Gold Price Analysis: Bulls break out of reverse hourly head & shoulders to fresh highs of $1870

- Precious metals have started the week on the front foot

- The inflation hedge playbook is fully underway.

- Gold has reached a fresh rally high in a breakout of the reverse head and shoulders.

Precious metals have started the week on the front foot despite growing fears of renewed stay at home orders in major US cities, most recently being Los Angeles.

As we have witnessed in the past, gold does not hedge against a deflationary shock such as the virus, but so far inflation expectations have managed to hold firm in face of the latest worries,

analysts at TD Securities have argued.

Indeed, with yields sinking lower, real rates continue to make new lows and, along with mass stimulus and liquidity, remain the largest contributors to precious metal strength.

We expect that these common drivers will continue to drive capital to shelter itself from negative real yields in both risk assets and real assets, and therefore, we argue that money managers need not be concerned about trading gold in a risk-on environment.

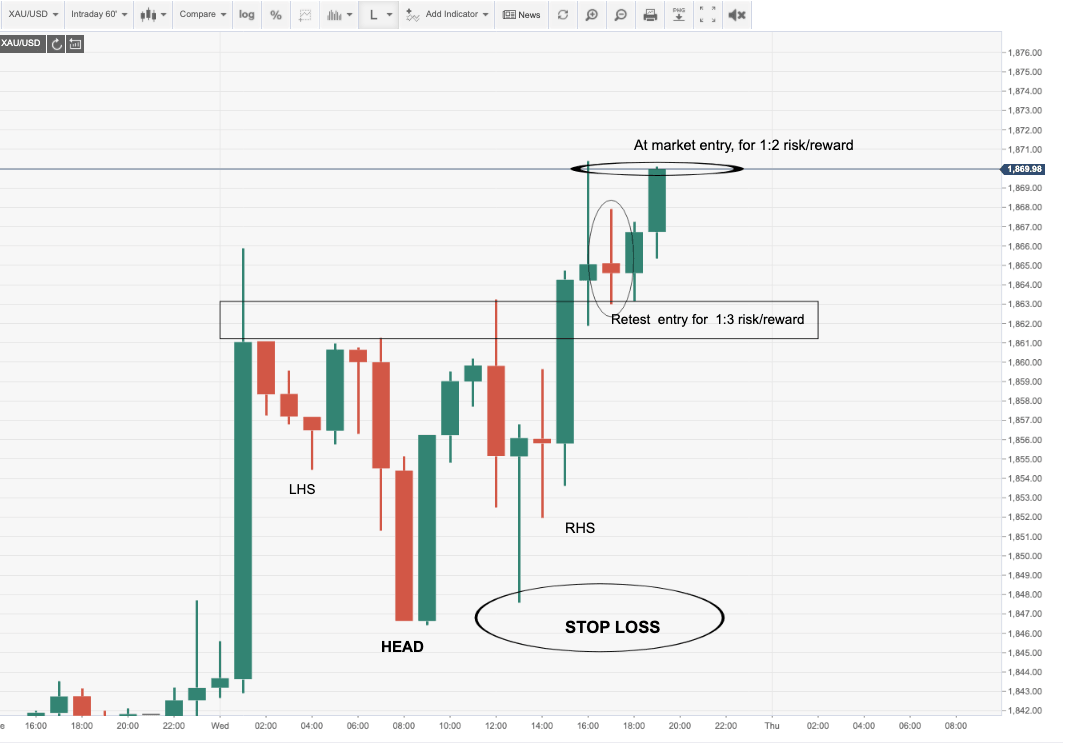

From a technical perspective, the bulls are breaking away from the neckline of the reverse head and shoulders on the hourly chart:

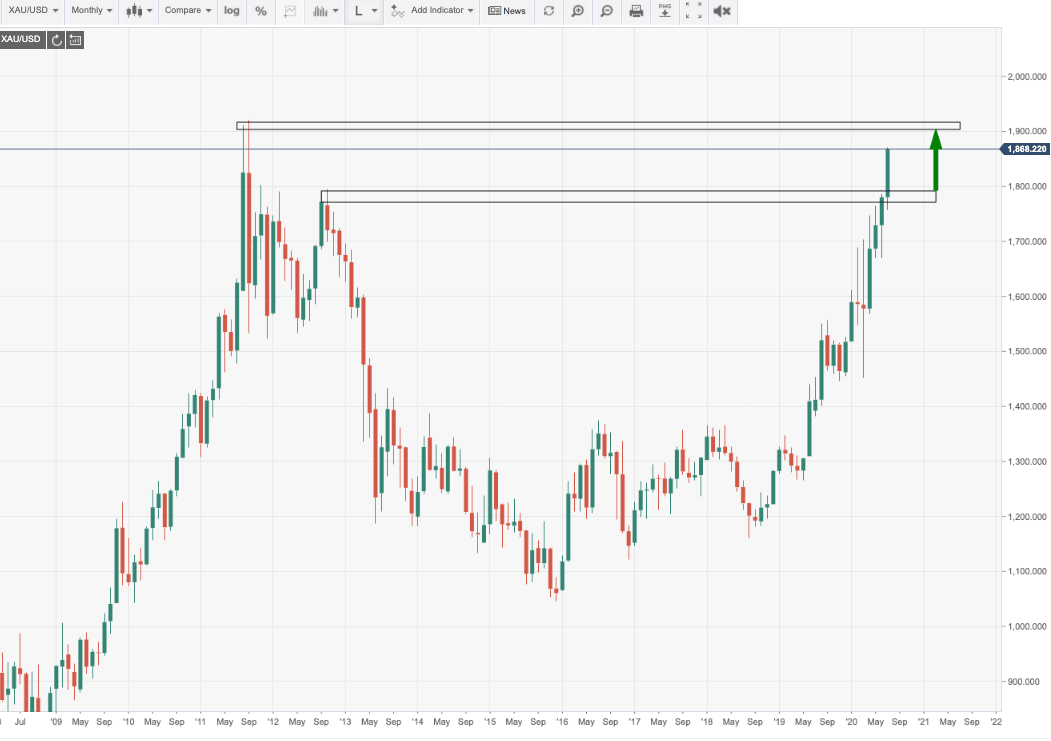

Bulls can take comfort that the price is through the AUG 2012 resistance turned support:

A retest of the neckline and a stop below structure could have been a set-up for the committed bulls chasing the bid towards all-time highs set back in September 2011 for a 1:3 R/R.

Bulls that missed that train still have a 1:2 at market.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.