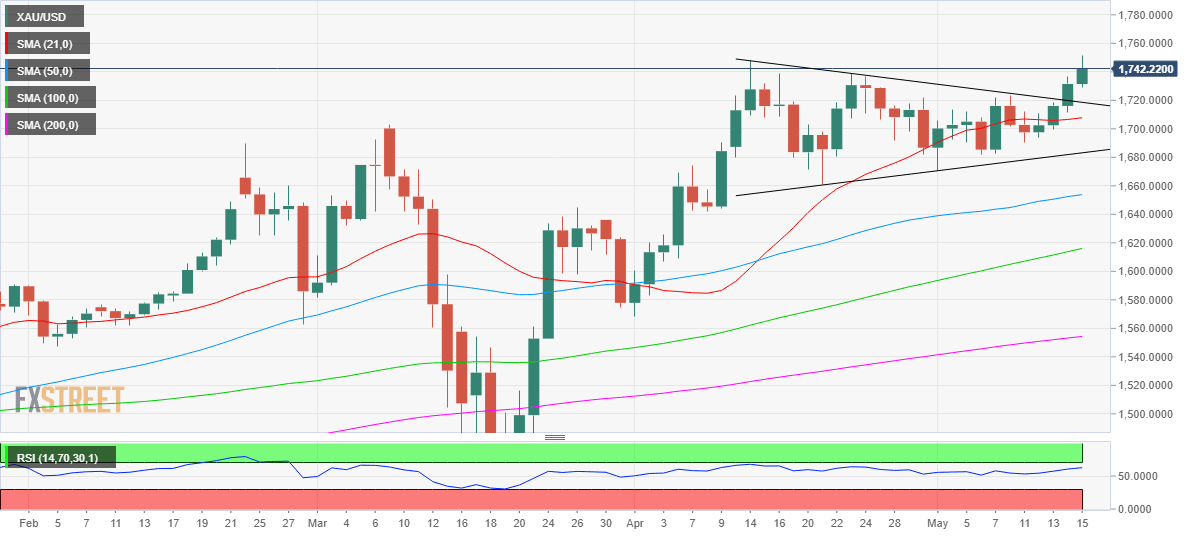

Gold Price Analysis: Symmetrical triangle breakout targets $1805 in the coming weeks

- Gold hit 7-year tops after symmetrical triangle breakout on the daily chart.

- XAU/USD trades above all major Daily Simple Moving Averages (DMA).

- Daily RSI suggests more room for additional upside.

The bullish reversal in Gold prices (XAU/USD) kicked-off last week after bottoming out at 1690 levels.

The upside momentum gained traction after the rates closed Wednesday above the 21-DMA, then at 1705.81.

While the actual bullish break materialized after a classic symmetrical triangle pattern was confirmed on the daily chart last Thursday. The bulls rallied hard to clock a fresh seven-year high at 1751.80 before retracing slightly into the weekly closing on Friday.

In a month’s time, the price is likely to test the pattern target at $1807. Ahead of that level, the key resistances are located at 1754.39 (Nov 2012 high), 1760 (round number) and 1795.25 (Oct 2012 high).

Advocating the case for additional gains, the daily Relative Strength Index (RSI) is pointing upwards, although remains below the overbought territory, near the 65.15 region. Meanwhile, the spot trades above all majors DMAs.

Alternatively, any pullback will target the earlier resistance-turned-descending trendline support aligned at 1719.61, below which the 21-DMA will be tested on its south run towards the 1700 level. Selling pressure will accelerate below the latter, opening floors for a test of the ascending trendline (pattern) support at 1685.56.

Gold: Daily chart

Gold: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.