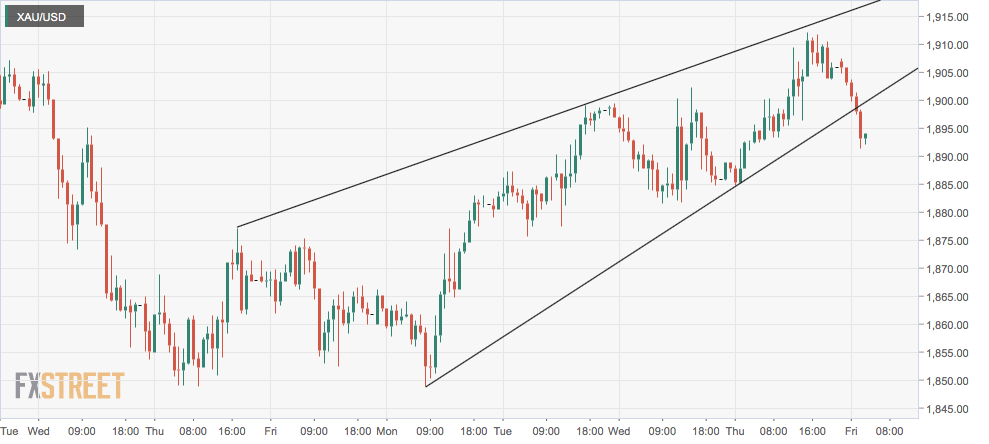

Gold Price Analysis: XAU/USD drops in Asia, confirming rising wedge breakdown

- Gold's hourly chart shows a bearish reversal pattern.

- The breakdown has exposed the recent low of $1,948.

Gold is currently trading at $1,893 per ounce, representing a 0.65% drop on the day.

The decline has confirmed a rising wedge breakdown on the hourly chart. The bearish reversal pattern indicates that the recovery rally from the Sept. 28 low of $1,948 has ended, and the sell-off from the Sept. 16 high of $1,973 has resumed.

As such, the yellow metal could re-test $1,948. On the way lower, the higher low of $1,880 created on the hourly chart on Sept. 30 could offer support.

The bearish bias would be invalidated if prices find acceptance above Thursday's high of $1,912.

Hourly chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.