Gold price sees Friday's gains erased as stronger Dollar upends Gold rally for now

- Gold price firmly dips below $3,300 on Tuesday, unable to find quick support.

- Improving market sentiment due to US-EU trade talk efforts sees safe-haven demand fade.

- The Greenback meanwhile is rolling through markets and is acting as headwind after Japan considers reducing its debt issuances.

Gold (XAU/USD) price is trading near $3,290 at the time of writing on Tuesday with Risk On pushing the precious metal lower. Gold extends its decline for a second day this week as the US dollar caught up with some gains and demand for haven assets cooled, with investors also weighing prospects for improving trade relations between the US and the EU after US President Donald Trump said on Sunday that he agreed to an extension on the 50% tariff deadline on the European Union (EU) until July 9.

The stronger USD gained momentum at the end of Asian trading after the Japanese Ministry of Finance (MoF) stated that its bond issuance plan might see some tweaking, with lower volumes. This made Japanese yields collapse and saw the Japanese Yen (JPY) devalue against the US Dollar, triggering a spillover effect in favor of the Greenback against several other major currencies. A stronger US Dollar makes Gold more expensive for most buyers, and thus it is seen as a headwind.

Daily digest market movers: Looking for other metals

- Exchange Traded Funds (ETFs) flows for gold relative to peers such as silver and palladium is showing reduced demand for bullion. Accumulations into gold ETFs have turned negative this month, halting what had been the strongest stretch of monthly inflows to start the year since 2022. Meanwhile, ETFs increased their holdings of silver, platinum and palladium, Bloomberg reports.

- Demand for safer assets like Gold has been impacted as signs emerge that the White House may be making progress in negotiations with some trading partners. Gold-backed Exchange Traded Funds (ETFs) registered five straight weeks of outflows since peaking at the highest in more than a year in mid-April, Bloomberg reports.

- One of China’s biggest Gold miners is planning its second US Dollar bond offering in two weeks, the latest in a slew of global companies looking to tap growing investor interest in the precious metal. Shandong Gold Group is considering issuing a roughly $100 million perpetual bond as soon as this week. The potential sale comes after it already raised $300 million via a three-year bond offering earlier this month, Bloomberg reports.

- Harmony Gold Mining Co. has agreed to buy MAC Copper Ltd., enabling the top producer of South African Gold to gain a further foothold in Australia and increased exposure to Copper. Harmony is offering $12.25 for each MAC share, implying a total equity value for the Australian company of about $1.03 billion, Reuters reports.

- There are still tailwinds at play, with markets remaining in wait-and-see mode, weighing several risks, including the swelling US deficit, ongoing trade talks, and worsening conflicts in the Middle East and Ukraine.

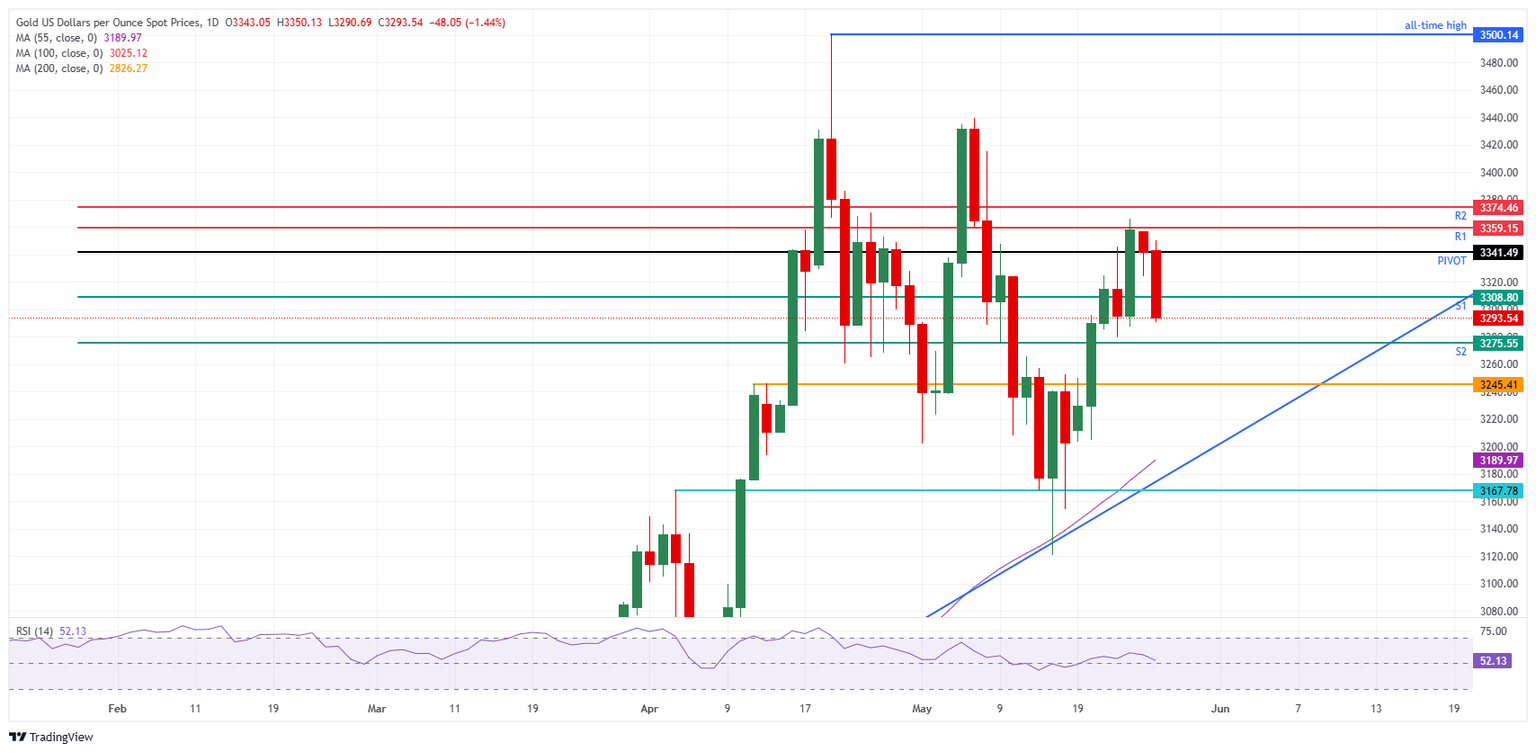

Gold Price Technical Analysis: Eking out more losses

Some downside pressure appears on Gold’s price this week. The headwinds mentioned above could be proven quite persistent, as the US Dollar has already experienced a long stretch of devaluation and is due for some recovery at the expense of the precious metal. Add some more possible positive signs on trade talks, and any prospects of Gold extending its highs might fall short of expectations.

On the upside, the daily Pivot Point at $3,341 is the first level to look out for, followed by the R1 resistance at $3,359. Further up, the R2 resistance at $3,374 follows not far behind and could open the door for a return to the $3,400 round level and potentially further course to $3,440, coinciding with May 6 and May 7 peaks.

On the other side, some thick-layered support emerges in case the Gold price declines. In case the $3,300 mark breaks, some intermediary support could come from the S2 support at $3,275. Further below, there is a technical pivotal level at $3,245 (April 11 high).

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.