Gold Price Forecast: XAU/USD trims intraday gains below $1,750 amid subdued session, US CPI eyed

- Gold fades bounce off four-month low as US stimulus passage, Fed’s tapering tantrums propel greenback despite budget questions.

- Firmer USD, stronger equities dim gold’s safe-haven demand.

- Covid woes in Asia, largest customers, also challenge the bulls.

- Gold Weekly Forecast: Eyes $1,750 on NFP-inspired USD strength

Update: Gold (XAU/USD) consolidates recent losses above $1,700, up 0.28% intraday around $1,733, ahead of Wednesday’s European session. In doing so, the commodity justifies the previous day’s Doji candlestick formation to portray the biggest daily gains, for now, in two weeks.

The US dollar pullback and cautious sentiment ahead of the US Consumer Price Index (CPI) data triggered gold’s corrective pullback earlier in Asia. However, the metal fails to keep the upside momentum as European traders brace for German inflation and the covid woes are back on the table.

It’s worth mentioning that US Repubilcans’ readiness to stall budget talks and not support Democrats also eased the greenback a bit and helped the gold price a bit before the latest pullback.

Gold (XAU/USD) bounces off intraday low towards regaining $1,730 level, up 0.06% on a day during a bearish consolidation play amid early Wednesday. Even so, the yellow metal remains on the back foot, fading the corrective pullback from the multi-day bottom, marked on Monday, amid broad US dollar strength.

The US Dollar Index (DXY) printed a four-day winning streak to poke July’s high as the passage of US President Joe Biden’s infrastructure spending joins Fed policymakers’ cautious optimism, favoring concerns over tapering and rate hike.

The greenback gauge recently eased as the US Republicans pledged, as per the Wall Street Journal (WSJ), to not support Democrats over the debt ceiling plan. This indicates further policy deadlocks and the risk of the US government offices shut-down as the current budget plans expired in early August. House Majority Leader Steny Hoyer conveyed the policymakers’ readiness to return early from the break to tackle the budget concerns if passed by the Senate.

On the other hand, comments from US Atlanta Federal Reserve President Raphael Bostic, Richmond Fed President Thomas Barkin and Chicago Fed President Charles Evans signal that the tapering is a favorite among the Fed policymakers.

It’s worth mentioning that Australia’s successive record high infections and the recent jumps in the covid numbers from China and India, the world's largest customers of gold, exert additional downside pressure on the yellow metal prices.

To portray the market’s mood, the US 10-year Treasury yields remain firmer around a one-month high whereas S&P 500 Futures drop 0.11%, which in turn put a safe-haven bid under the DXY.

Although gold bears are likely to keep the reins, today’s US Consumer Price Index (CPI) for July, expected to ease from 0.9% MoM to 0.5%, will be important to determine short-term moves.

Read: US July CPI Preview: Inflation data unlikely to change Fed tapering expectations

Technical analysis

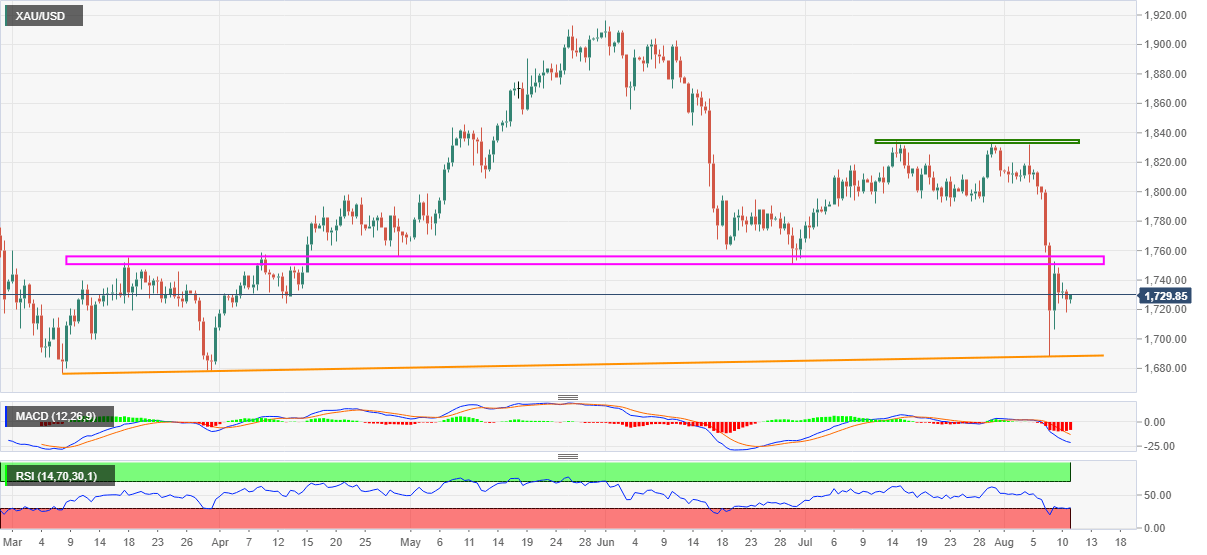

Although an ascending trend line from early March joined the oversold RSI conditions to challenge gold’s slump earlier in the week, bearish MACD and failures to cross a four-month-old horizontal hurdle keep the metal sellers hopeful.

The latest weakness aims for the $1,700 before the stated support line, around $1,688, question the gold bears.

In a case where the commodity prices remain weak past $1,688, the yearly low surrounding $1,676 and late April 2020 bottom close to $1,660 will be in focus.

Meanwhile, an upside clearance of the stated horizontal resistance around near $1,755-60 will direct the quote towards the late July lows near $1,789 and then to April’s peak of $1,798 before highlighting the $1,800 threshold.

If at all gold buyers keep reins beyond $1,800, double tops near $1,835 will be crucial to watch.

Gold: 12-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.