Gold Price Forecast: $1,850 could be a tough nut to crack for XAUUSD bears – Confluence Detector

- Gold Price snaps a five-day uptrend, as the US dollar stages a solid rebound.

- US Treasury yields remain on the back foot ahead of the FOMC minutes.

- Strong support at $1,850 could limit the pullback in XAUUSD from two-week highs.

Gold Price is retreating from two-week highs of $1,870, as tensions mount in the lead-up to the minutes of the Fed May policy meeting, which is likely to provide fresh hints on the central bank’s tightening path. The broad rebound in the US dollar, despite a cautious market mood, is weighing negatively on the bright metal. Although the latest Fed commentary, which expressed concerns of soft-landing, undermines the US Treasury yields across the curve. This, in turn, helps XAUSUD to find a floor, for now.

Also read: Gold Price Forecast: XAUUSD bulls await Fed minutes for the next upside leg

Gold Price: Key levels to watch

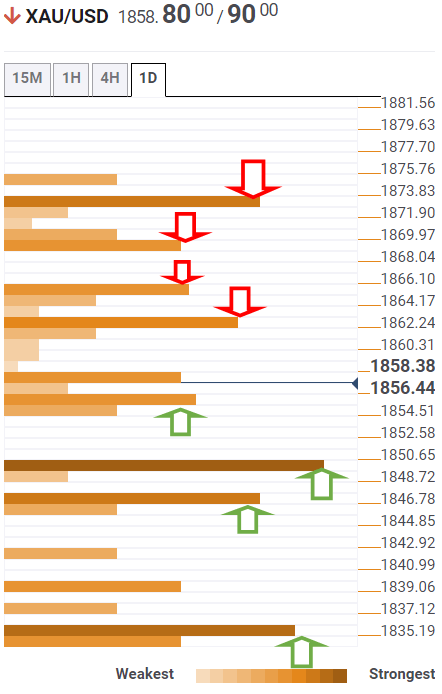

The Technical Confluences Detector shows that the Gold Price is teasing the $1,855 support area, which is the convergence of the pivot point one-day S1 and the previous low four-hour.

Failure to resist above the latter will trigger a fresh drop towards the $1,850 cap, where the previous day’s low and the previous week’s high coincide.

Gold sellers will then look out for the $1,845 demand zone, which is the intersection of the SMA5 one-day and pivot point one-month S1.

Further down, the SMA200 one-day at $1,839 will be put to test.

On the upside, XAU bulls could face initial resistance at around $1,862 on buying resurgence. That level is the confluence of the Fibonacci 38.2% one-day and SMA10 four-hour.

The Fibonacci 23.6% one-day at $1,865 will then challenge the bearish commitments.

The previous day’s high of $1,870 and the previous month’s low of $1,872 will be next on the buyers’ radars.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.