Gold price nosedives 1.50% while reciprocal tariffs ripple through markets

- Gold price hits a curb and drops below $3,100 as selling pressure increases.

- Markets are taking hits in all corners after US President Trump issued the most harsh tariffs possible.

- Gold traders are taking the money and are running for the hills.

Gold price (XAU/USD) snaps under pressure from the selling orders on Thursday, selling off over 1.25% towards $3,095 at the time of writing. Traders are taking profit, pushing the Bullion price below important pivotal levels. Markets see all asset classes absorbing the overnight shocking statement from United States (US) President Donald Trump, who unleashed his reciprocal tariff plan onto the world.

Traders are still mulling over the meaning of the announcement where a global base tariff of 10% is the minimum to apply to any country in the world importing into the US. From there, all other earlier levies remain in place, which means, for example, a total of 54% tariff on China applicable as of this Thursday. Markets are seeing safe haven flow with Equities dropping multiple percentages globally, bond yields falling as Bonds are bid and the US Dollar (USD) devaluing against all major currencies.

Daily digest market movers: Easing once deals are being done

- Asian Gold producers rise after the precious metal hit a record high as US President Donald Trump’s “reciprocal” tariffs stoke fears of a global economic slowdown and raise demand for haven assets, Bloomberg reports. The move goes against the overall global selloff seen in Equities.

- The CME FedWatch tool sees chances for an interest rate cut in May standing at 21.5%. A cut in June is still the most plausible outcome, with only a 27.5% chance for rates to remain at current levels. In the overall yield curve a shift is noticed that a longer pause from the Fed might play out here.

- Going back to the White House fact sheet in detail, Steel, Aluminum, Gold and Copper imports won’t be subject to reciprocal tariffs, providing at least some relief to domestic buyers who are already bearing the cost of 25% tariffs under Section 232 of the Trade Act of 1962 on all imports of some key metals, Reuters reports.

- Treasury Secretary Scott Bessent issued comment after the announcement of reciprocal tariffs by United States (US) President Donald Trump, that tariffs could quickly be lifted or removed if countries bring back their production to the US.

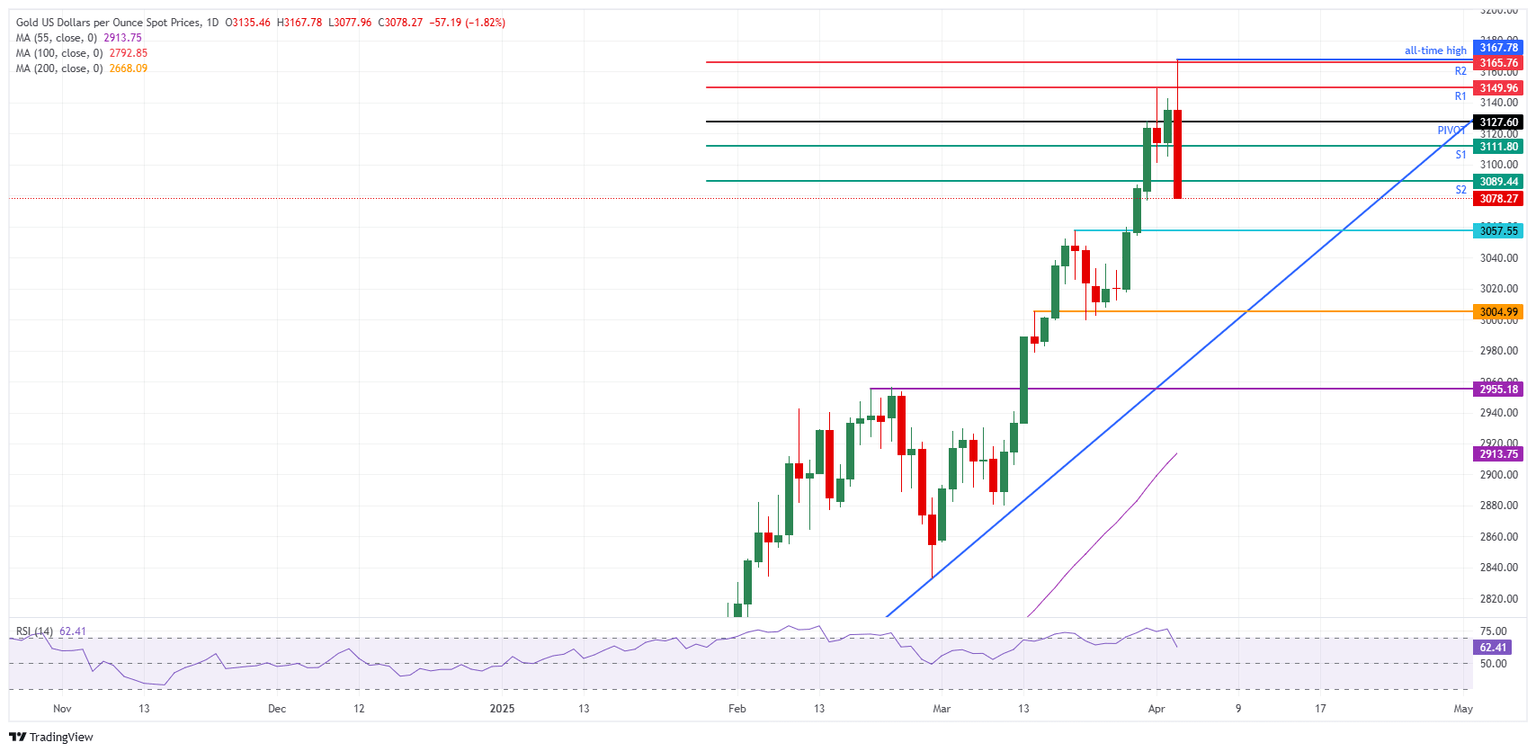

Gold Price Technical Analysis: H

A logical turn of events is taking place in Gold price this Thursday as the dust settles over the implementation of reciprocal tariffs by the Trump administration. The “buy the rumor, sell the fact” was the proverb FXStreet was already alluding to in past articles, and that is currently playing out. With negotiations and possible deals being brokered between the US and other countries to circumvent Trump’s tariffs, sentiment can only improve from here, meaning a softening in the Gold price.

On the contrary, should countries start to issue retaliation tariffs, Gold could stretch higher with fresh all-time highs being forecasted.

On the upside, the daily R1 resistance at $3,149 is the first level that needs to be reclaimed again, followed by the $3,167 fresh all-time high. That roughly coincides with the R2 resistance at $3,165. Beyond that, the broader upside target stands at $3,200.

On the downside, the S1 support at $3,111 is quite close, though it could still be tested without completely erasing this week’s gains. From a technical point of view, avoiding a break of this week’s low is essential. Further down, the S2 support at $3,089 should ensure that Gold does not fall back below $3,000.

XAU/USD: Daily Chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.