Gold Price Analysis: XAU/USD bears rolling up their sleeves

in the shorter term, the price action of late has seen prices fall out of a rising wedge formation which in its self is bearish, as described in the following article from the New York session on Tuesday:

The article notes how the Chaikin Money Flow on the hourly time frame and divergence shouldn't be ignored whereby the expansion of volume on the support line break can be taken as bearish confirmation.

keynotes

- On the hourly time frame, we have seen a 38.2% Fibonacci retracement.

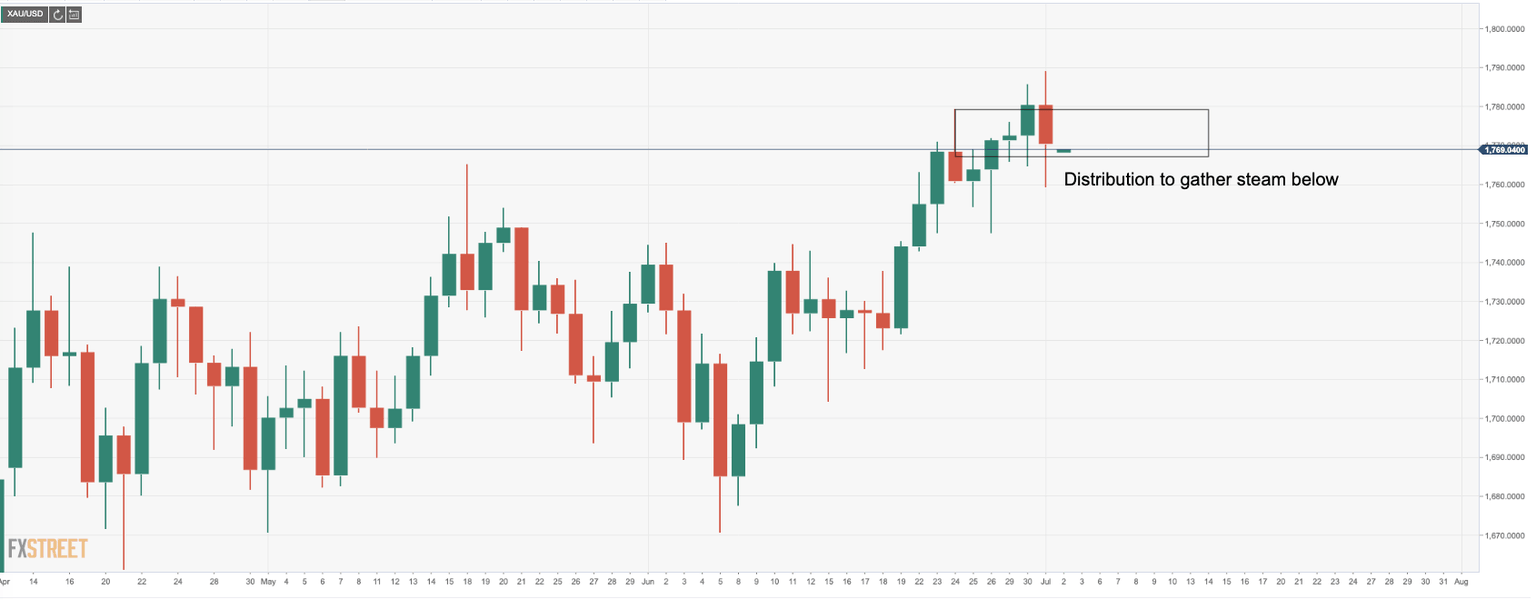

- Some bearish consolidation can be expected at this juncture to form the right-hand shoulder (RHS) of the head and shoulder, (H&S) ahead of the next impulse to the downside towards the 1750s and then the 1730s.

- On the other hand, should fundamentals flip significantly in the bulls favour and override the technical outlook, the 1800s will be a magnet.

Adding to this, there is still an overwhelming bullish bias in terms of positioning data as money managers aggressively increased their long exposure ahead of a run to $1,800 for the third time this year.

The increase in long positions was also driven by a weakening USD.

Inflation expectation increases outpaced the rise in yields as well leading to a slide in real yields.

However, some specs grew their short positioning amid worries that prices were too 'toppy' and this is where the near term downside in gold is playing out.

should there be a fundamental shift in positioning, we can expect the bulls to take over and a prolonged period of distribution play out and probably quite quickly when the price gets below key support.

Here is the near term picture:

Now let's look into gold from a top-down analysis:

Monthly distribution outlook

Key Fib of prior downside correction

5-wave count, sell off playing out?

Distribution to gather steam

As can be seen, all are lining up for a major sell-off with price pressuring into the major distribution zone below support.

A break into the 1800s will likely encourage a further push to the upside.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.