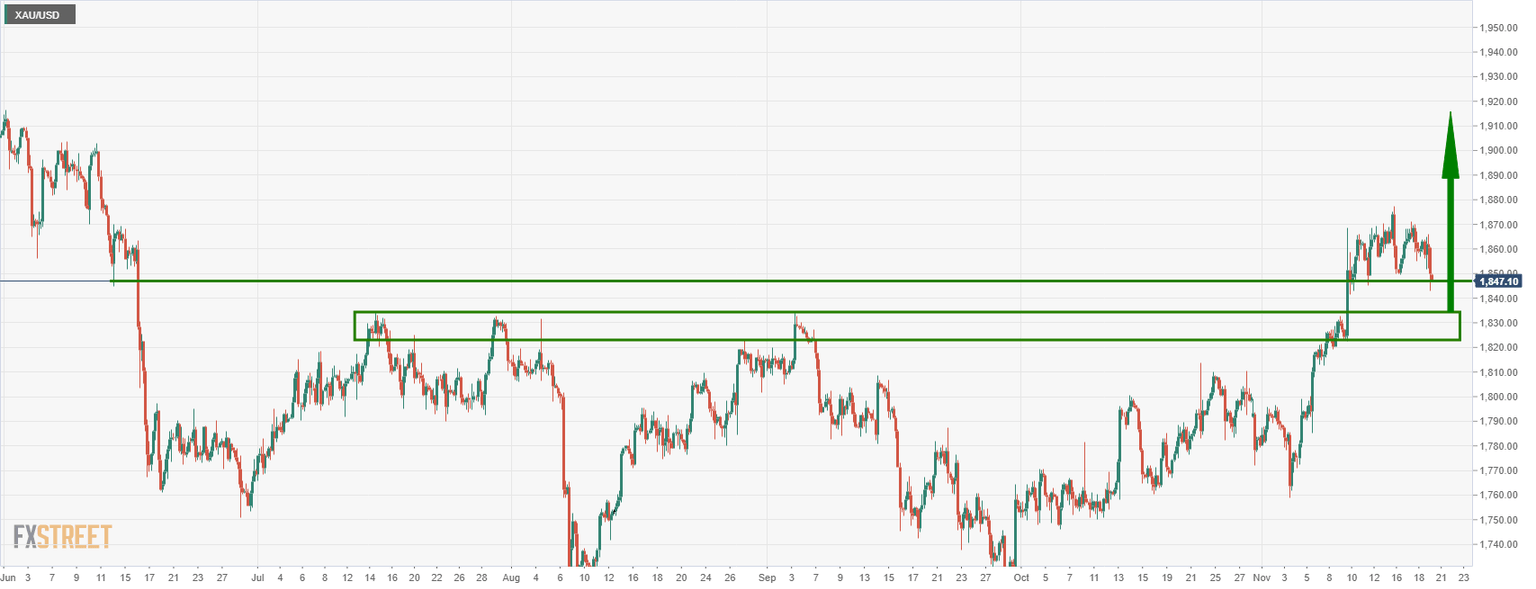

Gold Price Forecast: XAU/USD off weekly lows, recaptures $1,840 amid risk-aversion

- Gold is on the back foot on the approach to prior resistance.

-

XAU/USD could stage a deep correction if $1,850 becomes resistance - US dollar on form as European covid risks rear their ugly head again.

Update: Gold is trading above $1,840, attempting a recovery from an eight-day low of $1,839 amid the covid resurgence-led risk-off mood. Concerns over the renewed lockdown in Europe due to another wave of coronavirus rearing its ugly head, as the winter sets in, dents the investors’ sentiment. However, the further upside appears limited due to a broadly stronger US dollar alongside the Treasury yields. Despite the rebound, gold price remains on in the red zone for the third straight session, having faced rejection at the critical $1,870 level in the previous week. The focus this week remains on the Fed minutes to gauge the timing of a potential rate hike, which could likely have a significant impact on the non-interest-bearing gold.

The price of gold is lower despite the risk-off mood. XAU/USD ended on Friday down some 0.70% falling from a high of $1,865.83 to a low of $1,843.09. The greenback was favoured instead after Austria said it would be the first country in Western Europe to reimpose a full lockdown while Germany said it could follow suit, sending the euro lower and lifting the US dollar.

The dollar index, which tracks the greenback against a basket of six major currencies, was up 0.57% at 96.066 by the close, a touch lower than an its16-month high of 96.266 printed mid-week. For the week, the dollar was up around 1% DXY. It has the edge as the market's expectations have grown that interest rates will be hiked faster in the United States.

For instance, Federal Reserve Governor Christopher Waller said the Federal Reserve should speed up the pace of tapering its bond purchases to give more leeway to raise interest rates from their near-zero level sooner than it currently expects if high inflation and the strength of job gains persist. Additionally, Fed Vice Chair Richard Clarida said it "may very well be appropriate" to discuss speeding up the Fed's asset purchase wind-down when it next meets, on Dec. 14-15.

Meanwhile, the CTA buying program in gold has run out of steam, leaving the yellow metal vulnerable to a deeper consolidation if prices fail to hold above the $1,840/oz region, analysts at TD Securities argued.

''After all, while the yellow metal remains an ideal hedge against rising stagflationary winds, the tug-of-war between high inflation prints and market pricing for central bank hikes hasn't definitively concluded.' TD Securities forecast slowing growth and inflation next year, noting that the market's pricing for Fed hikes remains far too hawkish.

Gold technical analysis

The bias is to the downside at the moment taking into account the weekly, daily and lower time frames:

Gold, Chart of the Week: Bears eye the 38.2% Fibo for the open

From a four-hour perspective, the price is meeting short term support. However, the price action is strongly bearish and a continuation to the downside would be expected at this juncture.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.