Gold Price Analysis: Recapturing $1754 barrier is critical for XAU/USD, Powell eyed – Confluence Detector

Gold (XAU/USD) is edging lower from near the $1750 supply zone, although holds most of Tuesday’s gains induced by broad-based US dollar sell-off. The greenback wallows in three-week lows against its main competitors, weighed down by the decline in Treasury yields after stronger US CPI. Solid US 30-year bond auction also collaborated with the weakness in the yields, booting the non-yielding gold.

The next direction in gold could likely be determined by Fed Chair Powell’s speech after stronger Inflation failed to spark fears over Fed’s tapering. Meanwhile, let’s take a look at the key technical levels for trading gold.

Gold Price Chart: Key resistance and support levels

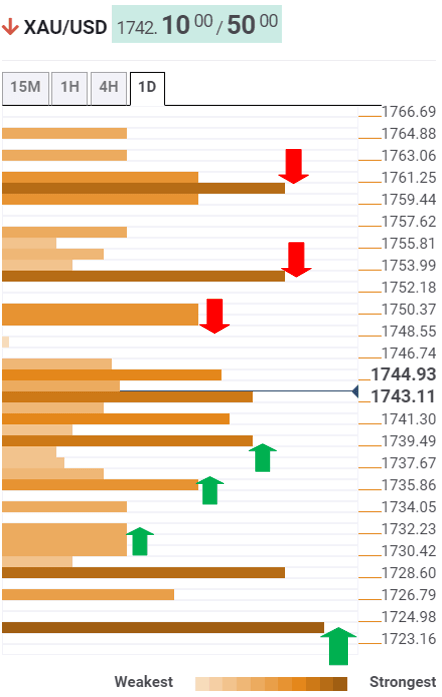

The Technical Confluences Detector shows that gold faces strong resistance just near $1750, the confluence of the previous day high and Fibonacci 23.6% one-week.

The XAU bulls need to recapture the critical resistance at $1754 to unleash additional upside. That level is the convergence of the SMA50 one-day and pivot point one-month R1.

The next bullish target is aligned at the previous month high of $1761.

To the downside, the Fibonacci 38.2% one-day level at $1740 could offer immediate support, below which the Fibonacci 61.8% one-week at $1735 could be challenged.

Further south, the intersection of the SMA10 one-day and pivot point one-day S1 around $1730 could be the last line of defense for the XAU bulls before the price tests six-day lows of $1724.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.