Gold Price Forecast: XAUUSD bulls await Fed minutes for the next upside leg

- Gold Price turns negative for the first time in six trading days.

- The USD attempts a bounce, Treasury yields stabilize ahead of Fed minutes.

- XAUUSD closed Tuesday above 21-DMA, what’s next?

The buying momentum around Gold Price extended on Tuesday, as bulls cinched fresh two-week highs at $1870. In doing so, the bright metal gained for the fifth straight trading day, continuing its recovery from four-month troughs of $1787. As I noted earlier this week, the inverse relationship between the US Treasury yields and gold price is playing out well, with Tuesday’s drop in the yields having strengthened the recovery momentum in the non-yielding precious metal.

The bets for aggressive Fed tightening have cooled off amid fears of hard-landing, especially after Atlanta Fed President Raphael Bostic warned that headlong rate hikes could create "significant economic dislocation.” Additionally, comments from Fed Chair Jerome Powell also weighed on the US rates. Powell said ‘Soft’ economic landing may be out of US Fed’s control while speaking in an interview on the American Public Media programme Marketplace. The US dollar tumbled alongside the yields, extending its downward correction despite a cautious market mood, led by a tech sell-off on the global markets. Weak US Manufacturing PMI for May also added to the dollar’s misery, benefiting XAUUSD.

Heading into Fed’s May meeting minutes release, gold bulls are taking a breather while the dollar attempts a bounce, despite risk being in a better spot. The US Treasury yields stabilize, as markets reposition ahead of the critical events, the Durable Goods data and the FOMC minutes. Wednesday's publication of minutes from the Fed's May meeting could show the reluctance of the Fed policymakers for further rate hikes at the September meeting. Also, the Fed members’ discussion around quantitative tightening will be closely eyed. In the meantime, the profit-booking decline in gold price could extend, as the metal’s daily chart points to a brief technical correction before the next uptrend kicks in.

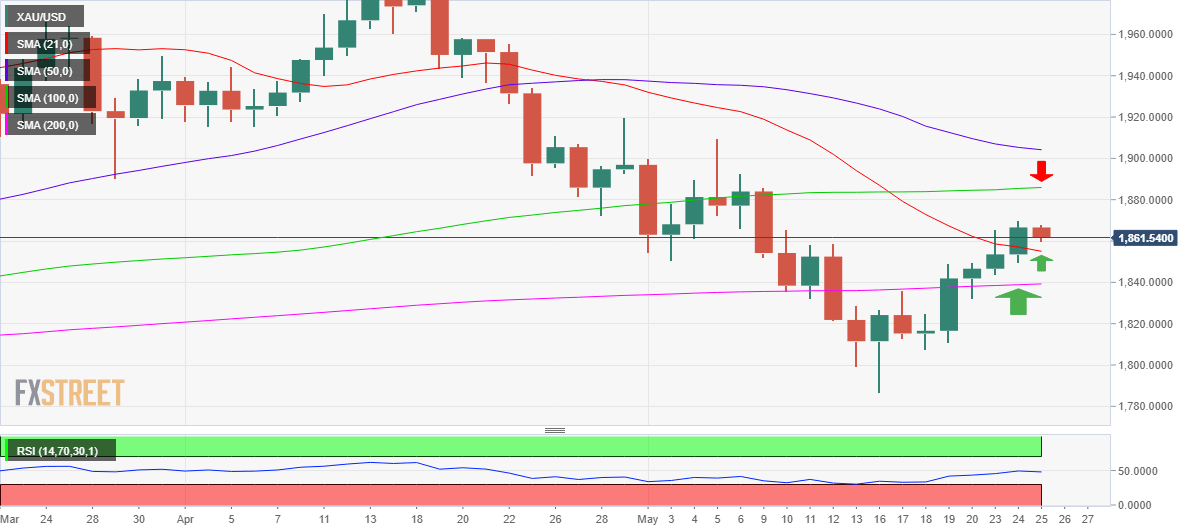

Gold Price Chart: Daily chart

Gold Price has finally yielded a daily closing above the critical 21-Daily Moving Average (DMA) hurdle at $1,855. So, what’s next?

After the relentless surge, gold bulls could see a minor pullback from two-week highs, with the immediate support of the 21-DMA likely to be tested.

A sustained break below the last could expose the next downside target of $1,850, below which the mildly bullish 200-DMA at $1,839 will challenge the bullish traders.

The 14-day Relative Strength Index (RSI) has turned south just below the midline, justifying the retreat in the price of gold.

On the flip side, if the Fed minutes downplay aggressive rate hike expectations, providing a cautious take amidst hard-landing fears, then the metal could resume its recent uptrend towards the horizontal 100-DMA at $1,886.

The next relevant hurdle aligns at the $1,900 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.