Gold Price Analysis: XAU/USD consolidates the upside near $1900, as focus shifts to FOMC

- Gold is testing the bearish commitments at critical resistance.

- Ther FOMC is the next major event for the gold market following Thursday's US CPI.

- The bond markets are priced for dovish outcome and gold is enjoying some potentially short-term dollar weakness.

Update: Gold price is in an upside consolidative phase just below the $1900 mark in Friday’s Asian trading, as the bulls take a breather before the next leg higher. Expectations that the Fed will maintain its accommodative monetary policy stance, even though the US inflation ran hotter than the forecasts, keeps the bullish undertone intact around gold price. Treasury yields dropped alongside the US dollar in the aftermath of the CPI report, as the Fed is still likely to consider the price rise as transitory.

Further, news that US bipartisan Senators agreed over President Joe Biden’s infrastructure spending plan also underpins gold. Markets now look forward to the G7 meeting and the US Michigan Preliminary Consumer Sentiment data slated for release on Friday, although the main focus remains on next week’s FOMC meeting.

Read: Hot Inflation is warming the seat for the June FOMC

At the time of writing, gold is trading at $1,899, higher by some 0.56% and up from a low of $1,869 near to the highs of the day at $1,899.41.

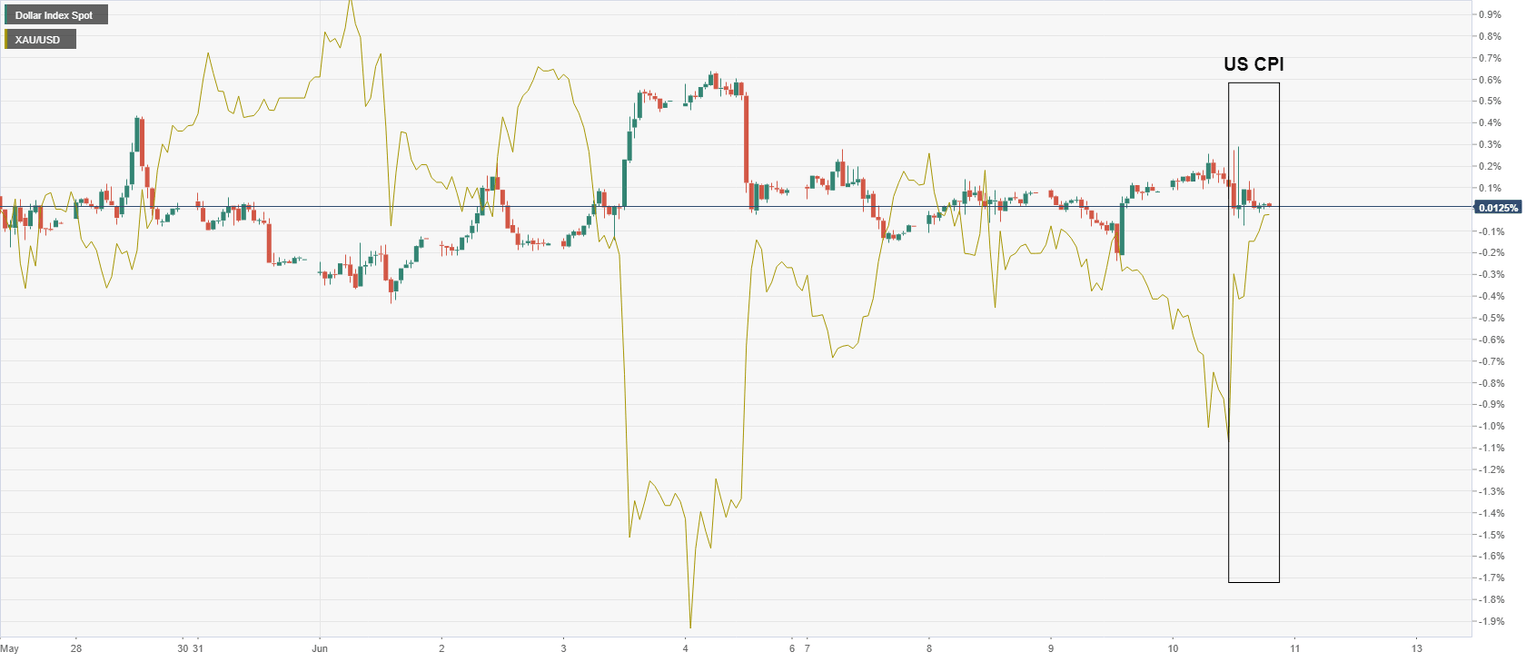

Risk sentiment is subdued on Thursday as investors remained cautious ahead of the US Consumer Price Index print.

The fear was that another strong inflation print could once again spark talk of taper talks that could weigh on gold as the transitory or not debate rages on.

However, instead, gold collected a bid as the US dollar sank in a market priced for a dovish Federal Open Market Committee next week.

