Gold Price Analysis: XAU/USD fails to resist above $1900 as US dollar rebounds

- Gold is being capped at a critical level of resistance.

- Bulls need to get back over the counter trendline or face bearish pressures below it.

- Gold Weekly Forecast: XAU/USD snaps four-week winning streak, closes below $1,900

Update: Gold price is reversing an uptick above $1900, as the US dollar bulls are back on the bids amid worsening market mood. The greenback is recovering a part of Monday’s steep drop induced by US Secretary Janet Yellen’s clarification that she doesn’t expect higher spending levels would create inflation overrun. Over the weekend, Yellen hinted at potential tightening amid economic optimism, which rescued the dollar and the Treasury yields from the NFP blow.

Adding to the retreat in gold price, US inflation expectations have dropped to the lowest in six weeks. Gold’s inflation-hedge appeal gets diluted amid falling expectations. All eyes remain on the US CPI data due this Thursday for the next direction in gold price. In the meantime, investors are likely to take cues from the US stimulus updates and broader market sentiment.

Read: US inflation expectations drop to the lowest in six weeks

A weaker USD helped gold prices rebound from earlier losses following US Treasury Secretary’ Janet Yellen’s weekend comments on interest rates.

At the time of writing, XAU/USD is trading at $1,899 and flat on the day. Gold ended the North American session higher by some 0.4% following a run from the lows of $1,881.60 to a high of $1,900.19.

The dollar index DXY was down 0.21% at 89.946. Benchmark 10-year Treasury yields were last at 1.569%, dropping from 1.560%, and from 1.628%, on Friday.

''Yellen's view that a higher interest rate environment would be a plus for the US initially spooked investors,'' analysts at ANZ Bank explained.

''However, the central bankers have stuck to the Fed’s hymn book, suggesting inflationary concerns will be short-lived and monetary policy will be loose for the foreseeable future. This should provide support for gold prices, with our gold valuation model suggesting fair value is around USD2000/oz.''

Meanwhile, the greenback and US Treasury yields were moribund and investors looked ahead to Super Thursday with the ECB and US CPI on the same day.

Friday's Nonfarm Payrolls data had put pressure on the dollar as investors bet that jobs growth was not strong enough to raise expectations for the US Federal Reserve to tighten its monetary policy.

As for positioning, speculators decreased their net short dollar positions in the latest week, according to calculations by Reuters and US Commodity Futures Trading Commission data released on Friday.

