Gold Price Forecast: Acceptance above $2,000 to open doors towards $2,022 – Confluence Detector

- Gold price rallies as the Russia-Ukraine crisis gets entrenched, triggers oil shock.

- Gold bulls are gearing up to regain the upside towards $2,020 and beyond.

- Gold price risks a correction before next upswing kicks in above $2,000.

A new week begins but nothing changes on the geopolitical front, as Russia’s resolve to invade Ukraine gets firmer while the US looks to isolate Russia completely by banning oil imports. As the Ukrainian crisis deepens, the market sentiment remains roiled, facing a double whammy from soaring oil prices. Investors take shelter in the traditional safe-haven gold, in the face of raging energy inflation and its impact on global economic growth. All eyes remain on geopolitics and oil prices for fresh trading opportunities in gold price.

Read: US weighs acting without allies on ban of Russian oil imports

Gold Price: Key levels to watch

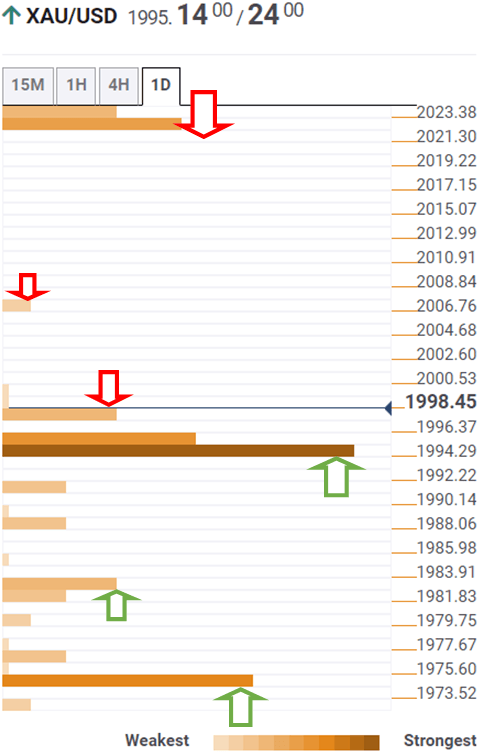

The Technical Confluences Detector shows that gold price has recovered ground once again above $1,995 strong resistance, where the pivot point one-month R1, pivot point one-week R1 and the previous high four-hour.

The pivot point one-day R2 at $1,998 will guard the immediate upside, above which buyers will retest the multi-month highs at $2,001.

On buying resurgence, gold price could advance towards the Bollinger Band one-hour Upper at $2,007 before resuming storming towards $2,022.

Gold bulls will then gear up for a fresh upswing to conquer the $2,000 mark.

On the flip side, fierce support is seen at $1,982, where the pivot point one-day R1 coincides with the SMA5 four-hour.

The previous month’s high of $1,975 will be tested once again if the correction picks up pace. The last line of defense for gold bulls is the daily lows of $1,972.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.