Gold Price Forecast: XAU/USD surrenders Tuesday’s gains as yields rebound on mixed Asian markets

- Gold has surrendered its entire gains on a rebound in US Treasury yields.

- Markets eye the Ukraine crisis, with mixed headlines overnight.

- Can XAU/USD push higher as west blocks Russia's gold transactions?

Update: Gold (XAU/USD) has witnessed selling pressure near Tuesday’s high at $1,929.44. The precious metal has surrendered its all intraday gains and is preparing to turn bearish. The gold prices are likely to display a bearish open rejection-reverse day in which the initial upside move is considered as a selling opportunity by the market participants. The precious metal is likely to extend losses after tumbling below Monday’s low at $1,917.00 decisively.

It is worth noting that mixed cues from the Asian markets have supported the US Treasury yields. The 10-year benchmark US Treasury yields has turned positive after a weak opening on Tuesday, which has also weighed pressure on the gold prices.

Meanwhile, the US dollar index (DXY) has been cushioned after slipping near 99.00. The mighty greenback is likely to advance gains on hopes of an aggressive monetary policy by the Federal Reserve (Fed) in May. But before that, the US Nonfarm Payrolls (NFP) will remain in focus, which are due on Friday.

End of Update

The gold price fell sharply at the start of the week while the greenback picked up the flow, eradicating the demand for the precious metal. The US dollar climbed to its highest level in more than a week, while yields on two-year Treasuries surged. At the time of writing, XAU/USD is 0.2% higher in Asia as the bulls move in and the price attempts to recover.

The gold price has travelled from a low of $1,921.54 to a high of $1,929.45 so far. Markets remain hinged to developments regarding the Ukraine crisis, with mixed headlines overnight. The Financial Times on Monday published news that Russia is no longer demanding that Ukraine be ‘denazified’ in ceasefire talks and will allow Kyiv to join the EU if it abandons Nato aspirations. It went on to say that Moscow & Kyiv will discuss a pause in hostilities at talks in Turkey on Tuesday and draft documents do not contain three of Russia’s initial core demands — “denazification”, “demilitarisation”, and legal protection for the Russian language in Ukraine, sources told the FT.''

With that being said,the possibility of a Putin-Zelenskiy meeting is slim. The Kremlin says there has been no progress. The Russian Foreign Minister Lavrov said recently that any meeting between Putin and Zelenskiy to exchange views currently would be counter-productive. Additionally, a senior US official said Russian President Vladimir Putin did not appear ready to make compromises. Ukrainian officials are also playing down the chances of a major breakthrough at the talks.

Meanwhile, US equities slipped early in new York trade as high inflation and monetary tightening risks weighed on market sentiment. However, there was a rebound late in the day as big tech names supported the Nasdaq, the S&P 500 and the Dow. The Dow Jones Industrial Average ended up 0.3%, the S&P 500 gained 0.7% while the Nasdaq Composite added 1.3%.

As for data, the Dallas Federal Reserve's monthly manufacturing survey for March, a narrower advance trade gap for February and a rise in inventories. The Dallas Fed's Manufacturing Activity Index dropped to 8.7 in March from 14 in February, in contrast to other regional data that indicated expansion in the sector.

Additionally, the trade gap narrowed 0.9% to $106.6 billion in February amid higher exports. The updated trade data for the month will be released on April 5. Lastly, Wholesale Inventories rose by 2.1% in February and retail inventories by 1.1%. Wholesale inventories will be updated on April 8, while retail inventories will be updated on April 14.

Key data ahead

Looking ahead for the week, the labour market in the US, as well as the eurozone inflation data, will be keenly eyed. The US Nonfarm Payrolls at the start of the new month on Friday is likely to show that Employment continued to advance in March following two strong reports averaging +580k in Jan and Feb, analysts at TD Securities argued.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

As for eurozone inflation, the analysts expect ''headline HICP inflation to soar across the euro area in March, mostly due to a substantial surge in energy prices.''

They are also looking for a rise in non-energy industrial goods prices to boost euro area core inflation to a 28-year high of 3.2% (mkt: 3.1%). ''However, newly passed energy subsidies and price caps add some downside risk to our headline forecasts.''