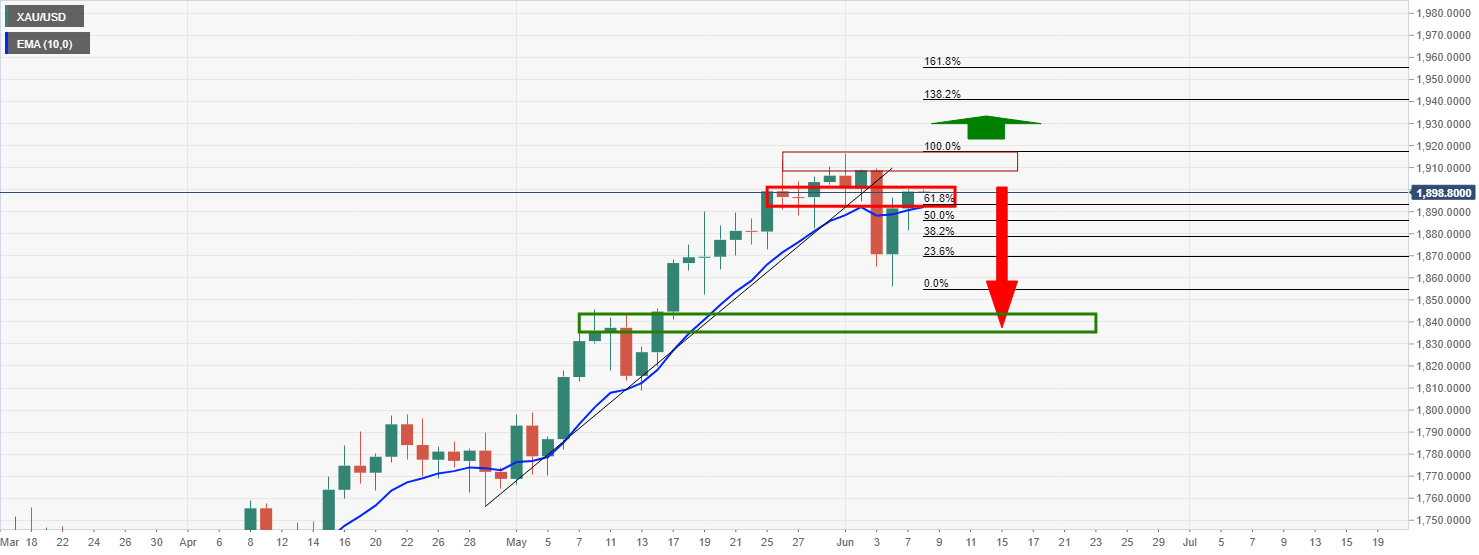

Gold technical analysis

Technically, the price has rallied to an area of horizontal resistance above the 10-day EMA.

The vicinity of the counter trendline on the daily time frame is also a level of resistance that might cap the strong bullish correction that extended on Monday.

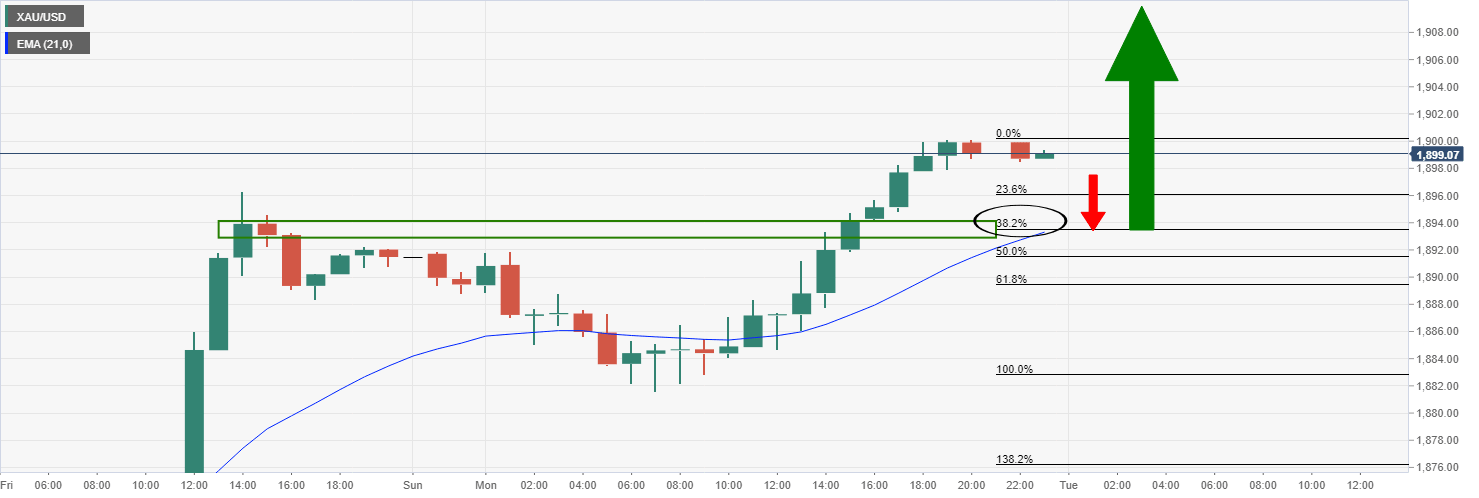

The 4-hour 20 and 10 EMAs are also bullish at this point with the 10 crossing the 20 EMA.

In contrast, from an hourly perspective, there are possibilities of a correction to the prior resistance and the confluence of the 38.2% Fibo and 21-hour EMA before an onward extension.

Previous updates

Update: Gold (XAU/USD) refreshes intraday high in a bid to piece the $1,900 threshold, up 0.13% intraday around $1,902, during early Tuesday. Gold traders cheer a 0.15% uptick of the S&P 500 Futures joining the downbeat US Treasury yields and inflation expectations to print a three-day uptrend by the press time.

Behind the moves could be increasing optimism over the coronavirus (COVID-19) vaccinations in the west and readiness to ease the virus-led restrictions. Also, a six-week low print of the US inflation expectations, as per the St. Louis Fed data, joins the downbeat US employment figures and the Fed’s repeated rejection to reflation fears to help the risk-on mood.

It should, however, be noted that the cautious sentiment ahead of this Thursday’s key US inflation figures and the ECB, coupled with the jitters over China and Brexit, probe the optimists.

Also challenging the bulls could be the technical hurdle around the $1,900 threshold.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.