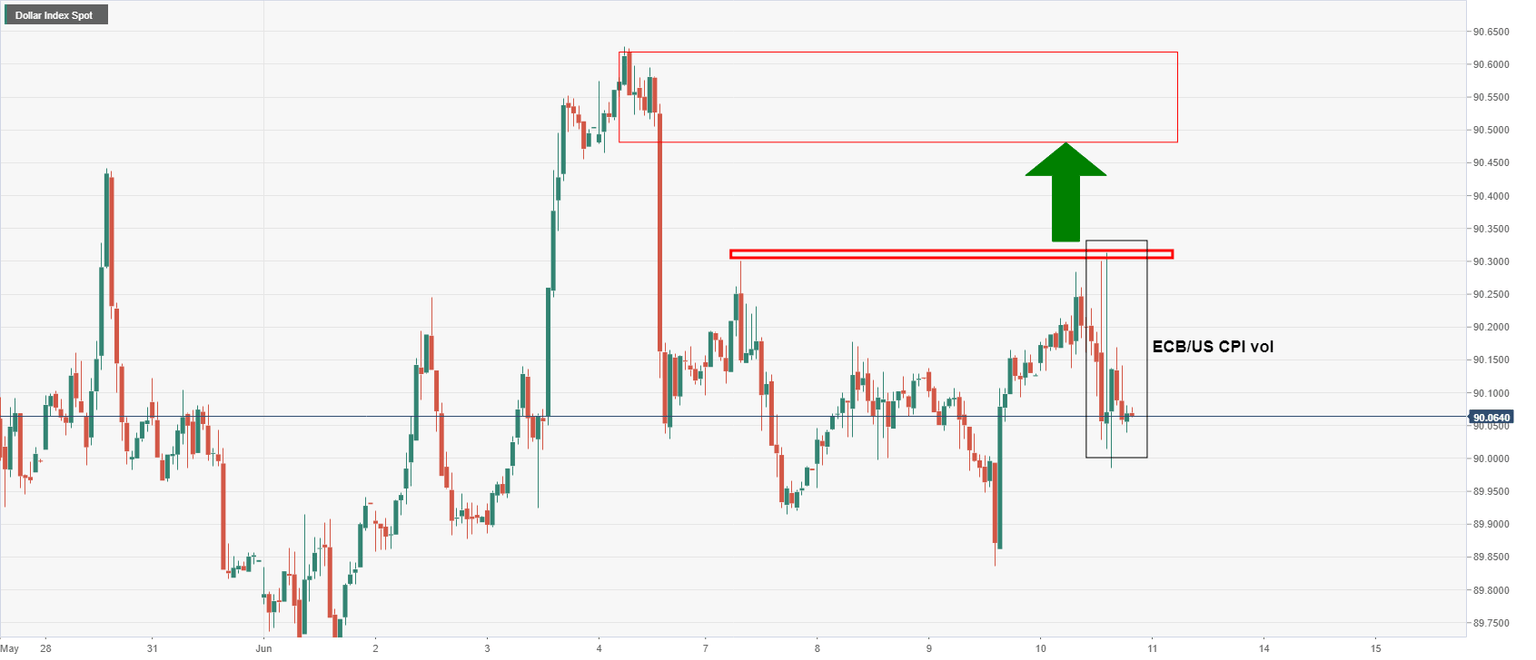

The greenback had been building on its modest gains ahead of theUS CPI data, edging higher for a third straight day the highest level since Monday at around 90.30.

However, the index drifted lower into what was a relatively disappointing reaction to the data considering the anticipation leading into the event and a strong outcome.

The CPI rose 0.6%, with core up 0.7%, stronger than expected. Also, the US CPI rose 5.0% YoY which was the largest annual gain in more than a decade

However, the outcome was not entirely a surprise given the potential changes as the economy re-opens.

''All in all, strong core data again, but the strength can probably still be viewed as "transitory" to a large extent, due to post-COVID reopening as well as fallout from the semiconductor shortage,'' analysts at TD Securities said.

''We don't think this report materially changes the Fed's thinking as much of the strength remains confined to reopening-related sectors.''

''... it would take a string of strong CPI reports later this year for the Fed to get concerned about an earlier overshoot.''

Moreover, forex volatility is at its lowest since the turn of 2020 and one report was unlikely to kick-up a huge storm:

The CPI appeared to add little new direction to currency markets and the greenback is stuck in familiar ranges:

DXY hourly chart

''A clean break above 90.325 is needed to set up a test of last week’s pre-NFP high near 90.627,'' analysts at Brown Brothers Harriman argued.

Instead, traders are treading water ahead of the Fed next week and gold is enjoying some renewed softness in the greenback.

FOMC will be important for gold

The upside US CPI print may trigger calls to challenge the Fed on taper and rate hike pricing. However, the Fed is in no hurry to exit, at least according to the bond market and gold's performance today.

