Gold Price Analysis: XAU/USD spikes back closer to multi-month tops, eyeing $1,900 mark

- Gold remains steady after Fed, boosted by fears of rising inflation

- Eyes turn to EZ and US PMI for the last trading day of the week.

- Technically, the price is supported by the hourly structure.

Update: Gold finally broke out of its intraday consolidative trading range and jumped to the $1,888 region, back closer to multi-month tops during the early North American session. The latest leg of a sudden spike over the past hour or so could be solely attributed to a further decline in the US Treasury bond yields. This, in turn, was seen as a key factor that provided a goodish lift to the non-yielding yellow metal.

The supporting factor, to a larger extent, helped offset the underlying bullish sentiment in the equity markets, which tends to act as a headwind for traditional safe-haven assets, including gold. Even a modest US dollar rebound from multi-month lows did little to weigh on the dollar-denominated commodity or hinder the intraday positive move. This comes amid expectations that the Fed will retain its accommodative policy stance for a longer period and supports prospects for additional gains. That said, bulls might still wait for some follow-through buying beyond the $1,900 mark before placing fresh bets.

Update: Gold extended its sideways consolidative price action through the first half of the European session and remained confined in a range, just above the $1,875 level. The prevalent risk-on mood, as depicted by a generally positive tone around the global equity markets, acted as a headwind for the safe-haven XAU/USD. The downside, however, remains cushioned amid a modest US dollar weakness, which tends to benefit dollar-denominated commodities, including gold.

Despite hawkish FOMC minutes, which indicated that policymakers have begun discussion on QE tapering, investors remain convinced that the Fed will retain its accommodative policy stance for a longer period. This, along with the ongoing decline in the US Treasury bond yields, continued extending some support to the non-yielding gold. Meanwhile, the narrowing trading band constitutes the formation of a symmetrical triangle, indicating indecision among traders and warranting caution before positioning for any firm near-term direction.

Update: Gold (XAU/USD) trims intraday losses following its U-turn from $1,870.44, down 0.05% around $1,876.30 by the press time of pre-European session trading. Gold buyers seem to recollect Thursday’s upbeat sentiment ahead of the key PMI releases from Eurozone, the UK and the US after a light calendar and dead news feed during Asia. While portraying the mood, stock futures print mild gains while the US dollar index (DXY) remains pressured, which in turn helps gold prices to pick up bids of late.

Moving on, preliminary readings of the May month PMIs will be the key gold traders as markets await Eurozone’s strong recovery moves, backed by recently escalating vaccinations. In the absence of which the US dollar can have an opportunity to consolidate the latest losses, also exert downside pressure on the gold prices.

The gold price on Thursday at $1,877.00, has ended the day below its highs around 0.4% up having travelled between a low of $1,863.95 and $1,883.98.

Global equities were stronger and there was stabilisation in crypto which sent the US dollar lower as yields sank as market fears of tapering have cooled upon deeper thought. Fewer initial jobless claims were also taken into account.

The yield on the US 10-year note fell 3.8bps to 1.634%, but, all in all, it was a US dollar story on the day once again.

The greenback retreated hovering near a multi-month low as a risk-on rally drew investors away from the safe-haven currency.

Gold responded in kind as the Us dollar reversed Wednesday's bounce that had come of the US Federal Reserve's most recent monetary policy meeting's minutes.

The minutes showed that several policymakers said discussions on tapering of government bond purchases would be appropriate "at some point" should economic recovery continue to gather steam.

The surprise was in stark contrast to numerous Fed reassurances that it is too soon to tighten its accommodative policy or think about thinking about tapering.

''Ultimately, the taper looms large for gold with angst also growing in rates markets, as participants eye the massive Treasury supply on the horizon, particularly as the Biden Administration pushes through with their large fiscal plan,'' analysts at TD Securities said.

''With investors sounding the alarm over inflation, institutional interest in the precious metals complex is likely to continue rising following months of outflows, providing an offsetting force against taper fears,'' the analysts argued.

''Ultimately, our rates strategists also caution that it is still too early for taper talk, which suggests gold bugs are likely to benefit from the ongoing increase inflows for the time being.''

Looking ahead, attention is now focused on the preliminary US and eurozone May PMI data.

''We expect the service sector will lead gains in Europe, underpinned by the improved vaccination programme and gradual easing in restrictions in the euro area,'' analysts at ANZ Bank said.

'By contrast, the analysts said ''the PMI for the US is expected to ease slightly, implying growth momentum is in the euro’s favour at present.''

