Gold Price Analysis: XAU/USD is under water after firmly hawkish Fed chair Powell

- Fed's Powell moves the markets and Gold price collapses.

- Gold price breaks out which leaves $1,800 vulnerable and the $1,770s thereafter.

Gold price is licking its wounds as being highly susceptible to the prospects of a firmer rate hike of 50 bps from the Federal Reserve. At the time of writing, Gold price is trading at $1,813.53 and has been testing lower in Asia to $1,1812.60, a fresh low made following the sell-off that ensued on the back of an uber-hawkish Federal Reserve chair Jerome Powell on Tuesday who testified to Congress.

Gold price dropped hard on the back of Fed chair Powell's comments, dropping hard like the heavily weighted metal that it is from a high on the day of $1,851.70 to a low of $1,1812.36. This has come about due to the Federal Reserve's chair Jerome Powell saying that the US central bank will stay the course until the job is done. He added more fuel to the fire by saying that the ultimate level of interest rates is likely to be higher than previously anticipated.

The clincher is when Federal Reserve's chairman Jerome Powell also said that the Fed is prepared to increase the pace of rate hikes if data indicates it is warranted:

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," Fed's Powell said in his testimony.

As a consequence, the yield on the US 10-year Treasury note rose to 4% before easing back to 3.96%, remaining marginally below the three-month high of 4.07% touched on March 2nd as investors assessed the pace of future rate hikes by the Federal Reserve. This gave the greenback a boost. The DXY index, a measure of the US Dollar vs. a basket of currencies, slammed through 105 the figure in a move that started out from 104.43 and kept going until 105.435, weighing heavily on the Gold price.

China increased its gold reserves for a fourth month

Meanwhile, data on Tuesday revealed that China increased its gold reserves for a fourth month in February. ''Reports that China's central bank added another 25t of gold to their reserves in February are keeping the spotlight on physical flows in precious metals, which are increasingly dominating financial flows,'' analysts at TD Securities said.

''This fits with our observations of the microstructure in gold — elevated premiums in China, despite modest mainland wholesale demand implied by Shanghai Gold Exchange withdrawals and little activity in our tracking of Shanghai positioning, suggest that elevated Chinese demand is still overwhelmingly driven by official sector purchases,'' the analysts explained, adding, ''in turn, while the focus remains on Chair Powell's congressional testimony this session, financial flows are increasingly being dominated by physical demand.''

Gold technical analysis

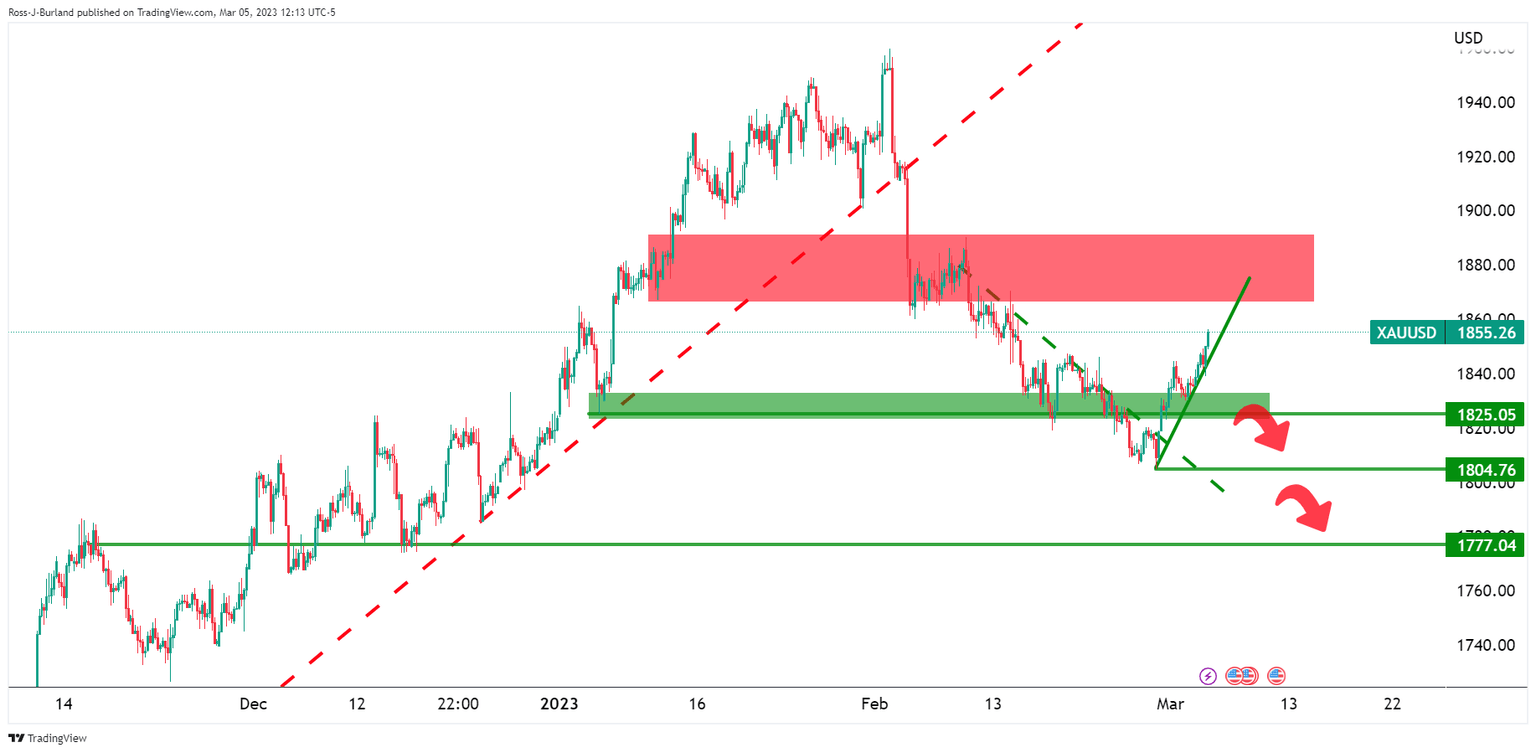

In prior analysis, Gold Price Forecast: XAU/USD bears move in for the kill ahead of key event, Fed's Powell, it was explained that ''the 200dma was some way off but it was within striking distance depending on the outcome of this week's data and events.''

The analysis showed that a $100.00 move last happened at the start of February (eclipsed in red below) following the European Central Bank and US Nonfarm Payrolls as the major catalysts:

Gold price update

It was also explained in the Chart of the Week article, Gold, the Chart of the Week: XAU/USD bulls ride H4 dynamic support on key week ahead that the Gold price was riding dynamic support that would be expected to hold initial tests ''but a break thereof opens the risk of a move to test the $1,825 all-important support structure. A break there will most probably see a flurry of orders triggered and a fast subsequent move lower.''

As illustrated above, we have seen that break happen which leaves $1,800 vulnerable and the $1,770s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.