Gold Price Forecast: XAUUSD hovering around $1,910 as tensions mount

- Gold Price extends slump and approaches $1,900 ahead of the Fed’s policy announcement.

- Tensions in Eastern Europe are still under permanent scrutiny from speculative interest.

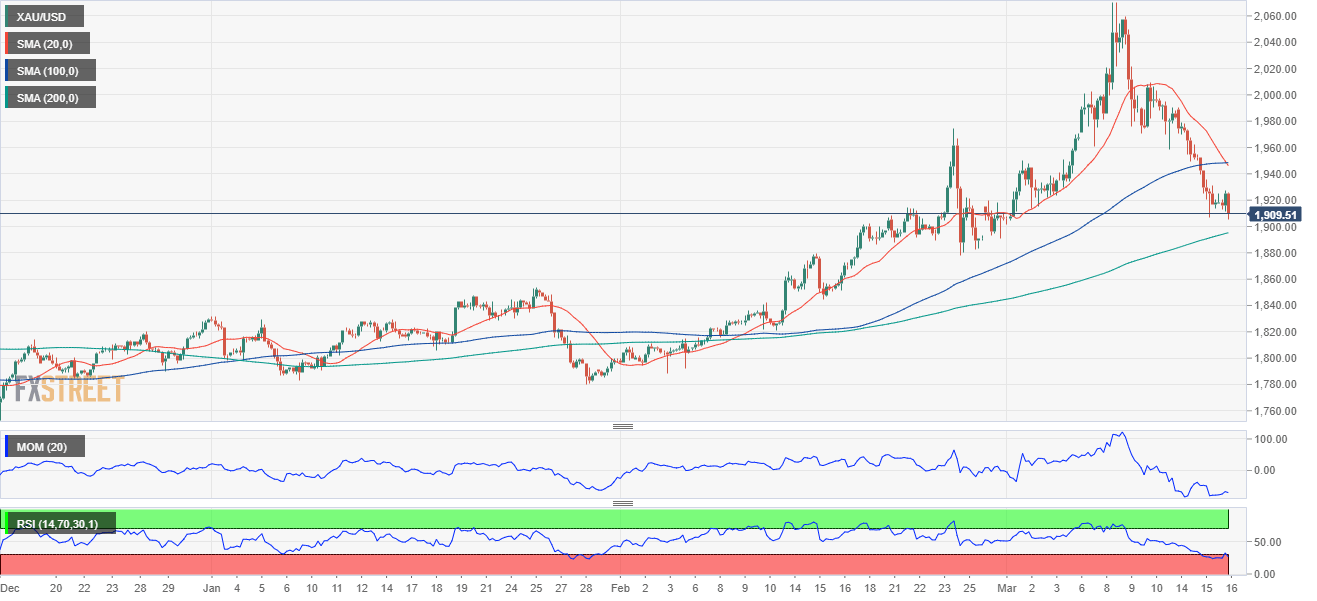

- A bearish crossover from 20 and 50-period EMAs adds to the XAUUSD downside fillers.

Gold Price is down for a fourth consecutive day, having reached so far a fresh two-week low of $1,903.84 a troy ounce. Market participants remain optimistic, despite back-and-forth headlines coming from Eastern Europe. The mood improved on hopes Russia and Ukraine could reach a diplomatic solution after the Russian Foreign Minister Viktorovich Lavrov said that some parts of a deal with Ukraine are close to being completed. Also, news made the rounds about “significant progress” in peace talks, amid Moscow drawing up a neutrality plan, although the proposed neutrality was quickly rejected by Kyiv.

Wall Street holds on to early gains but entered a consolidative phase ahead of the US Federal Reserve monetary policy announcement at 18:00 GMT. The US central bank is widely anticipated to hike its main benchmark by 25 bps and present fresh growth and inflation forecast. Investors will be closely watching the dot-plot and chances of further rate hikes later in the year. Ahead of the event, government bond yields consolidate at the upper end of their weekly range, with the 10-year Treasury note currently yielding 2.17%. Gold Price may come under renewed selling pressure if the Fed moves on with a dovish hike.

Also read: Fed March Preview: Gold needs a dovish Fed to regain traction

Previous update: Gold (XAUUSD) is falling sharply as investors are dumping the asset on skyrocketing odds of an interest rate hike by the Federal Reserve (Fed). The precious metal is hovering around $1,917.00 on Wednesday. Gold Price has witnessed a fall of almost 7.4% from their recent highs at $2,070.54 last week.

The Fed will announce the interest rate decision on Wednesday and a rate hike is imminent amid the soaring inflation. But the fact is, investors are eyeing the scale of a rate hike to adjust their positions in respect to the precious metal. A 25 basis point (bps) rate hike by the Fed may not have a serious impact on the Gold Price as the market participants are aware that only a rate hike is the remedy to curtain the galloping inflation now. However, half of the percent rate hike by the Fed may trigger further short build-ups for the yellow metal.

Apart from the caution over an aggressive tightening policy after the Fed Open Market Committee (FOMC) meet, improvement in the demand of risk-perceived assets has also trimmed preference for the precious metal. Global equities are trading in the bullish territory despite intensifying fears of Covid-19 in China. Also, fewer headlines from the Russia-Ukraine war have weighed pressure on the Gold Price.

Meanwhile, the US dollar index (DXY) has settled below 99.00 after tracing subdued US Treasury yields on Wednesday. The 10-year US Treasury yields are trading at 2.15%, 0.34% down from Tuesday’s close.

Gold Price Technical Analysis

On a four-hour scale, XAUUSD is trading below 50% Fibonacci retracement (placed from January 28 low at $1,780.75 to March 8 high at $2,070.54) at $1,925.30. The 20-period and 50-period Exponential Moving Averages (EMA) have given a bearish crossover at $1,965.20, which adds to the downside filters.

The Relative Strength Index (RSI) (14) has shifted its range from 40.00-60.00 to 20.00-40.00, which indicates an establishment of a bearish setup.

Gold Price four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.