Gold Price Analysis: XAU/USD could extend rebound with daily close above $1,900

- Gold closed last two days of the week in the positive territory.

- XAU/USD lost more than 3% for the week.

- Gold could continue to push higher with a daily close above $1,900.

The XAU/USD pair closed the last two days of the week in the positive territory but closed below $1,900. On a weekly basis, the pair erased more than 3%.

Gold technical outlook

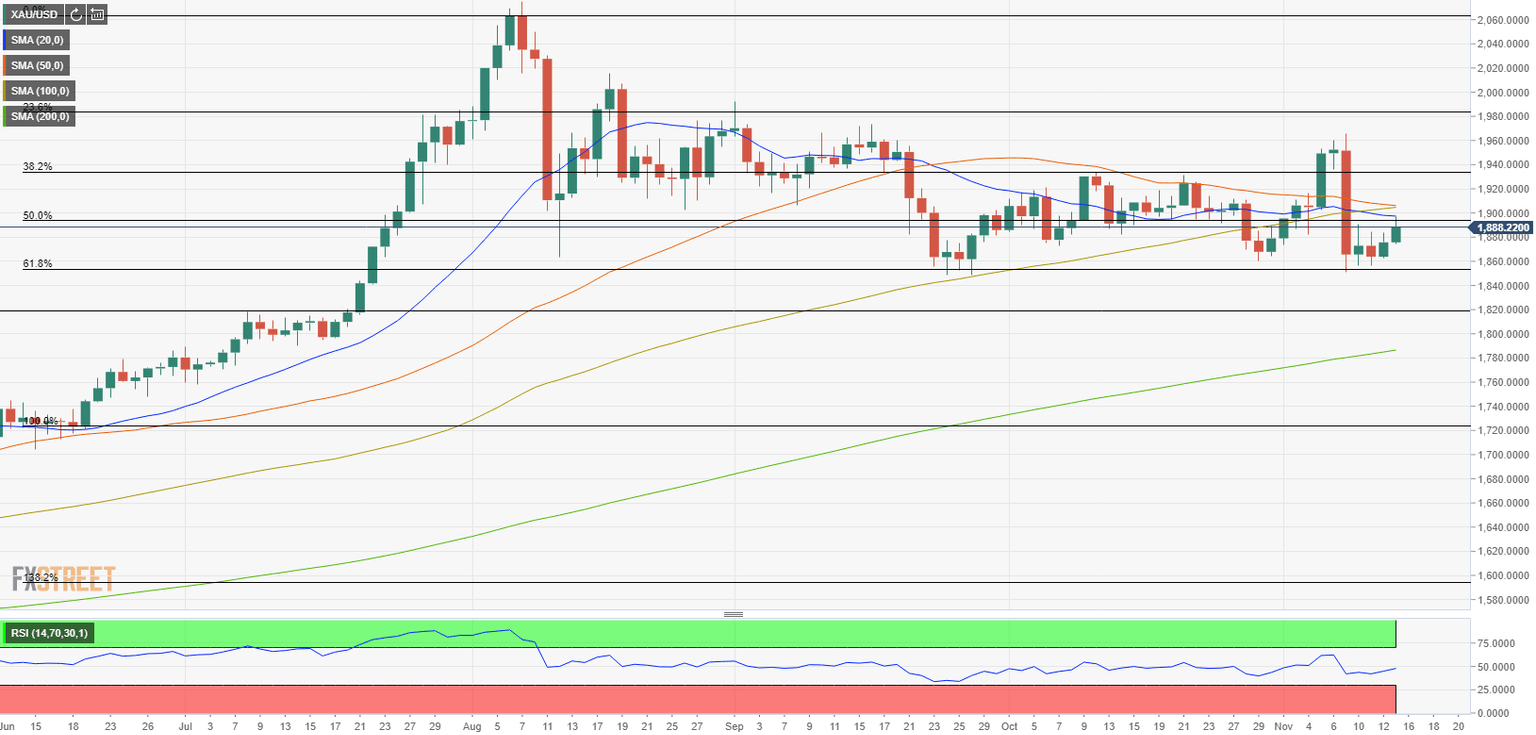

Despite the recovery witnessed in the second half of the week, the Relative Strength Index (RSI) indicator on the daily chart stays below 50, pointing out to a neutral outlook in the near-term. On the upside, $1,900 (50-day SMA, 100-day SMA, Fibonacci 50% retracement of the June-August uptrend) aligns as a key resistance. With a daily close above that level, gold could target $1,930 (Fibonacci 38.2% retracement).

On the other hand, strong support seems to have formed at $1,850 (Fibonacci 61.8% retracement). If the price drops below that level and flips it as a resistance, $1,820 (former static resistance) could be targeted.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.