Gold Price Forecast: XAU/USD eyes $1767 critical supply zone – Confluence Detector

- Gold extends Friday’s recovery moves from monthly low.

- Risk-on mood weighs on US dollar, stimulus, covid headlines entertain optimists.

- China’s Evergrande, German Election, US Durable Goods Orders eyed for fresh impulse.

- Gold Weekly Forecast: XAU/USD remains vulnerable amid hawkish Fed outlook

Update: Gold is easing off the higher levels, as the risk-on market environment amid ebbing China Evergrande fears and US stimulus optimism dulls the safe-haven appeal of the bright metal. Gold bulls also take a breather after the recent rebound from six-week lows, ahead of the Fedspeak and US Durable Goods Orders data.

According to the Technical Confluences Detector, gold is unable to clear out a powerful hurdle at $1760, which is the convergence of the pivot point one-day R1 and the SMA5 one-day. The next hurdle awaits at $1763, the confluence of the SMA100 one-hour and the Bollinger Band four-hour Middle. Further up, a dense cluster of healthy resistance levels stacks up around $1766-$1767, where the Fibonacci 61.8% one-week, SMA200 one-hour and pivot point one-day R2.

On the other side, immediate support is seen at the Fibonacci 23.6% one-day at $1754, below which the $1750 level could be put at risk. At that point, the Fibonacci 23.6% one-week collides with the Fibonacci 38.2% one-day and SMA10 four-hour. The last line of defense for gold bulls will be the critical Fibonacci 61.8% one-day at $1747.

Here is how it looks on the tool

Gold (XAU/USD) floats around $1,760, up 0.50% intraday, during the second consecutive daily upside ahead of Monday’s European session start. In doing so, the metal cheers US dollar weakness amid the risk-on mood. However, the recent consolidation in the market sentiment seems to poke the buyers by the press time.

Market optimism takes clues from US stimulus and welcome covid headlines from Japan, India and Australia. Also, the China-Canada prisoner swap recently eased the Sino-American tension by allowing Huawei founder’s daughter, also the firm’s Chief Financial Officer (CFO) to go home. It’s worth noting that the absence of Evergrande news and a bit of silence over the Fed tapering concerns add to the brighter risk appetite.

Meanwhile, China’s power cuts and energy crisis in the UK weigh on the sentiment. Further, fears that the Eurozone’s powerhouse will be in political limbo, due to the German election, challenge the risk-on mood.

Amid these plays, the US 10-year Treasury yields pull back from a three-month high whereas the S&P 500 Futures rise 0.38% intraday by the press time. Further, the US Dollar Index (DXY) snaps a three-week uptrend with a 0.05% intraday loss, recently easing to 93.20.

Given the major attention over the risk catalysts, today’s US Durable Goods Orders may fall short of entertaining the gold traders. However, optimistic forecasts for August can renew Fed’s tapering concerns and weigh on the gold prices.

Read: US Durable Goods Orders August Preview: Retail Sales have led the way

Technical analysis

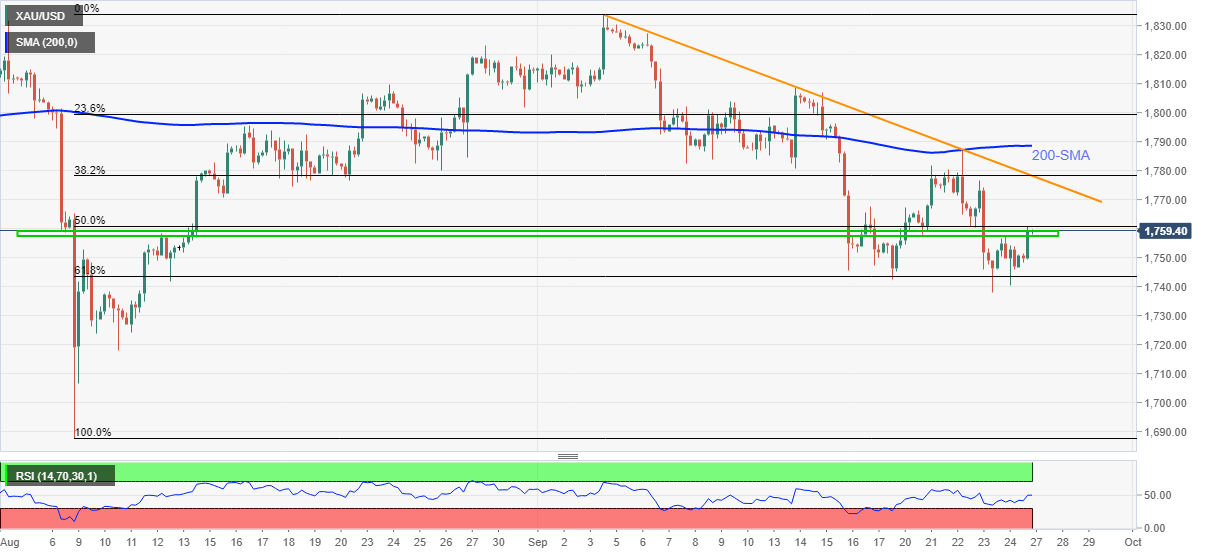

Gold keeps rebound from the golden Fibonacci retracement (Fibo.) level of 61.8% amid firmer RSI. However, multiple levels marked since early August joins 50% Fibo. to restrict the metal’s immediate upside to around $1,760.

Even if the gold prices rally beyond $1,760, a downward sloping trend line from September 03 and 38.2% Fibonacci retracement near $1,778 will precede the 200-SMA, near $1,788, to challenge bulls.

Meanwhile, pullback moves need to sustain below the 61.8% Fibo. level surrounding $1,743.

Following that, $1,724 and $1,718 may offer intermediate halts during the gold bears’ rush towards the $1,700 threshold, a break of which will highlight the yearly low of $1,687.

Gold: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.