Gold Price Analysis: XAU/USD bears stay directed towards $1,900

- Gold prices remain on the back foot for second consecutive day.

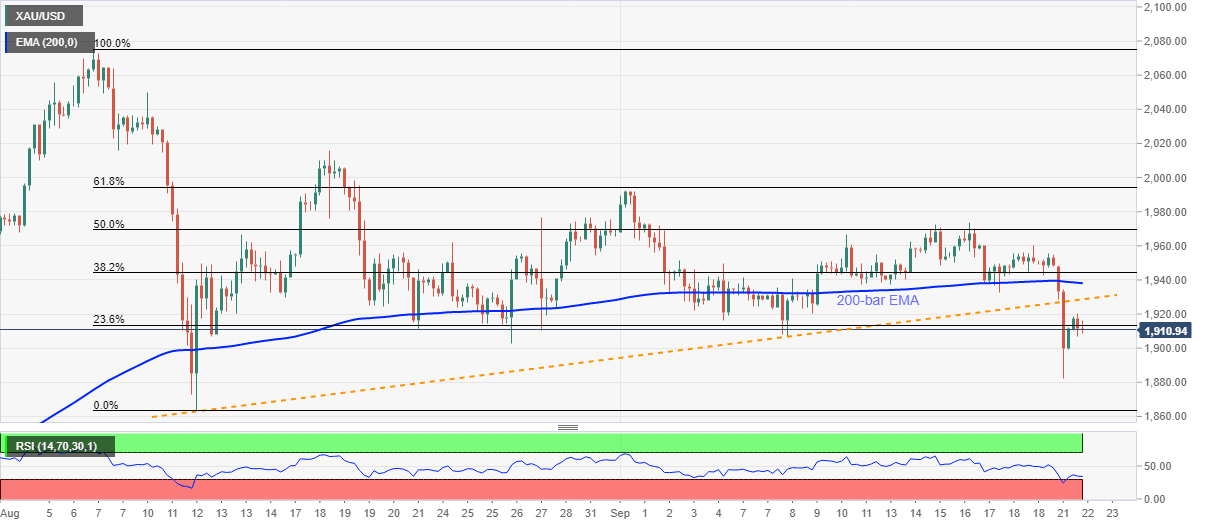

- Sustained break of six-week-old support line, now resistance, keeps the sellers hopeful.

- 200-bar EMA adds to the upside barriers, August month’s low offer extra support.

Gold remains mildly heavy around $1,910, down 0.11% on a day, while heading into Tuesday’s European session. The bullion slumped the most since August 19 the previous day after breaking a 1.5-month-old ascending trend line.

Although counter-trend traders tried to recover losses from $1,882 while reaching $1,920, failures to cross the previous support line keeps the bears hopeful.

Hence, gold sellers are currently targeting the $1,900 psychological magnet before the previous day’s low of $1,882. Though, any further downside will have to respect August month’s bottom surrounding $1,863, if not then the early-July tops near $1,818 will return to the charts.

In a case where the fresh pullback moves cross the immediate resistance line around $1,928/29, the 200-bar EMA level of $1,938 can question the buyers.

If at all the upside momentum stays strong beyond $1,938, the previous week’s high around $1,973 will lure the bulls.

It’s worth mentioning that the RSI conditions may probe bears below the $1,900 round-figures.

Gold four-hour chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.