Gold Weekly Forecast: Can XAU/USD push higher as west blocks Russia's gold transactions?

- XAU/USD recovered a portion of the previous week's losses despite rising US yields.

- West decided to block the Russian central bank's gold transactions.

- Gold needs to use $1,950 as support in order to extend its rebound.

Gold spent the first half of the week fluctuating in a relatively tight range above $1,920 but regained its traction after breaking above $1,950 on Thursday. Although the yellow metal struggled to preserve its bullish momentum on Friday, it rose more than 1% on a weekly basis.

What happened last week?

In the absence of high-tier macroeconomic data releases on Monday, gold staged a technical correction and ended up closing the first day of the week in positive territory. With FOMC policymakers opening the door for an aggressive policy tightening, however, US Treasury bond yields surged higher and forced XAU/USD to stretch lower on Tuesday.

FOMC Chairman Jerome Powell said on Monday that there is an obvious need to “move expeditiously” to a more neutral level or even restrictive levels to tame inflation. “If we need to raise the Fed funds rate by more than 25 basis points (bps) at a meeting of meetings, we will do so,” Powell added. Similarly, Cleveland Fed President Loretta Mester argued that a 50 basis points rate increase should not be off the table. On the same matter, “the data will tell us if 50 bps is the right recipe” San Francisco Fed President Mary Daly noted. “I have everything on the table.”

The negative shift witnessed in risk sentiment caused US T-bond yields to turn south on Wednesday and helped gold stage a rebound.

On Thursday, the benchmark 10-year US T-bond yield reversed its direction once again and rose nearly 4% on a daily basis. Nonetheless, gold ignored rising yields and registered impressive gains on the same day.

The US and its allies announced on Thursday that they will block the Russian central bank’s financial transactions involving gold to make it difficult for the country to finance the war and bypass sanctions. Experts think that the Central Bank of Russia has more than $100 billion worth of gold in its holdings, which makes up roughly 20% of the bank’s reserves. Following this development, XAU/USD reached its highest level in more than a month at $1,966.

Meanwhile, the data from the US showed that weekly Initial Jobless Claims declined to 187,000 in the week ending March 19, marking the lowest print since 1969. Additionally, Markit Manufacturing PMI improved to 58.5 in early March from 57.3, revealing that the business activity in the manufacturing sector continued to expand at a strengthening pace.

With US T-bond yields extending the weekly rally on Friday, gold lost its momentum but ended up gaining more than 1% on a weekly basis.