On the other hand, analysts at TD Securities argue that the tone will probably be slightly less dovish than in April.

''We expect the chair to say that the committee has started discussing a progress-dependent tapering plan while also emphasizing that action will require much more progress,'' the analysts argued.

''A less dovish Fed tone next week would help to stabilize the USD in the very short run,'' the analysts forecasted.

''Of course, it may not reverse all of Q2's weakness, but positioning has turned short once again, real rates might be bottoming, and global growth shows signs of pausing. All signs to expect some USD stability as we enter the summer months.''

A surge in the greenback would equate to a pullback in gold which is increasingly vulnerable as speculative flows are now slowing alongside physical flows.

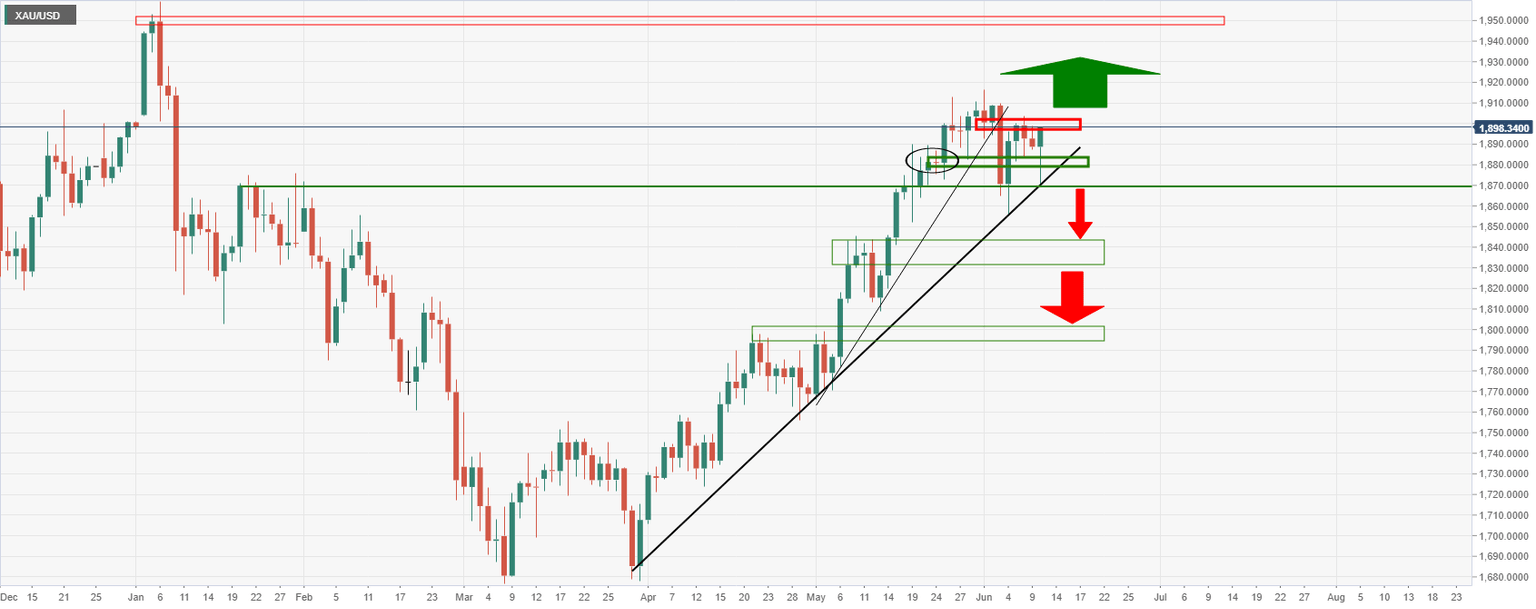

Gold technical analysis

The price is range bound and trapped between critical daily support and resistance, resting against the newly formed dynamic supporting trendline since breaking the prior.

A break above the 1,900 level would be just as significant as a break below the 1,870 support.

Previous update

Update: Gold (XAU/USD) portrays sluggish moves around $1,900-1898 amid the initial Asian session on Friday. Downbeat Treasury yields dragged the US dollar and pleased the gold buyers the previous day. Also contributing to the yellow metal’s upside could be the ECB’s refrain upward revision to the inflation and growth forecasts as well as firming fears of the Fed’s tapering, backed by a strong beat of inflation.

More recently, US bipartisan Senators’ agreement over the infrastructure spending plan backs the gold prices amid a quiet session after the quote jumped the most in a week and the Wall Street benchmarks also cheered an anticipated busy day.

Given the start of the Group of Seven (G7) meeting, coupled with the recent positive chatters over the US-China ties and vaccine donations, the market sentiment is likely to improve, putting a bid under the gold. However, looming risks over tapering and detailed investigation of the covid origin may probe the gold bulls amid a light calendar day.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637589449181097612.jpeg&w=1536&q=95)