Gold Futures: Further upside on the cards

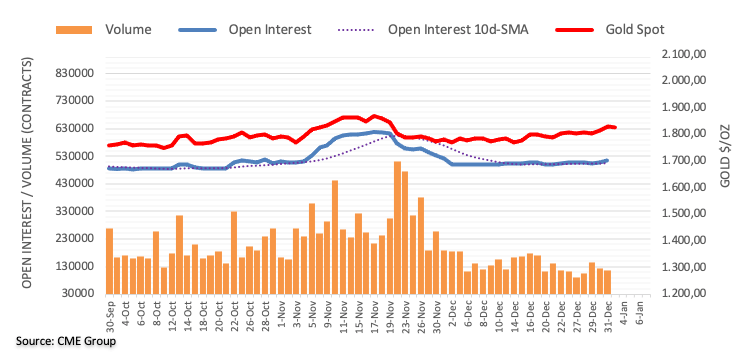

Open interest in gold futures markets rose for the second session in a row on Friday, this time by nearly 5K contracts considering flash data from CME Group. On the other hand, volume dropped for the second consecutive session, now by around 6.7K contracts.

Gold appears capped by $1,830

Prices of the ounce troy of the precious metal traded on a positive mood in the second half of last week, although the move higher seems to have met decent resistance around $1,830. Friday’s uptick in gold was amidst rising open interest, which remains supportive of extra gains going forward, at least in the very near term.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.