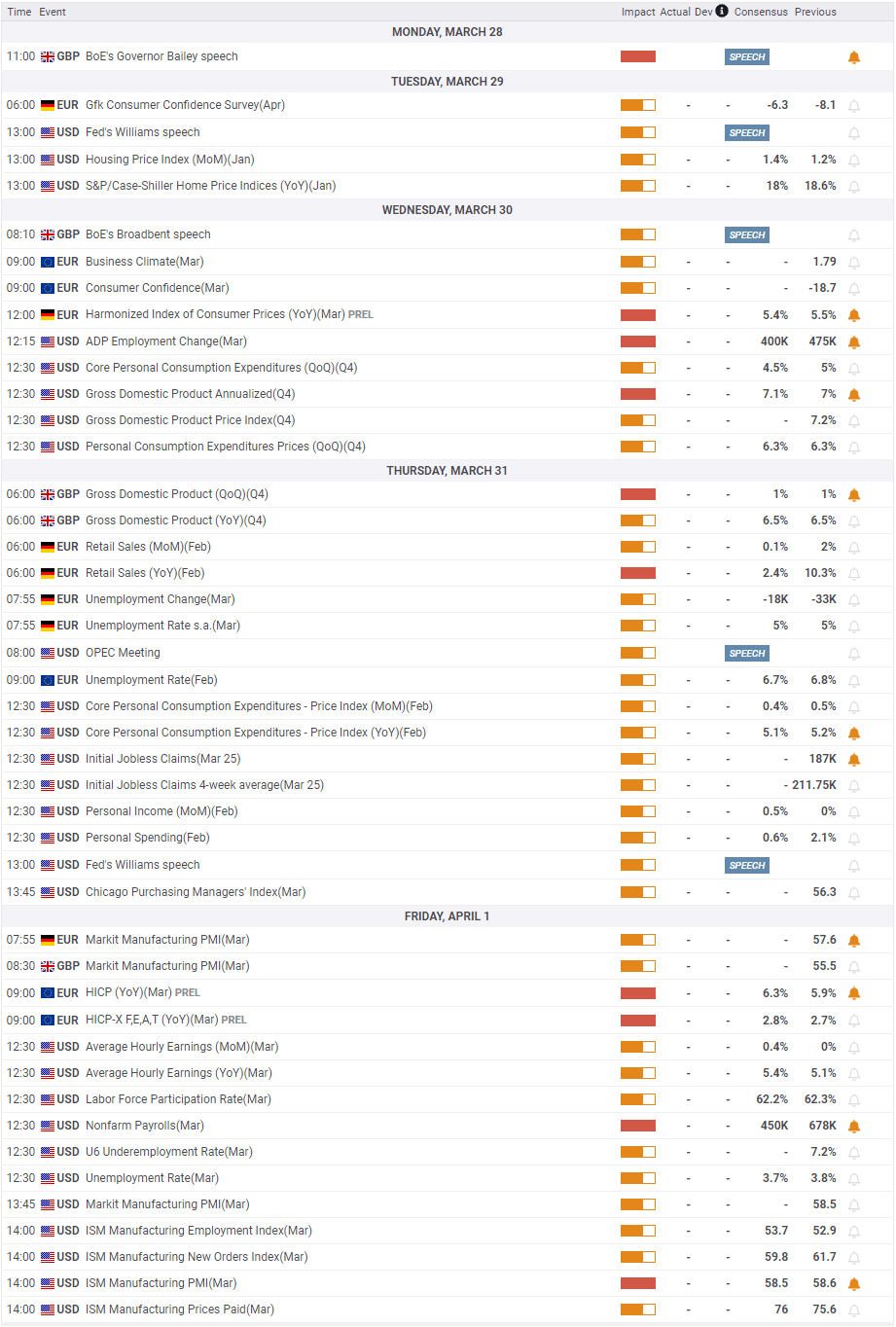

Next week

The US economic docket will not feature any high-impact data releases on Monday and Tuesday. On Wednesday, the ADP’s private-sector employment report and the US Bureau of Economic Analysis’ final revision to the annualized Gross Domestic Product (GDP) growth for the fourth quarter will be looked upon for fresh impetus.

In the second half of the week, the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, on Thursday and the Nonfarm Payrolls (NFP) data on Friday will be watched closely by market participants.

Investors forecast the PCE Price Index to have climbed to 6.7% in February from 6.1% in January. Even if the actual print comes in lower than expected, it shouldn’t have a significant impact on the market pricing of the Fed’s policy outlook since it will not reflect the rise in energy prices in March.

The US Bureau of Labor Statistics’ monthly publication is expected to show an increase of 450,000 in NFP in March. In January and February, NFP surpassed analysts’ estimates and reaffirmed the Fed’s view that the labor market is doing well. Friday’s jobs report is unlikely to change policymakers’ willingness to continue to tighten the policy.

As it currently stands, the CME Group FedWatch Tool shows that markets are pricing a 70% chance of a 50 bps rate hike in May. Next week’s data releases could ramp up this probability and allow US T-bond yields to push higher. In that case, gold’s upside is likely to remain capped.

On the other hand, investors grow increasingly concerned over the potential negative impact of a prolonged Russia-Ukraine conflict on global economic activity. A further escalation of geopolitical tensions should help the yellow metal limit its losses and vice versa.

