Gold Price Analysis: XAU/USD aims next two resistances, as $1969 gets tested – Confluence Detector

Gold (XAU/USD) is rejoicing another leg higher, sitting at the highest levels in nine days above $1960. Gold benefits from the US dollar weakness, as the greenback breaks lower on the return of the risk appetite, thanks to the stronger Chinese activity numbers and US-Sino trade optimism. Looming Brexit risks boost the safe-haven appeal of gold.

Coronavirus vaccine hopes will continue to bode well for global equities at the expense of the dollar, which is likely to render gold supportive. Let’s take a look at whether gold’s charts?

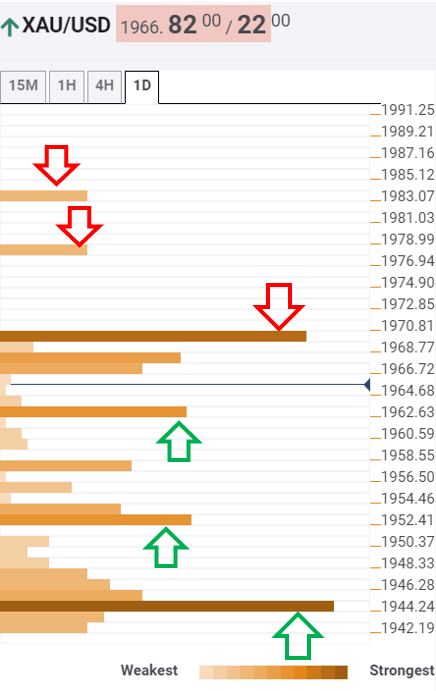

Gold: Key resistances and supports

The Technical Confluence tool shows that gold is on the verge of recapturing the robust barrier at $1969, which is the convergence of the pivot point one-week R1 and Bollinger Band 15-minutes Upper.

Alternatively, plenty of healthy support levels are likely to limit any retracements, with the immediate cushion aligned at $1962, the intersection of the previous day high, SMA200 four-hour and Bollinger Band four-hour Upper.

Sellers will then challenge minor support at $1957, where the Fibonacci 23.6% one-day and SMA5 four-hour coincide.

Further south, the Fibonacci 23.6% one-week level at $1951 will get tested. A break below which a dense cluster of support levels is seen around $1947.

The downside target of $1945 is the level to beat for the bears. That level is the Fibonacci 38.2% one-week.

Here is how it looks on the tool

About the Confluence Detector

The TCI (Technical Confluences Indicator) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.