Gold Price Analysis: XAU/USD’s acceptance above $1815 strong cap is critical for further recovery – Confluence Detector

Gold (XAU/USD) is reversing a part of Tuesday’s 2% recovery rally from five-month lows, as the coronavirus vaccine optimism supersedes the renewed hopes for additional US stimulus. Markets remain wary about a stimulus deal despite the Bipartisan Congress’s $908 billion aid proposal.

The vaccine rollout is imminent this month on both sides of the Atlantic, which could likely keep gold’s recovery in check. Meanwhile, US fiscal stimulus hopes and negative real yields could cushion the downside. The focus shifts on the US economic data and stimulus updates for fresh trading impetus.

Gold: Key levels to watch

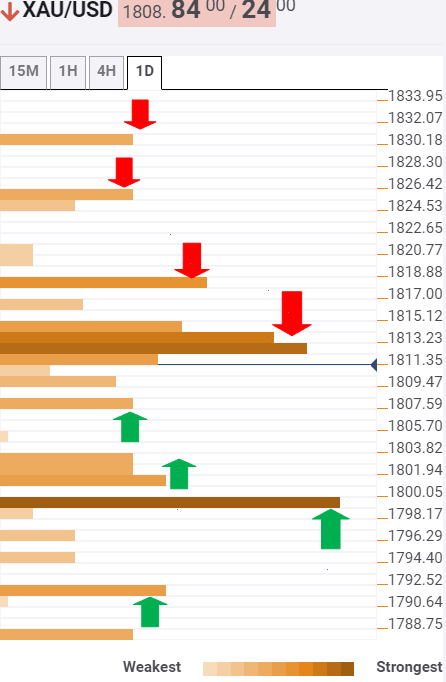

The Technical Confluences Indicator shows that the XAU/USD pair faces powerful resistance around $1813/1815 levels, which is the convergence of the Fibonacci 23.6% one-month, SMA10 one-hour and Fibonacci 38.2% one-week.

Recapturing the latter is critical to reviving the recovery momentum from the multi-month trough. The next crucial hurdle is seen at $1818, where the previous day high coincides with the SMA50 four-hour.

The bulls could then aim for the $1825 resistance, which is the SMA10 one-day. Further north, the Pivot Point one-day R1 at $1829.

Alternatively, immediate support awaits at $1807, which the Fibonacci 23.6% one-day, below which a dense cluster of supports is aligned around $1803. At that level, the Fibonacci 38.2% one-day and SMA200 one-day intersect.

The next fierce support is seen at $1800, which is the confluence of the SMA5 one-day and Fibonacci 23.6% one-week.

A breach of the last could trigger a fresh sell-off towards $1791, the meeting point of the Fibonacci 61.8% one-day and SMA50 one-hour.

Here is how it looks on the tool

About Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.