Gold Price Forecast: XAU/USD stays offered below $1,800, Fed eyed

- Gold is meeting a critical level of resistance ahead of the FOMC outcome on Wednesday.

- Technicians will be looking for a downside continuation from a daily perspective.

Update: Gold (XAU/USD) drops for the second consecutive day, down 0.18% around $1,785. The pair recently refreshed the intraday low to $1,782.58 during Wednesday’s Asian session as market sentiment sours ahead of the US Federal Reserve (Fed) verdict.

While the Fed tapering tantrums weigh on the gold prices, with $15 billion trimming to monthly bond purchases eyed, chatters surrounding the US stimulus also recently weighed down the sentiment. In contrast to the previous hopes of getting the deal done during this week, US Senator Joe Manchin said, per the CNN, to have chief concerns that will need to be addressed in order to secure his vote for the $1.75 trillion economic package. The policymaker was cited expressing new optimism that a deal could ultimately be reached that would win his support on President Joe Biden's domestic agenda before Thanksgiving.

Amid these plays, US Treasury yields rebound whereas the S&P 500 Futures print mild losses by the press time.

Given the lack of major data/events in Asia, the gold prices may extend the latest weakness, though with a mild force, ahead of the US ADP Employment Change and PMIs for October. However, major attention will be given to the Fed’s verdict to determine near-term gold moves.

End of update.

The price of gold fell some 0.3% to $1,786.45/oz overnight from a high of $1,796.43 while market participants stayed focused on the Federal Open Market Committee meeting which is now underway. The US dollar is firmly holding the 94 figure as per the DXY, an index that measure's the greenback vs a number of rival and major currencies.

FOMC in focus

In the interim, the US markets were buoyed by positive earnings data while awaiting the Federal Reserve Governor Jerome Powell’s post FOMC presser that will focus on a more evenly balanced assessment of inflation risks. The market has fully priced in the Fed's expected tapering announcement and will be looking for any clues as to when the central bank will begin raising rates, similar to last week's European Central Bank meeting.

'Most officials seem to agree that it’s better to get tapering over as quickly as possible in order to leave the Fed maximum flexibility to hike rates when needed,'' analysts at Brown Brothers Harriman explained. ''We believe that the most likely path for tapering has already been flagged by the Fed, which would reduce asset purchases by $15 bln per month ($10 bln UST and $5 bln MBS).''

The Fed will start tapering this month so that QE effectively ends by mid-2022, according to the analysts at BBH. The market has taken that process a step further and is pricing in around 50% odds for liftoff in Q2. ''Q3 liftoff is already fully priced in,'' they explained, ''followed by another hike fully priced in for Q4. This is much more aggressive than what the Fed itself anticipates, at least in the current Dot Plots. We suspect the Fed will try to push back a bit against such aggressive tightening expectations, but we are not sure that the market will listen.''

US jobs market a key event

Meanwhile, US data will be a key focus this week also. Yesterday, October ISM Manufacturing PMI came in strongly at 60.8 vs. 60.5 expected and 61.1 in September. Readings above 60 are rare and yet here we are above 60 for 8 of the past 11 months. Looking at the components, employment came in at 52.0 vs. 50.2 in September, which could be symbolic of a healthy Nonfarm Payrolls report at the end of the week where forex volatility could be highest, depending on the outcome.

''Employment component of 52.0 is the highest since July, when 57k manufacturing jobs were added out of 1.09 mln total NFP gain. All in all, this was a very solid report,'' analysts at Brown Brothers Harriman said. ISM services PMI will be reported Wednesday and so too will the ADP jobs report. The current consensus is 450k and we suspect it will creep higher.

Analysts at TD Securities argued that the US Nonfarm Payrolls likely reaccelerated in October, consistent with a fading of Delta's drag as well as a smaller education-related drop in government jobs than in September. ''We reiterate that pricing for Fed hikes remains far too hawkish, but the outlook for hikes will become increasingly dependent on the Fed's jobs mandate, setting up this week's nonfarm payroll number as a show-stealer.''

''With that said'', the analysts added, ''despite the keen focus on pricing the Fed's exit, recent pressure on gold has abated, prompting CTAs to begin to cover some of their short positions. Furthermore, a potential break higher would bring the $1830/oz level into sight, which represents a key level to shift momentum toward a notable uptrend.

Gold technical analysis

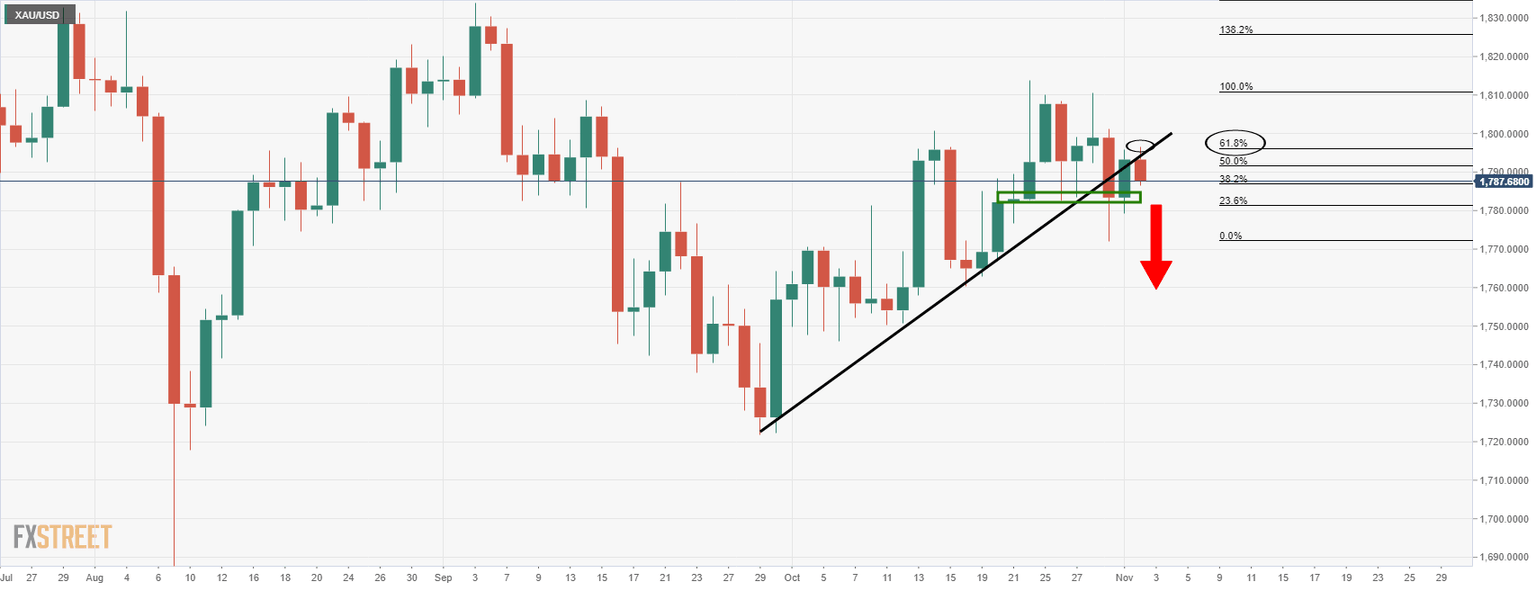

The price of the yellow metal has found the resistance of the M-formation's neckline that meets the dynamic trendline resistance also. This reinforces the prospects of a downward continuation having hit the 61.8% golden Fibonacci retracement level.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.