Gold price sticks to modest intraday gains; approaches $3,350 area ahead of US macro data

- Gold price attracts some buyers as Fed independence fears boost safe-haven demand.

- Fed rate cut bets exert additional pressure on the USD and benefit the XAU/USD pair.

- The optimism surrounding the Israel-Iran truce caps gains for the safe-haven commodity.

Gold price (XAU/USD) attracts some buyers for the second straight day on Thursday and retains its positive bias through the first half of the European session. The US Dollar (USD) selling remains unabated amid reports that US President Donald Trump was considering replacing Federal Reserve (Fed) Chair Jerome Powell, fueling concerns about the future independence of the central bank. Adding to this, bets that the Fed will resume its rate-cutting cycle as early as July drags the USD to over a three-year low and benefits the non-yielding yellow metal.

Meanwhile, the latest optimism over a ceasefire between Israel and Iran continues to underpin the global risk sentiment. This, in turn, might hold back the XAU/USD bulls from placing aggressive bets and cap any further gains. Hence, it will be prudent to wait for strong follow-through buying before confirming that the Gold price has bottomed out and positioning for a further recovery from sub-$3,300 levels, or a two-week low touched on Tuesday. Traders now look forward to US macro data and speeches by influential FOMC members for a fresh impetus.

Daily Digest Market Movers: Gold price draw support from Fed independence fears and weaker USD

- US President Donald Trump escalated his criticism of Federal Reserve Chair Jerome Powell for not cutting rates and said he was considering several candidates to replace him. In fact, Powell reiterated on Wednesday that the central bank is well-positioned to wait to cut interest rates until the inflationary effects of Trump's wide-ranging tariffs are better known.

- The Trump-Powell standoff comes on top of bets that the Fed would cut interest rates by at least 50 basis points before the end of the year. This, in turn, drags the US Dollar to over a three-year low and assists the non-yielding Gold price to attract some buyers for the second straight day on Thursday, though the intraday uptick seems to lack bullish conviction.

- The fragile truce between Israel and Iran continues to hold, with Trump declaring victory despite the uncertainty regarding the extent of the damage to Iran's uranium enrichment assets. Nevertheless, the optimism holds back the XAU/USD bulls from placing aggressive bets and warrants some caution before positioning for any further appreciating move.

- Moving ahead, traders now look to the US economic docket – featuring the release of the final Q1 GDP print, the usual Weekly Jobless Claims, Durable Goods Orders, and Pending Home Sales. Apart from this, investors will closely scrutinize comments from FOMC members for cues about the Fed's rate-cut path, which should influence the commodity.

- The market attention will then shift to the US Personal Consumption and Expenditure (PCE) Price Index, due on Friday. The crucial inflation data will play a key role in determining the next leg of a directional move for the USD and influence the bullion, which, so far, has been struggling to register any meaningful recovery from over a two-week low.

