Gold Futures: No changes to the consolidative stance

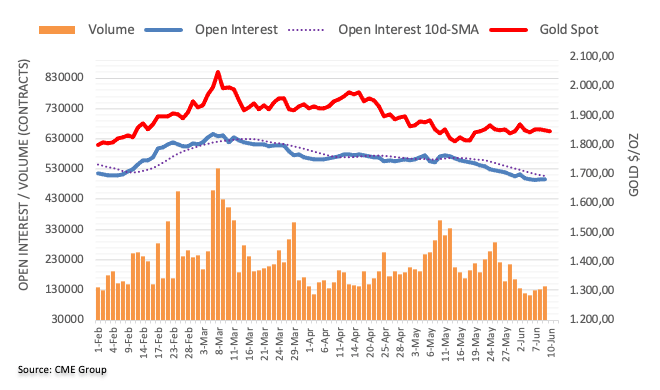

Open interest in gold futures markets resumed the downtrend and shrank by around 2.5K contracts on Thursday, according to advanced prints from CME Group. Volume, on the other hand, rose for the third session in a row, this time by nearly 10K contracts.

Gold keeps navigating around $1,840

Gold prices dropped to the $1,840 region on Thursday before ending the session a tad above this level. The bounce off this zone was amidst shrinking open interest and hints at the idea that further upside appears unlikely, leaving the ongoing consolidation largely in place for the time being.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.