Gold, the Chart of the Week: XAU/USD bulls ride H4 dynamic support on key week ahead

- Gold price is bid into a very important week.

- Federal Reserve Chairman Jerome Powell and Nonfarm Payrolls will be the key events.

- H4 dynamic support is key on the way up, but a break thereof opens downside risks to test $1,825.

Gold prices rallied Friday to post their first weekly increase in five, as a pullback in the US dollar and Treasury yields eased some concerns about further Federal Reserve rate hikes. However, fresh data earlier in the week showed continued resilience in the US job market which comes ahead of this week's Npnfarm Payrolls. At this pace, the jobs market is likely to keep pressure on the Fed to raise rates. A stronger USD and higher yields were also headwinds for investor demand for the precious metal.

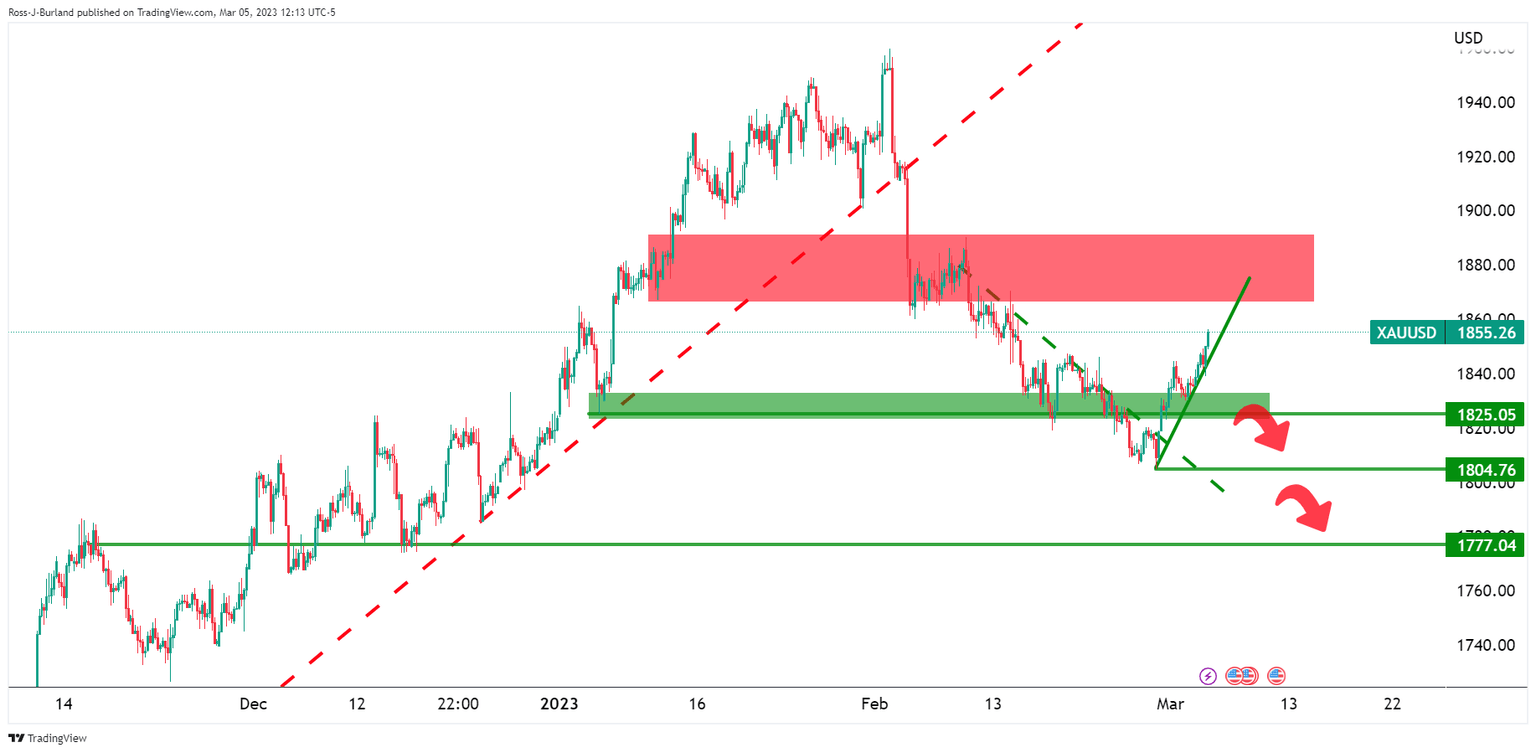

The US Dollar's bounce in February weighed on gold, but the bulls have been relieved of these pressures earlier in the month as the US Dollar Index ended with its first weekly loss in five. The charts below point to a temporary bullish phase as we head into the Federal Reserve's Chair Jerome Powell who will testify Wednesday on monetary policy to the House Financial Services Committee. However, if chair Powell voices hawkish rhetoric, gold could see this week's rally evaporate, especially should Nonfarm Payrolls give us another blockbuster.

