Gold Price Analysis: Bulls setting up for upside extension to -61.8% Fibo/$1,817/20

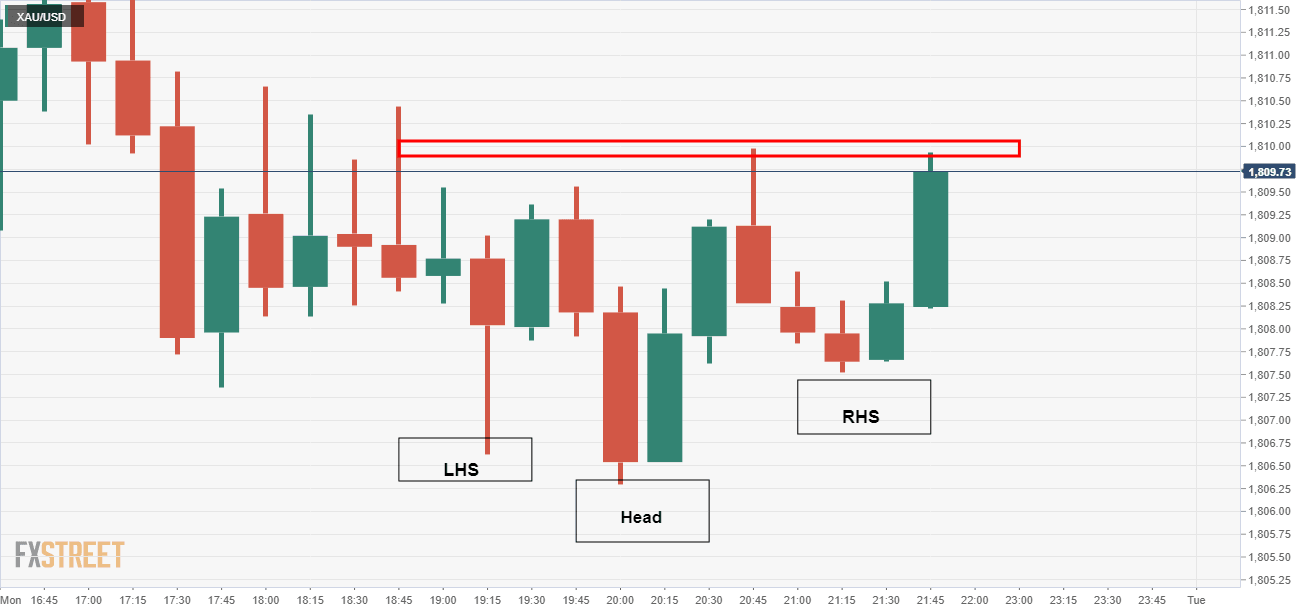

- Gold is consolidating the recent bullish impulse, but the 15-min reverse H&S is an extra conviction for prospects of a continuation.

- $1,817 and $1,820 are on the bulls map.