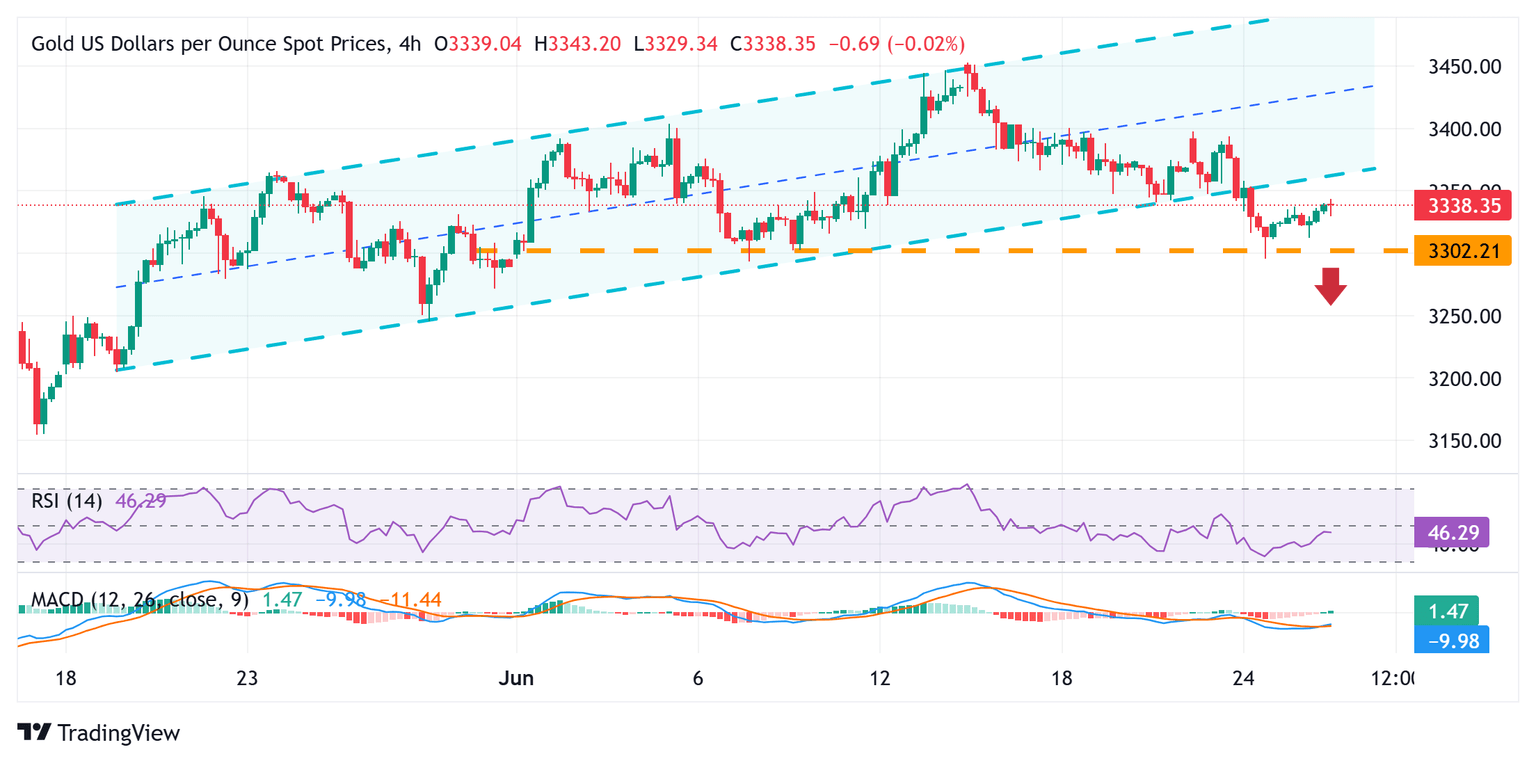

Gold price setup warrants caution for bulls; $3,368-3,370 support-turned-resistance holds the key

From a technical perspective, this week's breakdown below the lower end of a short-term ascending channel was seen as a key trigger for the XAU/USD bears. However, neutral oscillators on daily/4-hour charts and a failure to find acceptance below the $3,300 mark warrant some caution. Hence, it will be prudent to wait for some follow-through selling below the said handle before positioning for any further losses toward the $3,245 region. The downward trajectory could extend further and drag the Gold price to the $3,210-$3,200 horizontal support en route to the $3,175 area.

On the flip side, any subsequent move-up is likely to attract fresh sellers and remain capped near the $3,368-3,370 region, or the trend-channel support breakpoint. A sustained strength beyond could allow the Gold price to reclaim the $3,400 round figure, which, if cleared decisively, could negate the negative outlook and shift the near-term bias in favor of bullish traders. The XAU/USD might then climb to the $3,434-3,435 intermediate hurdle en route to the $3,451-3,452 zone, or a nearly two-month top touched last week, and the all-time peak, around the $3,500 psychological mark.

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Jun 26, 2025 12:30

Frequency: Quarterly

Consensus: -0.2%

Previous: -0.2%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.