Gold Price Forecast: XAU/USD traders eye a correction before $1,850

- Gold prices seesaw around one-week high after four-day uptrend.

- US Treasury yields, DXY remains pressured despite 40-year high US inflation, hawkish Fedspeak, virus fears also test gold buyers.

- Fed policymakers’ speeches before the blackout period will be crucial for fresh impulse.

- Gold Price Forecast: Bulls maintain the pressure despite a better market mood

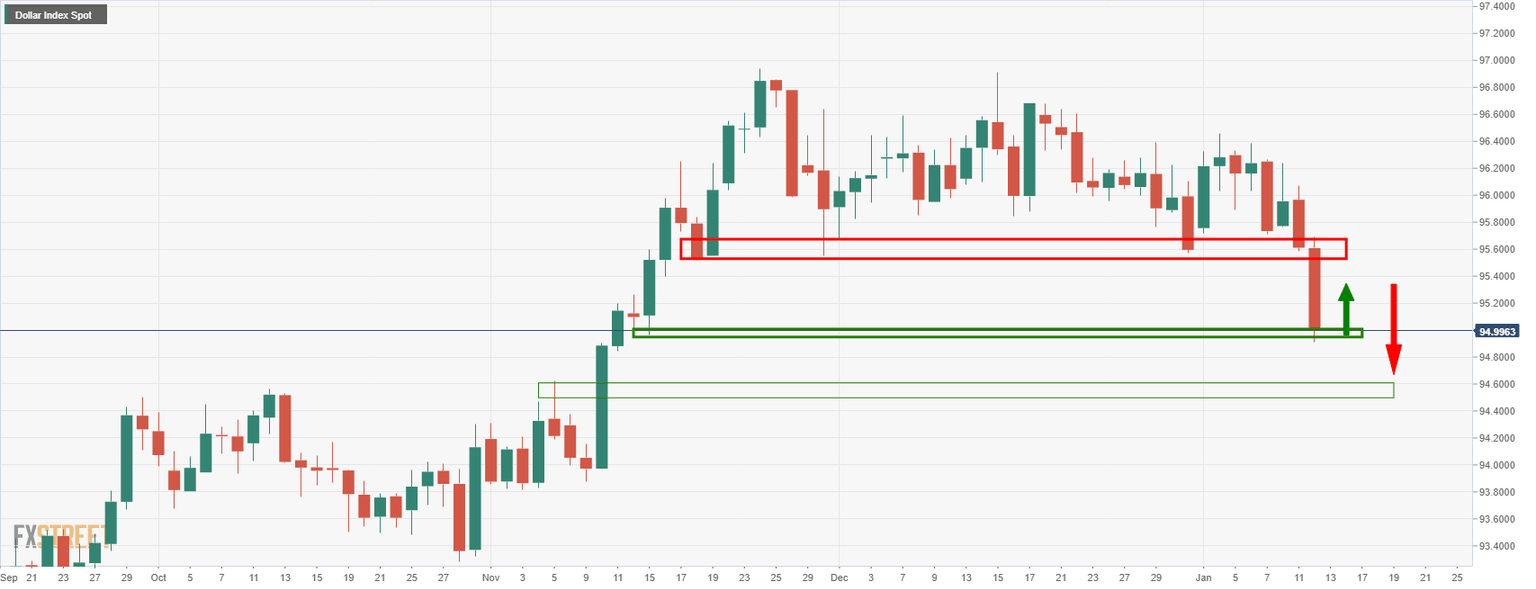

Update: Gold (XAU/USD) is flat in Asia as the markets consolidate the weakness in the greenback from overnight. The bears moved in despite prospects of a March hike taking the DXY index to a lower level of daily support as follows:

The move has left the price of the yellow metal in a bullish territory as follows:

The daily is printing a W-formation, however, so this could lead to a bearish correction to test the neckline support near to 41,815 in the coming sessions. Should this hold, then there will be a ficus on $1,850 again.

End of update

Gold (XAU/USD) buyers take a breather around the weekly top near $1,825-26 during the initial Asian session on Thursday. The yellow metal refreshed multi-day high on Wednesday after the US Treasury yields and the greenback marked a surprise fall despite a four-decade high inflation data, as well as hawkish Fedspeak.

That said, US CPI jumped to the highest levels since 1982 while matching 7.0% YoY forecasts, up from 6.8% previous readouts. The monthly figures rose to 0.5% versus 0.4% expected but softened below 0.8% prior.

After the US inflation data release, Federal Reserve Bank of St. Louis President James Bullard said, per Wall Street Journal (WSJ), “Four rate hikes in 2022 now appear to be on the table and, in the face of high inflation, a rate hike in March seems likely.” On the same line were comments from, Fed Board of Governors’ member and incoming Vice Chairman of the FOMC Lael Brainard who said, “Inflation control is Fed's most important task. Furthermore, White House Economic Adviser Brian Deese mentioned that supply chain issues are worse than expected, suggesting further inflation pressure.

Elsewhere, Japan witnesses the four-month high daily covid infections and is ready to push Tokyo towards the second highest COVID-19 alert level while Australian policymakers called for a snap Cabinet meeting to tackle the steady jump in the daily infections. Furthermore, the US and Europe aren’t behind the curve while China and India have also started reporting multi-day high daily covid numbers.

That said, the US Dollar Index (DXY) slumped to the lowest levels since November 11, also marking the biggest daily loss in nearly seven weeks. The US Treasury bond yields also marked a surprising extension of the previous weakness, which in turn propelled the Wall Street benchmark before the day-end pullback.

To sum up, the gold prices are likely consolidating November’s losses amid the softer yields and the US dollar. However, the fundamentals are against the bulls and hence incoming catalysts should be given higher attention while expecting a pullback. Among them, weekly prints of US jobless claims, monthly figures of the Producer Price Index (PPI) and Fedspeak can direct intraday moves while Friday’s US Retail Sales will be important too.

Read: Riding out inflation in style

Technical analysis

Gold refreshed one-week top post-US inflation data, extending the previous run-up beyond 100 and 50 SMAs. However, a descending resistance line from December 03, around $1,826, restricts the metal’s immediate upside.

Given the key SMA breakout, as well as bullish MACD signals and firmer RSI, gold buyers are likely to overcome the $1,826 immediate hurdle.

Following that, the 61.8% Fibonacci retracement (Fibo.) of November-December downside, near $1,830 and tops marked during July and September around $1,834 will be crucial to watch for gold’s further upside momentum.

Alternatively, pullback moves could eye 50 and 100-SMA region surrounding $1,805-08, a break of which will need validation from the $1,800 threshold to convince gold sellers.

During the quote’s downturn past $1,800, the 23.6% Fibo. level near $1,782, $1,770 and $1,762 will test the gold bears before directing them to December 2021 trough surrounding $1,753.

Gold: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.