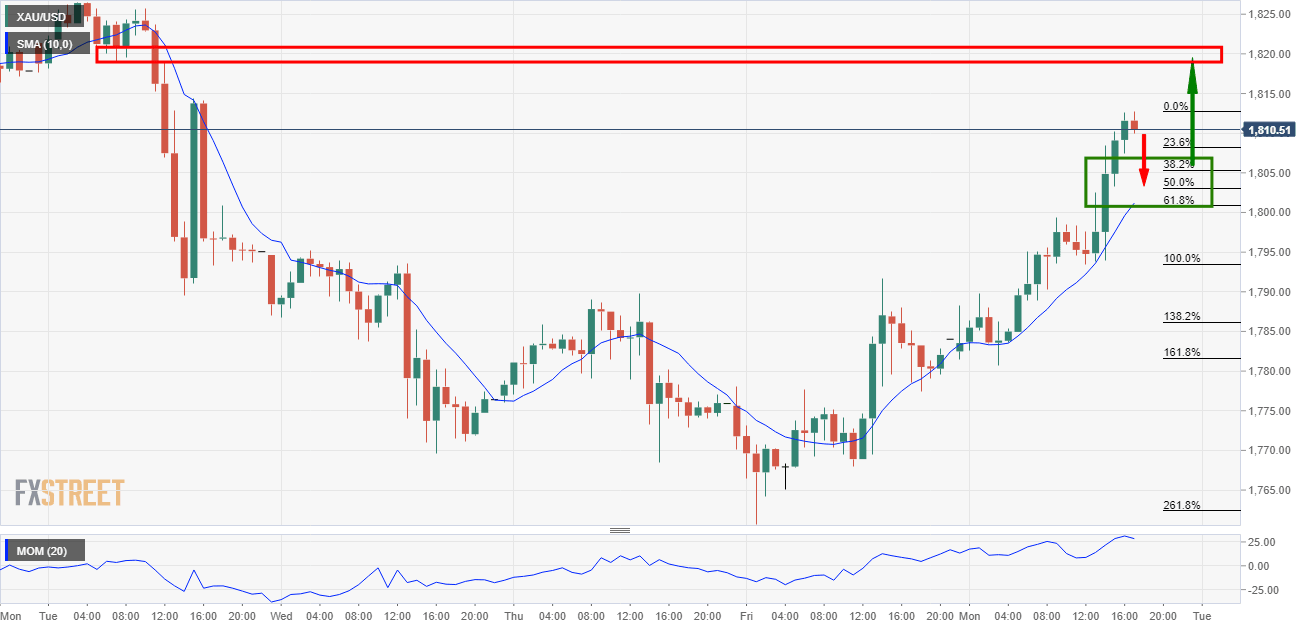

As per the prior analysis from the New York session, Gold Price Analysis: Bulls target $1,820, 1-hour Momentum points to meanwhile correction, the yellow metal did indeed decelerate to a measured target of the 38.2% Fibonacci retracement level.

Prior analysis

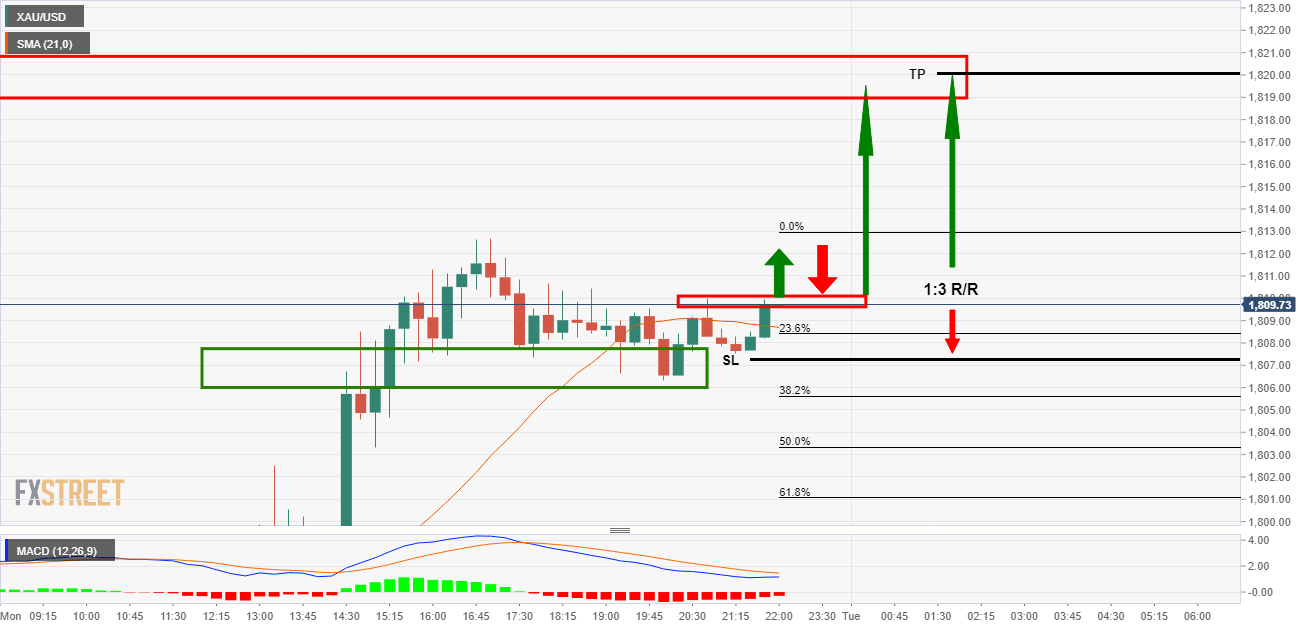

Live market, 1-hour chart

The bulls can seek an optimal entry for a continuation at this juncture from a lower time frame, such as the 15 or 5-minute charts.

15-chart setup

As illustrated on the 15-min chart, the price first needs to break the current resistance to confirm the bullish environment and commitment from the bulls at this juncture.

In doing so, this will have completed a bullish reverse head and shoulders pattern:

A buy limit placed at the new support structure, old resistance and neckline of the H&S pattern, will offer a discount.

This will enable the bulls to $1,820 target the upside with a stop loss protected by two layers of the support structure for a 1:3 risk to reward (R/R) long position.

A more conservative target, however, comes as the -61.8% Fibonacci retracement of the current correction's range at $1,817 for a 1:2 R/R.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.