Gold Price Forecast: XAU/USD teases $1,820 amid steady USD

- Gold prices were supported on a soft greenback and risk-on sentiment at the start of the week.

- Record low real rates are offering support to the precious metals in the immediate term.

Update:Gold prices edge lower on Tuesday after touching the $1,823 high in the previous session. The US Dollar index, which tracks the performance of the greenback stands steady at 92.0 despite the downbeat economic data. The higher USD valuations drive the precious metal lower. Investors risk appetite improve as worries over a Chinese regulatory crackdown eased. The riskier assets gain on the optimism, this, in turn, weighs on the gold prices. Further progress on the US $550 billion infrastructure package also boost the sentiments surrounding the greenback. Still, the lower US Treasury yields provide room for the continuation of the upside momentum in the precious metal. The lower readings add attractiveness to the non-yielding asset, also a rapid spread of the delta variant supports the demand for the gold on its safe-haven appeal.

At the time of writing, just ahead of the closing bell on Wall Street, XAU/USD is trading at $1,816.00 and higher by 0.1% after travelling from a low of $1,805.87 to a high of $1,819.56.

The dollar eased again on Monday, riding the ebbs and flows as markets continued to embrace risk following statements from Federal Reserve policymakers last week and conflicting subsequent comments after the event.

Overall, the market has speculated that the Fed is in no hurry to raise interest rates which is a green light for risk-on, denting the appeal of the greenback.

The dollar index, DXY, which measures the greenback against six major peers, was off 0.19% at 91.912 the lows but it has since recovered to a flat positing on the day, touching a high of 92.171.

The moves today reflect a softness from last week's 0.88% drop. This was the greenback's worst week since early May, as it turned away from a 3-1/2-month high a week before when traders were positioning for a speedy start of Fed tapering.

Fed Chair Jerome Powell said considerations of higher interest rates were "a ways away'' in presser which followed a hawkish turn in the statement with regards to timings of a taper.

However, the more dovish take on the Fed was affirmed on Friday when Fed Governor Lael Brainard said that "employment has some distance to go" to improve enough for the Fed to back away from support for the economy. Neel Kashkari has also advocated for a longer period of time before acting.

Meanwhile, US Treasury bond yields also slipped on Monday to 1.15%, taking real yields - adjusted for inflation - to record lows which is a supportive factor for the gold price.

Global stock indexes were up in morning trading in New York as improving prospects for passage of a US infrastructure bill encourage risk-taking.

US Senators introduced a sweeping $1 trillion bipartisan plan to invest in infrastructure, with some predicting the chamber could pass this week the largest public works legislation in decades.

Positive tones for the greenback

However, some analysts remain positive on the dollar and this week will be a critical one for the greenback in terms of data.

The less than inspiring Gross Domestic Product report of late as well as the miss in the Manufacturing PMIs today and Friday's PCE and the Fed's preferred measure of inflation rising only 0.4% MoM versus 0.6% expected, has not helped the greenback.

If there is going to be a rally, it is unlikely to resume in force until a more hawkish Fed narrative takes hold and data starts to reflect a faster pace of recovery.

Nevertheless, the US Nonfarm Payrolls data will be eyed this week and will be critical ahead of the Jackson Hole where some analysts are expecting a taper timing announcement.

Overall, analysts at Brown Brothers Harriman are bullish on the greenback and the US economy, explaining that the PMI readings of late, despite some misses of expectations, ''remain at historically high levels, signifying continued strength in the economy.''

'''Atlanta Fed GDPNow model just started estimating Q3 growth last Friday and clocks in at 6.1% SAAR. That's down slightly from the 6.5% reported for Q2 last week but is still well above the NY Fed's Nowcast reading of 4.19% SAAR for Q3. BBG consensus is 7.1% for Q3 but this is likely to edge lower after Q2 growth fell short of the 8.5% consensus,'' the analysts explained.

''The bar remains razor-thin for a pullback in gold, as the precious metals relatively weak price action, despite real yields hitting to new all-time lows, continues to signal there is a lack of impetus from speculators to buy the yellow metal,'' analysts at TD Securities argued.

''With the FOMC risk in the rearview, the gravitational pull of record low real rates is offering support to the precious metals in the immediate term.''

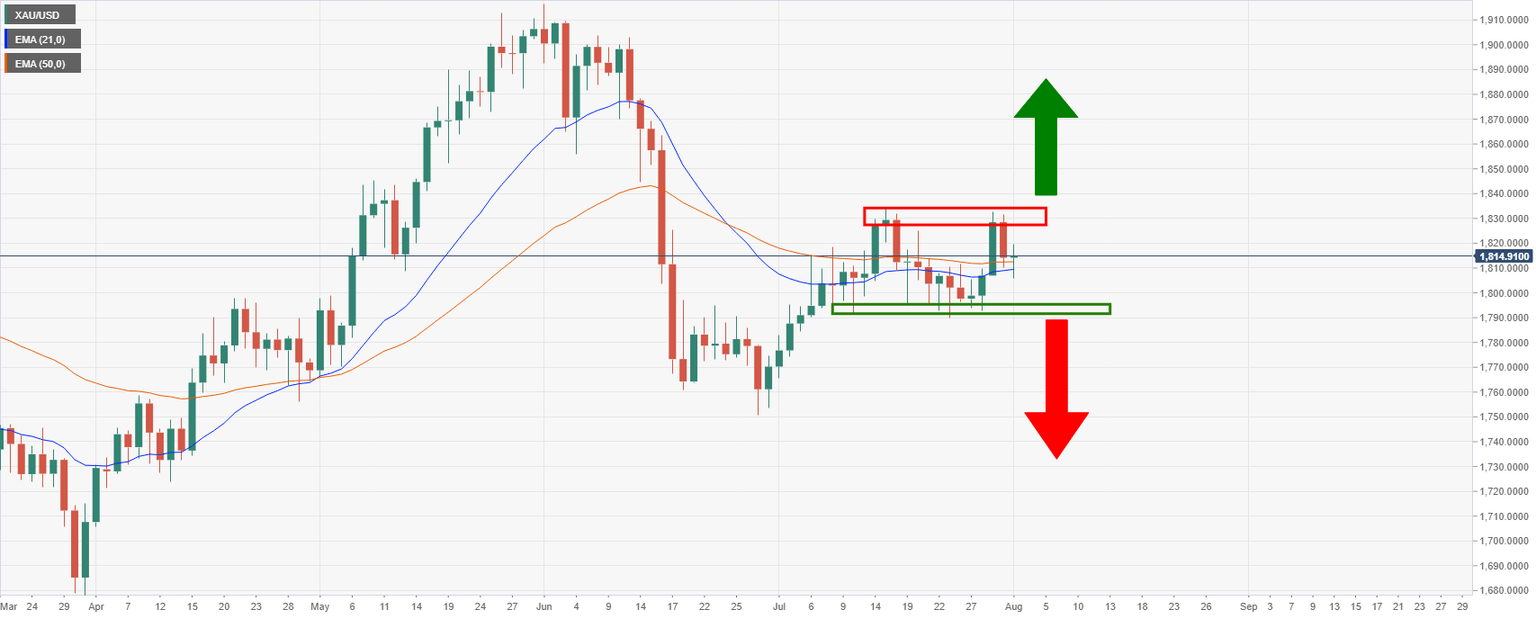

Gold technical analysis

From a daily perspective, it is make or break for the price of gold as its hovers around critical 21 and 50 EMA convergence and between support and resistance.

A break of either side would be a significant development.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.