Nevertheless, as the charts below show, we are in a bullish phase for the Gold price.

Gold price technical analysis

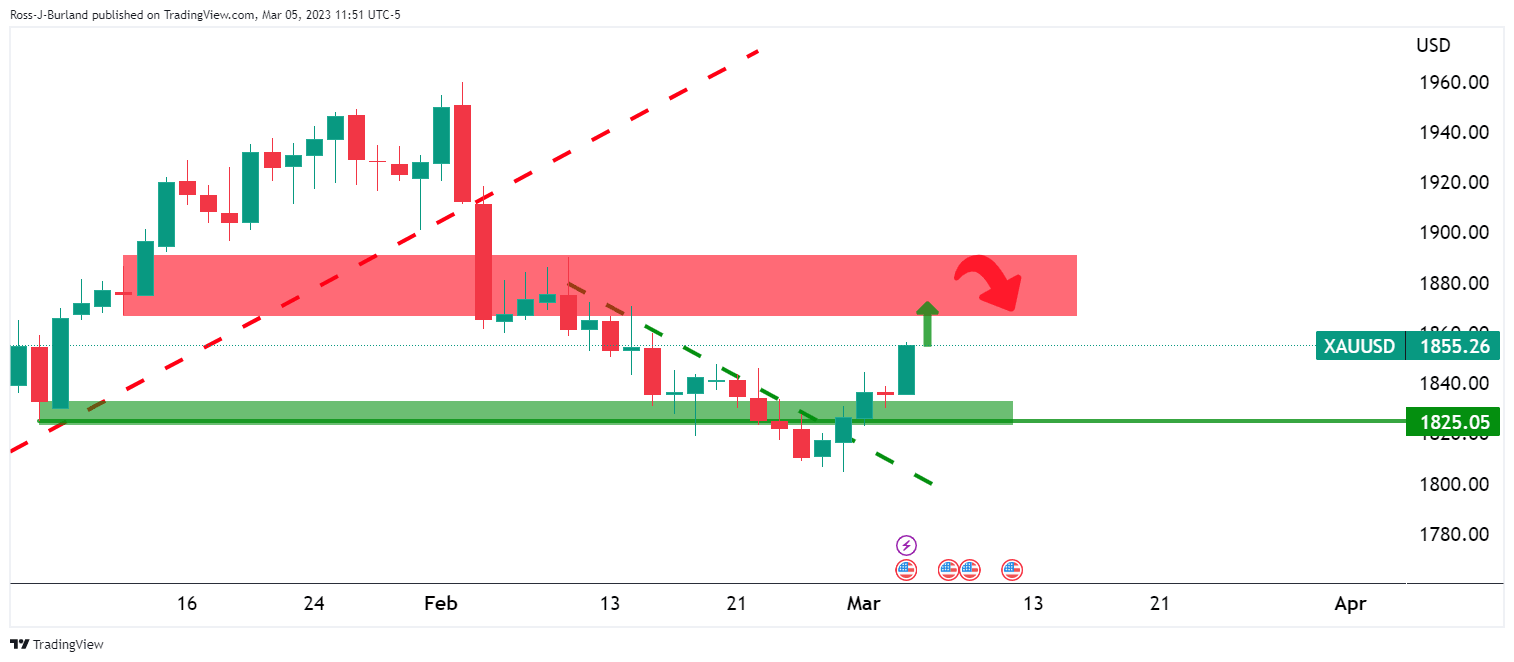

Bulls have stepped in and the Friday candle is strong which leaves prospects of a continuation at the start of this week.

We have resistance nearby where any further advances would be expected to be met by supply near $1,880/90.

The 4-hour chart shows that the Gold price is riding dynamic support that would be expected to hold initial tests but a break thereof opens the risk of a move to test the $1,825 all-important support structure. A break there will most probably see a flurry of orders triggered and a fast subsequent move lower.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.