Gold technical analysis

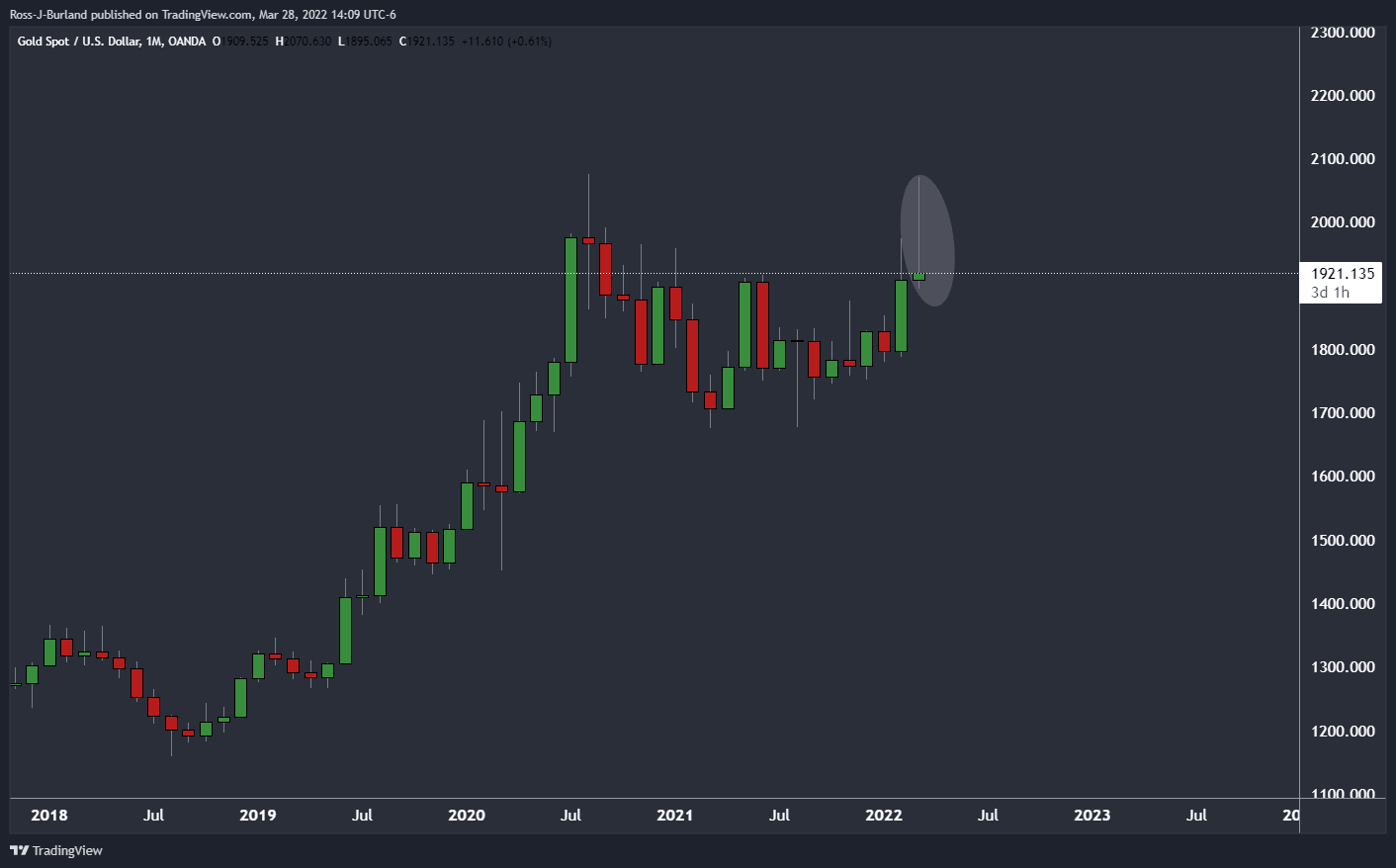

We are in the last week of the month and the start of a new quarter could print a bullish prospect on the monthly chart, as illustrated below:

The month is set could close with a bullish candle and long wick that represents a phase of accumulation on the lower time frames. Meaning, there is potential for a move high in the weeks ahead and a fresh cycle high thereafter.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.