Gold Price Forecast: XAU/USD bounded between H1 support and resistance over ECB rate hike

- The Gold price is offering two-way price action over the ECB.

- The Gold price broke the structure to the upside on Wednesday and we are seeing some consolidation of that.

- An extension to the bullish trend could unfold in the coming hours/sessions with $1,940 eyed.

Gold Price is two-way over the European Central bank interest rate decision. The initial reaction to the 50 basis point Refinancing Rate hike was a drop to test $1,926 before returning to $1,930.

ECB rate hike

- Main refi rate at 3.50% vs 3.00% prior.

- Raises interest rate on marginal lending facility to 3.75% vs 3.25% prior.

- Deposit facility to 3.00% vs 2.50% prior.

ECB statement key notes

- Refrains from signalling future rate moves in statement.

- Inflation projected to remain too high for too long.

- Headline inflation expected to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025.

- Forecasts done before market turmoil.

- Elevated level of uncertainty reinforces importance of a data-dependent approach to ECB policy decision, which will be determined by its assessment of inflation outlook in light of incoming data and dynamics.

- Banking sector sector is resilient, with strong capital and liquidity positions

- Policy toolkit is fully equipped to provide liquidity support to eurozone financial system if needed.

Meanwhile, markets are now pricing the terminal rate at 3% and the Euro is under pressure.

Markets will now turn to the ECB Governing Council Press Conference:

Watch Live: ECB Governing Council Press Conference

ECB President Christine Lagarde explains the Governing Council's monetary policy decisions and will answer questions from journalists at the Governing Council press conference to be held on 16 March 2023 at 14:45 CET in Frankfurt am Main. The key will be how the governor guides the markets in terms of the path of rate hikes given the lack of substance in the statement.

Elsewhere, the attention is on the banking sector crisis which is supportive of the Gold price as global yields take a knock in anticipation of less hawkish sentiment surrounding the Federal Reserve.

Credit Suisse said on Thursday it would borrow up to $54 billion from the Swiss National Bank to shore up liquidity and investor confidence, after its shares on Wednesday plunged as much as 30%. However, while the news helped to stem some heavy selling in Asia trade, market sentiment remained fragile.

Two supervisory sources told Reuters that the ECB has contacted banks on its watch to quiz them on their exposure to Credit Suisse.

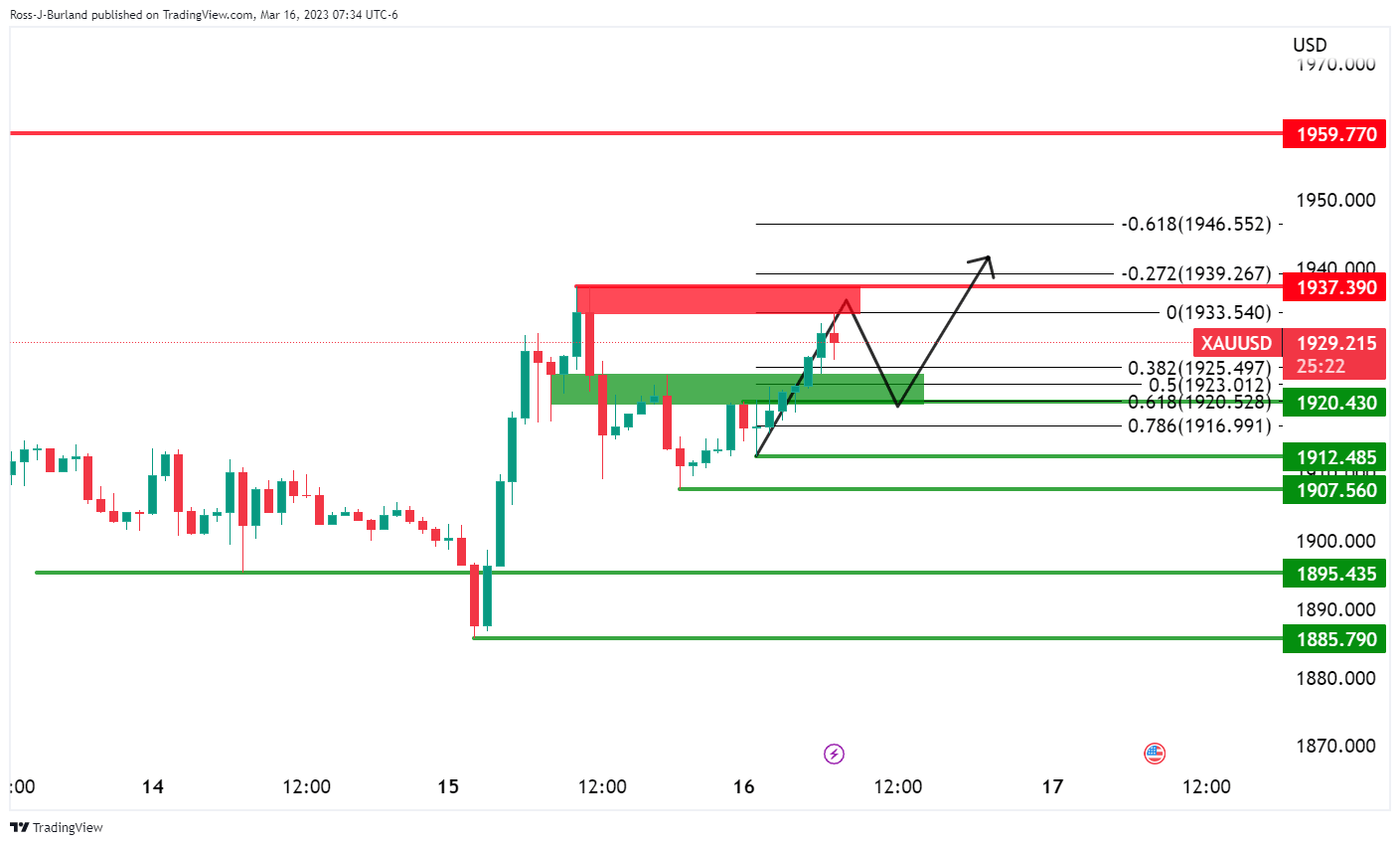

Gold technical analysis

The Gold price broke the structure to the upside on Wednesday and we are seeing some consolidation of that. However, should the support near a 61.8% Fibonacci retracement hold, then with bullish commitments, we could see an extension of the bullish trend unfold in the coming hours/sessions with $1,940 eyed.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.