Gold Price Forecast: XAU/USD cheers China-led risk-on mood on the way to $1,800, focus on Fed

- Gold retreats after two-day uptrend sidelined of late.

- Hopes that China will save Evergrande, US debt limit expiry will be extended favor buyers.

- Fed tapering concerns, geopolitical fears keep sellers hopeful ahead of multiple resistances.

- Gold Price Forecast: Further advances depend on the Fed

Update: Gold (XAU/USD) regains upside momentum after a sluggish start to the key day. That said, the yellow metal rises for the fourth consecutive day, up 0.10% around $1,776 during early Wednesday.

Although the pre-Fed cautious challenged gold buyers earlier in Asia, China’s heavy liquidity injection and Evergrande news suggesting the ability to pay coupons on expiry recently favored the risk-on mood, also the metal prices.

Earlier in the day, the International Monetary Fund’s (IMF) Chief Economist Gita Gopinath also sounded optimistic over China’s ability to tame the fears emanating from the real-estate firm. On the same line were hopes of the extension to the US debt limit expiry the House votes 217-207 to favor temporary government funding and debt limit increase debate.

While headlines concerning China and Evergrande may entertain gold traders, markets may witness sluggish moves ahead of the Fed decision.

End of update.

Gold (XAU/USD) bulls take a breather around $1,775, following a three-day uptrend during the key Wednesday’s Asian session. In doing so, the metal fades bounce off the mid-August levels while trading sideways of late.

Markets turn cautious, mostly inactive, as the Federal Reserve (Fed) prepares for the Federal Open Market Committee (FOMC) monetary policy meeting announcement. Recently mixed data contrasts the Fed policymakers’ hawkish bias to confuse traders. Goldman Sachs recently backed the Fed tapering announcement and challenged the gold buyers. On the same line could be firmer US housing market data, namely Housing Starts and Building Permits for August, which backed hopes of hearing the word taper from the US Fed in Wednesday’s meeting.

Also important is the return of China after a long weekend amid chatters that the dragon nation will save its biggest real-estate player. Evergrande Chairman and the International Monetary Fund’s (IMF) Chief Economist Gita Gopinath also sound optimistic in his latest speech and supported the brighter concerns.

It’s worth noting that the UK, Australia and US securities pact, followed by Bloomberg’s news stating that the European Union (EU) and the US aim to pledge more enforcement to curb China risk, add to the market’s fears and weigh on gold prices.

Also previously adding to the risk-on mood were the hopes of stimulus, as hinted by House Speaker Nancy Pelosi, as well as the US Democratic Party’s push to suspend the debt ceiling. Recently, the US House votes 217-207 to favor temporary government funding and debt limit increase debate.

While portraying the mood, US equities closed mixed while the 10-year Treasury yields rose 1.9 basis points (bps) to 1.328% by the end of Tuesday’s North American session. That said, S&P 500 Futures drop 0.25% by the press time whereas US Dollar Index (DXY) also portrayed the sluggish mood while keeping the previous day’s pullback from the monthly top on Tuesday.

Moving on, monetary policy decisions from the People’s Bank of China (PBOC) and the Bank of Japan (BOJ) may entertain gold traders, as well as chatters relating to Evergrande. However, the Fed decision will be crucial for gold traders. Should the US central bank hint at tapering, gold prices may have to bear the burden of the likely US dollar upside.

Read: Fed Preview: Three ways in which Powell could down the dollar, and none is the dot-plot

Technical analysis

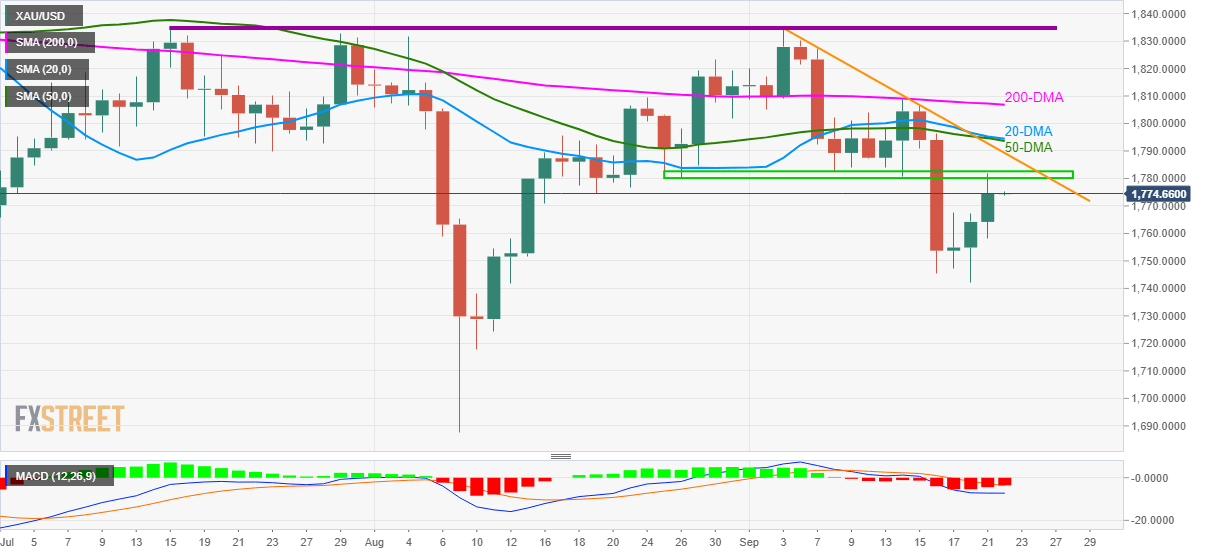

Gold retreats from the monthly horizontal hurdle, following a three-day rebound from the lowest levels in six weeks.

Not only a failure to cross the horizontal area from late August, around $1,780-82, but bearish MACD signals also keep gold sellers hopeful.

Even if the metal crosses the $1,782 hurdle, a downward sloping trend line from September 03, near $1,789, precedes a convergence of 20 and 50 DMAs close to $1,795 to challenge the gold bulls.

Additionally, 200-DMA and the famous double tops, respectively around $1,807 and $1,834, act as extra hurdles to the north.

On the contrary, the latest swing lows around $1,742 and August 10 bottom close to $1,717 may lure the gold sellers during fresh downside.

However, the $1,700 threshold and the yearly low of $1,687 may restrict the metal’s weakness afterward.

Overall, gold had many challenges to sustain before convincing the bulls.

Gold: Daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.