Gold Price Forecast: XAU/USD aims to extend rally above $1,920 as Fed to ease policy tightening pace

- Gold price is looking to extend gains above $1,920.00 decisively amid weakness in the US Dollar Index (DXY).

- The Fed is expected to scale down the policy tightening pace amid declining inflation.

- S&P500 recorded a four-day winning streak, portraying a risk-on market mood.

Gold price (XAU/USD) has turned sideways after a juggernaut rally to near the critical resistance of $1,920.00 in the early Asian session on Monday. The precious metal witnessed substantial buying interest after surpassing the round-level resistance of $1,900 for the first time in eight months. Also, a sell-off in the US Dollar Index (DXY) supported a rally in the Gold price.

The risk profile remains upbeat as S&P500 recorded a four-day winning streak as the Federal Reserve (Fed) is set to trim its current policy tightening pace after a decent decline in December’s inflation report. However, the return generated by US Treasury bonds remains solid and gained to 3.50% despite the risk appetite theme. The US Dollar Index remained below 101.80 despite an improvement in United States Consumer Confidence data on Friday.

The University of Michigan released Consumer Confidence at 64.6 vs. the expectations of 60.5. The street is aware of the fact that retail demand has slowed down, therefore, the catalyst that has cheered consumers is the lower inflation led by lower gasoline prices.

Analysts at Wells Fargo see that the relief on the inflation front and wage growth is lifting spirits, but warn the still-sour buying conditions suggest the good vibes in this report may not translate into a spending surge.

Gold technical analysis

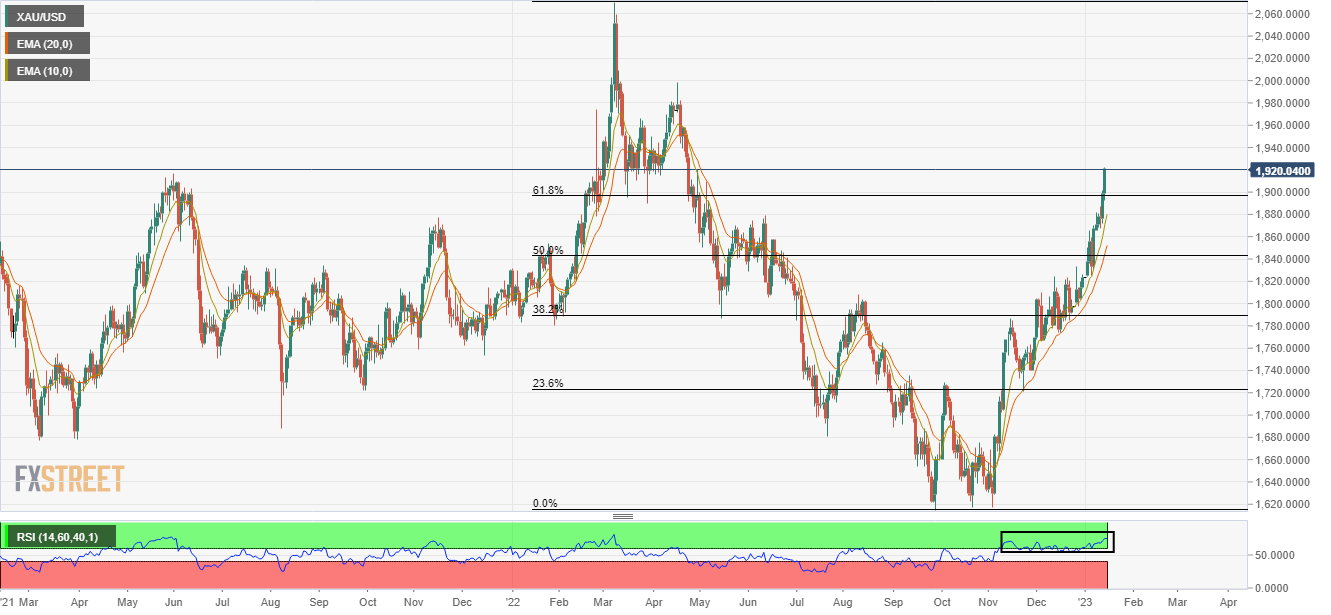

Gold price has scaled above the 61.8% Fibonacci retracement (placed from March 8 high at $2,070.54 to September 28 low at $1,614.85) at $1,897.42. The 10-and 20-period Exponential Moving Averages (EMAs) at $1,881.49 and $1,852.64 respectively are upward-sloping, which adds to the upside filters.

Also, the Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, which indicates that the upside momentum is active.

Gold daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.