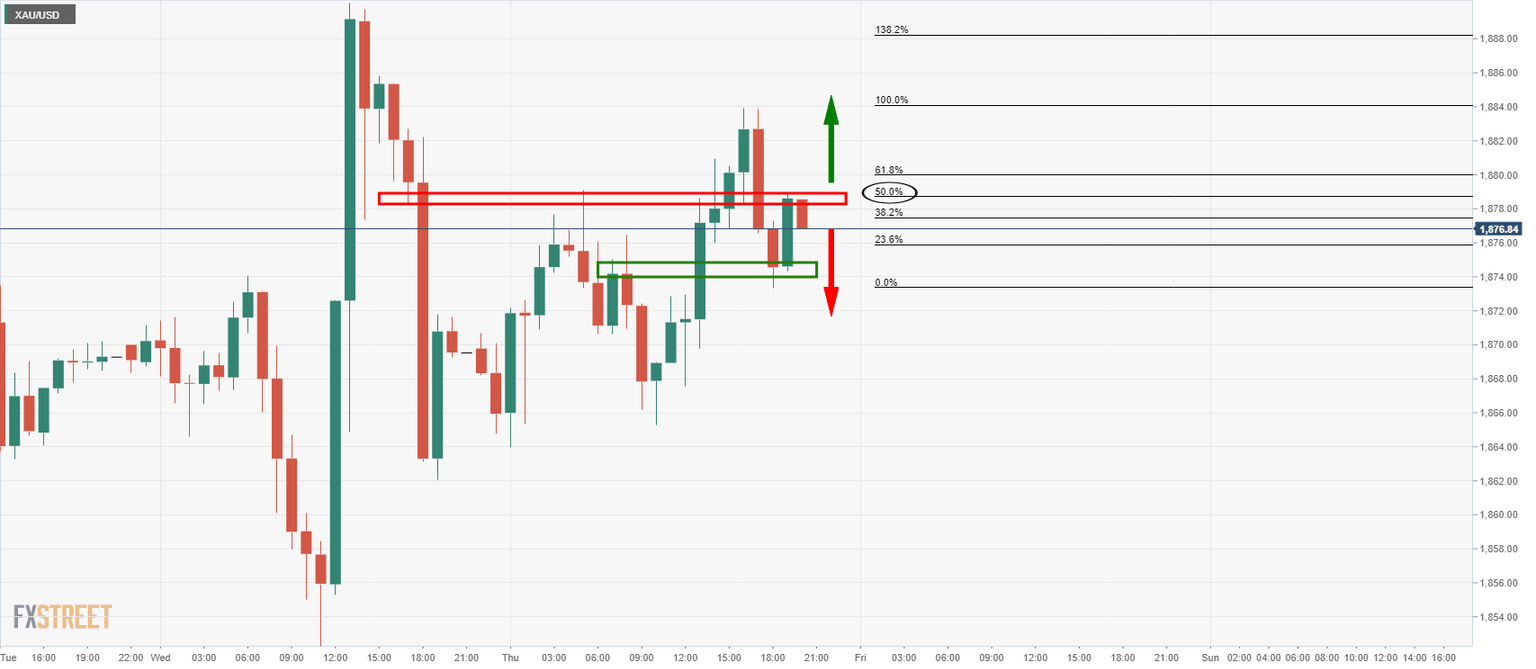

Gold technical analysis

The hourly chart shows the price has met the resistance of the 50% mean reversion area after finding support prior highs.

Previous updates

Update: Gold price is on the back foot so far this Friday, having faced rejection once again below $1890 levels. The bearish undertone in the US dollar and the Treasury yields is unable to motivate the gold price, as markets continue to weigh in the chances of the Fed’s tapering. Meanwhile, mixed Asian equities fail to offer any support to gold prices. Gold price feels the pull of gravity amid stabilizing conditions across the crypto board after Wednesday’s bloodbath. Investors scurried towards the traditional safe-haven gold in times of uncertainty and market turmoil. Gold traders now look forward to a fresh batch of second-tier economic data, as it remains on track to book the third straight weekly gain.

Update: Gold (XAU/USD) prints mild losses while bouncing off the intraday low around $1,874, down 0.10% on a day to $1,875.40, during Friday’s Asian session. In doing so, the gold traders consolidate gains earned in the last six days while also ignoring the upbeat market sentiment that earlier favored the bulls.

Gold buyers earlier cheered upbeat US data and chatters over the ceasefire in Gaza. However, a lack of any major data/events pushed traders to recollect the FOMC minutes that probed gold by the Fed tapering signals.

Moving on, the preliminary readings of May month activity numbers will be the key to watch gold traders while keeping their eyes on the risk catalysts.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.