Gold Price Analysis: Bulls target $1,820, 1-hour Momentum points to meanwhile correction

- Gold prices have been back on the bid through the psychological 1800 level.

- $1,820 is a marked target to the upside, but the hourly chart is on the verge of a healthy correction.

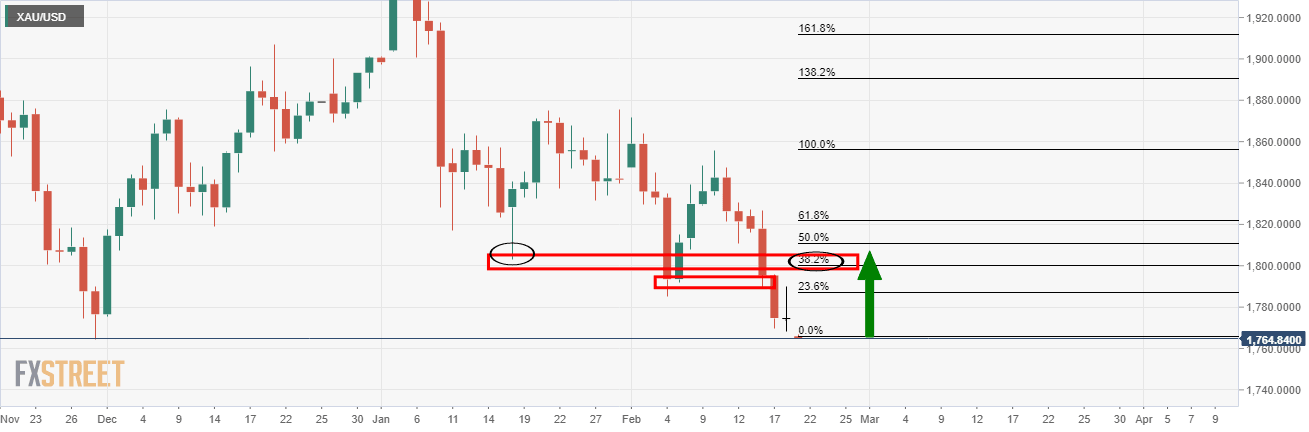

As per the prior analysis, Gold Price Analysis: Target achieved and fresh bear-cycle lows for 2021, where the price met weekly demand, it was argued that the price would resume the upside as follows:

Prior analysis

At this juncture, considering the weekly support, the price would now be expected to correct to the upside and restest the resistance of the $1,800 level again.

Daily chart

On the way there, $1,785 will be the first hurdle until the 38.2%, old support and psychological round number, $1,800, confluence.

Live market analysis

Meanwhile, the price has moved according to the analysis and has respected both the $1,785 and $1,800 levels as follows:

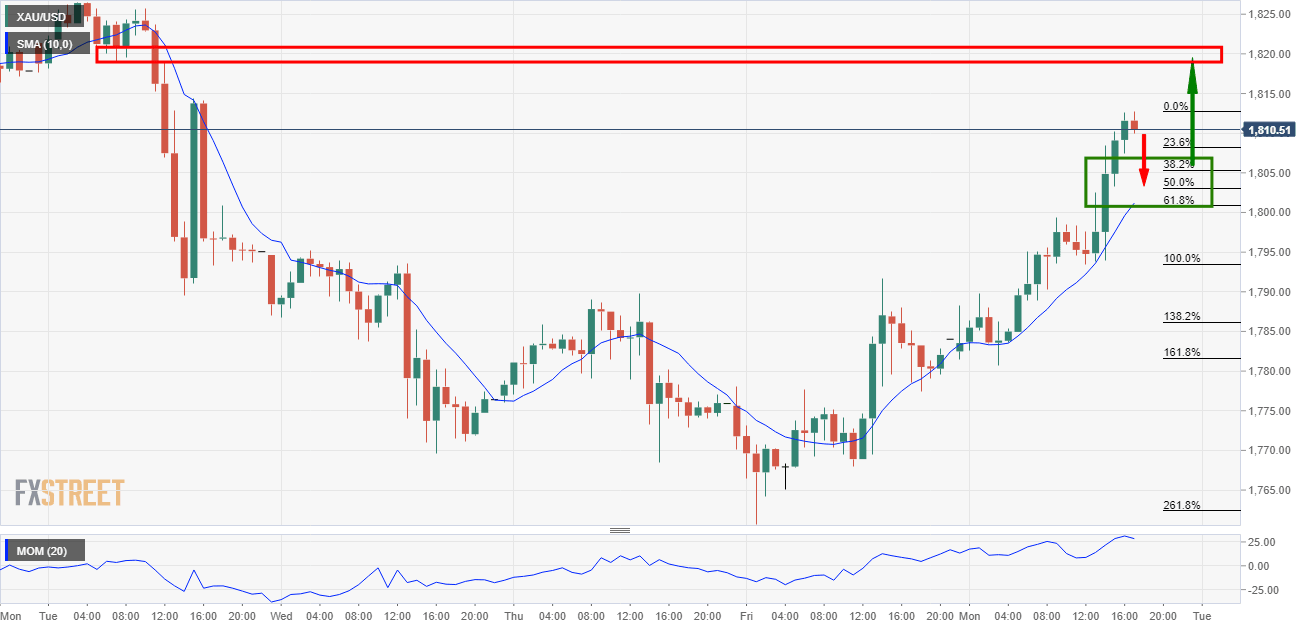

The US dollar has taken a nosedive at the start of the week which is fuelling the corrective surge to beyond a 50% mean reversion of the 10. Feb highs to the recent low's range as well as the 10-day EMA.

This gives scope to a continuation to test the bear's commitments at $1,820 where there is a confluence of the 61.8% Fibo retracements of the same range and the 20-day EMA.

On the way there, however and according to 1-hour Momentum, a correction to the 38.2% Fibonacci retracement or a 50% mean reversion of the recent bullish impulse may be in order first. This area comes in at $1,803/05 as a supporting structure.

Deeper than that, there is a confluence of the hourly 10-SMA and the 61.8% Fibo of the same range at $1,800 psychological support:

1-hour chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.