a multi-trillion-dollar social spending bill passed through Congress.

On the same line, Forbes came out with the news quoting House Speaker Nancy Pelosi’s new October 31 deadline for Congress to pass a $1.2 trillion infrastructure package. However, Reuters cites a White House Adviser while portraying disappointment from Democrats as Republicans gain external support to stop the much-awaited stimulus.

Furthermore, Bloomberg came out with the news citing China’s efforts to limit the fallout, signaling it’s willing to prop up healthy developers, homeowners and the real estate market at the expense of global bondholders.

Elsewhere, the US criticized China’s activity near Taiwan and is up for conveying the dislike for Beijing’s lack of performance on the phase one trade deal

Amid these plays, S&P 500 Futures rise 0.40% intraday by the press time while tracking Friday’s Wall Street gains.

It’s worth noting that the downbeat US Treasury yields weighed on the US Dollar Index (DXY) to underpin the gold buying of late. Some on the street also consider the gold dethroning the USD as a haven but the clarity over which remains absent as Fed tapering concerns join geopolitical woes from China and the covid fears.

Moving on, this week’s US jobs report will be important even though Fed Chair Jerome Powell showed readiness to accept softer numbers while reiterating the hawkish bias for Fed tapering. However, the policymaker rejected the rate hike concerns citing the virus-led challenges to employment. Hence, any further weakness in the US jobs report may extend the latest consolidation in the US dollar and help the gold buyers looking forward.

Technical analysis

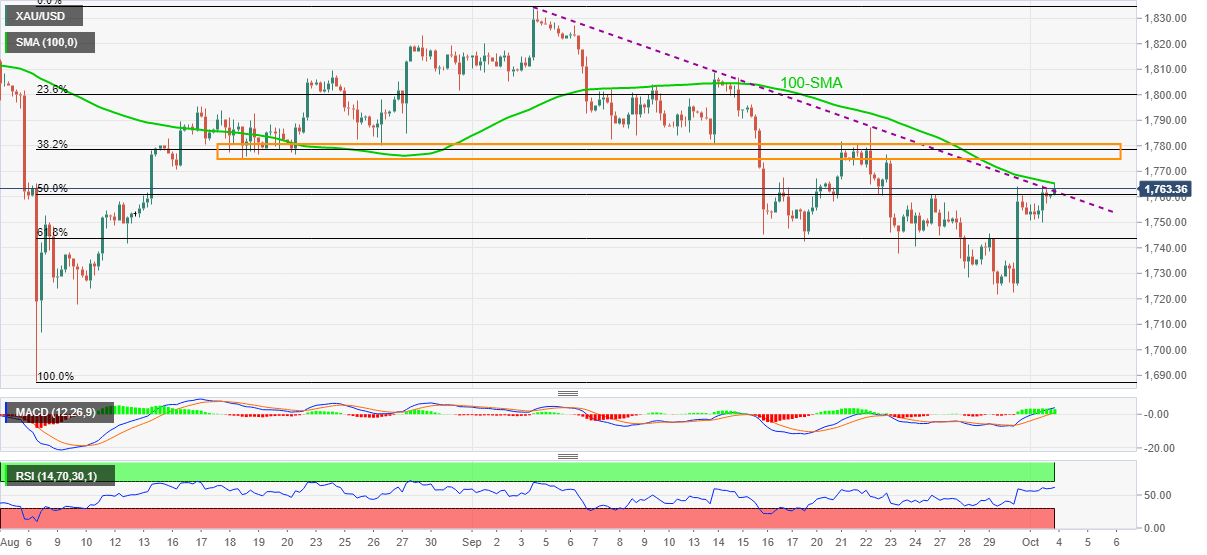

Gold breaks a monthly resistance line during the three-day upside but the 100-SMA level surrounding $1,765 challenges the metal buyers of late.

Given the bullish MACD signals and upbeat RSI conditions, not overbought, gold prices may remain firmer towards a seven-week-old horizontal resistance near $1,780.

Should the quote manages to remain stronger past $1,780, the $1,806 and the $1,821 levels may probe the upside momentum targeting the last month’s high near $1,834, part of the “double top” formation, will be crucial to watch.

Meanwhile, pullback moves may drop back below the previous resistance line near $1,760, targeting 61.8% Fibonacci retracement of August-September upside close to $1,743.

Though, the latest swing low surrounding $1,721 may challenge the gold bears after $1,743, if not then the odds of witnessing the sub-$1,700 area can’t be ruled out.

Gold: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.