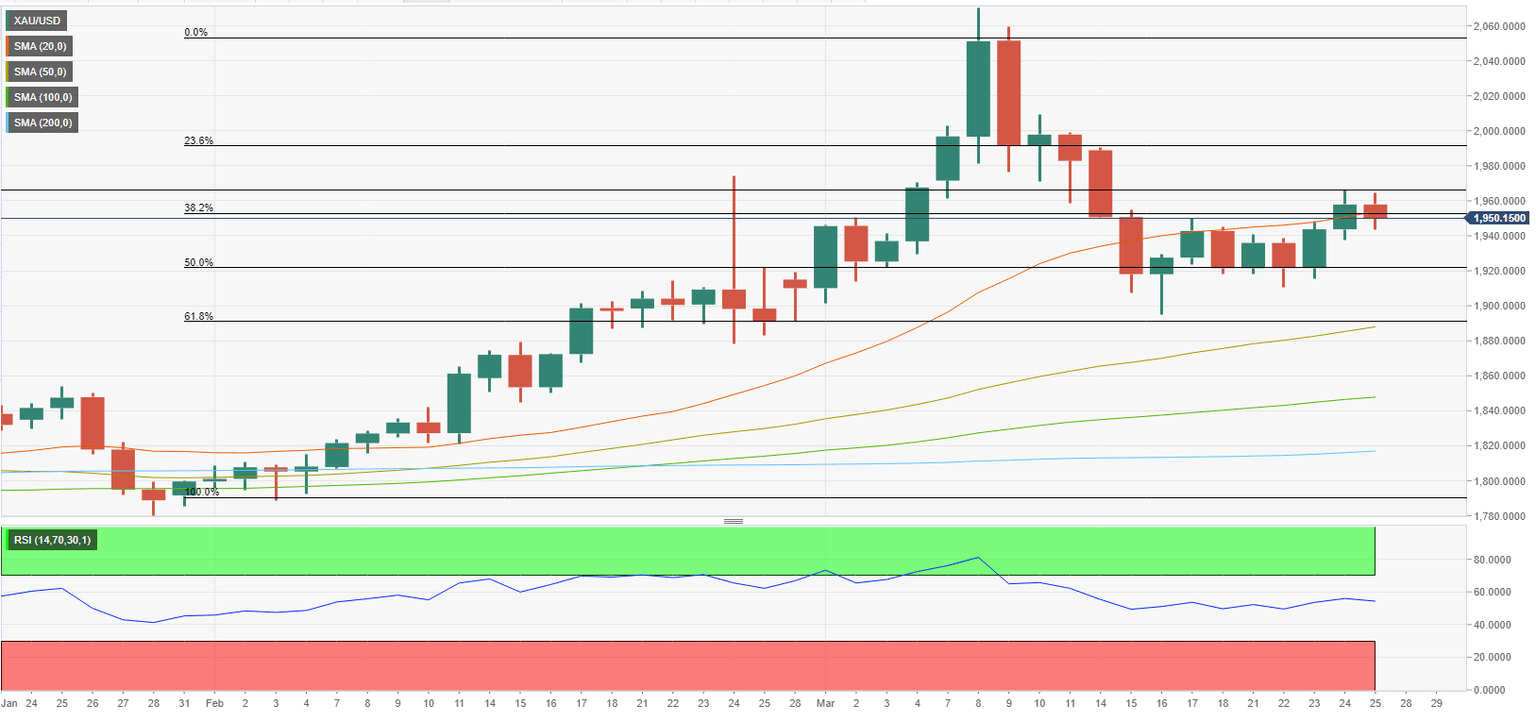

Gold technical outlook

The 20-day SMA and the Fibonacci 38.2% retracement of the latest uptrend seem to have formed a key technical level at $1,950. In case gold starts using that level as support, it faces an interim resistance at $1,965 (static level) before it can target $1,990 (Fibonacci 23.6% retracement) and $2,000 (psychological level).

On the flip side, XAU/USD could face renewed bearish pressure if it fails to hold above $1,950 and decline toward $1,920 (static level, lower limit of the consolidation channel). With a daily close below that level, the pair could test $1,900 (Fibonacci 61.8% retracement, 50-day SMA).

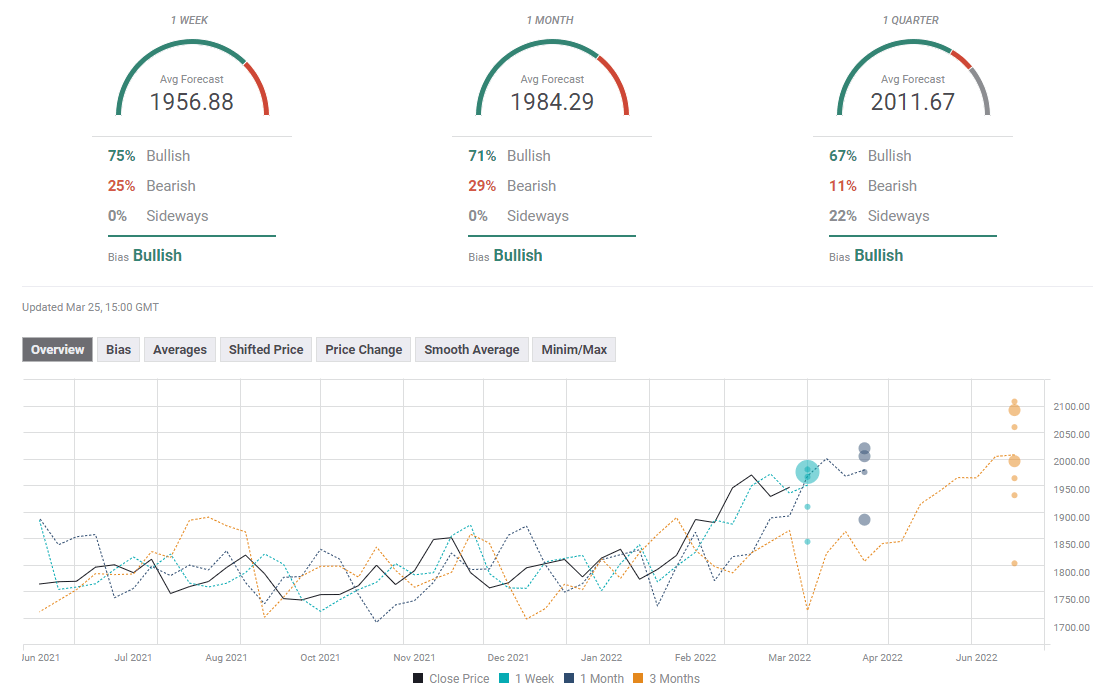

Gold sentiment poll

There is an apparent bullish tilt in the FXStreet Forecast poll. The majority of the polled experts see gold rising in the one-week and one-month time frames with average targets of $1,956 and $1,984, respectively.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.