Gold declines on investor disappointment at size of China stimulus

- Gold is falling to the base of its range as investors revise down their outlook for China, the world’s largest consumer of Gold.

- The precious metal is supported, however, by ETF flows and haven demand amid elevated geopolitical tensions.

- Technically, XAU/USD presses the bottom of its narrow range, threatening a downside break.

Gold (XAU/USD) exchanges hands in the $2,620s on Tuesday as the yellow metal reaches the floor of its familiar $50 range of recent weeks.

Disappointment at the limited extent of fiscal stimulus announced by China on Tuesday is a headwind for Gold, since China is the world’s largest consumer of the precious metal. Reduced chances that the Federal Reserve (Fed) will cut interest rates by another double-dose 50 basis points (bps) (0.50%) at its next meeting in November further weighs. The increasing probability that the Fed will only cut by 25 bps(0.25%), or even that it may not cut at all, is a headwind for Gold because it suggests the opportunity cost of holding the non-interest-paying asset will remain higher than previously expected.

Gold underpinned by ETF flows, haven demand

Gold finds some support, however, by data revealing continued high demand for Gold-backed Exchange Traded Funds (ETF). These enable investors to buy shares in Gold rather than purchasing actual bullion.

Net ETF inflows rose once again in September according to the latest World Gold Council (WGC) report. The level of ETF flows is often taken as a strong indicator of future demand trends.

Gold-backed ETFs added 18 tonnes of Gold in September, said the WGC report, taking total holdings to 3,200 tonnes. This resulted in cumulative inflows of $1.4 billion for the month, the fifth month of inflows in a row.

The data comes after similar results in August when Gold ETFs added $2.1bn and July, when the precious metal's ETFs attracted $3.7 billion – the highest inflows since April 2022.

Gold also continues to provide an attractive safe-haven amid rising geopolitical tensions. On Tuesday, Israel stepped up its attacks on targets in Lebanon after a Hamas bombing in southern Israel. Israeli forces further claimed to have killed a leading Hezbollah member in charge of budgeting and logistics.

In response to the relentless onslaught, which has claimed many of the group’s most senior figures, deputy leader of the group Naim Qassem said the conflict between Hezbollah and Israel “was a war about who cries first, and that Hezbollah would not cry first,” according to Reuters. He further added that Hezbollah’s capabilities were still intact.

Markets are also on tenterhooks anticipating a retaliatory attack by Israel on Iran for its ballistic rocket raid last week.

The overall trend lower in global interest rates – notwithstanding the recalibration of their trajectory in the US – puts a further floor under Gold price as it increases Gold’s attractiveness as a portfolio asset.

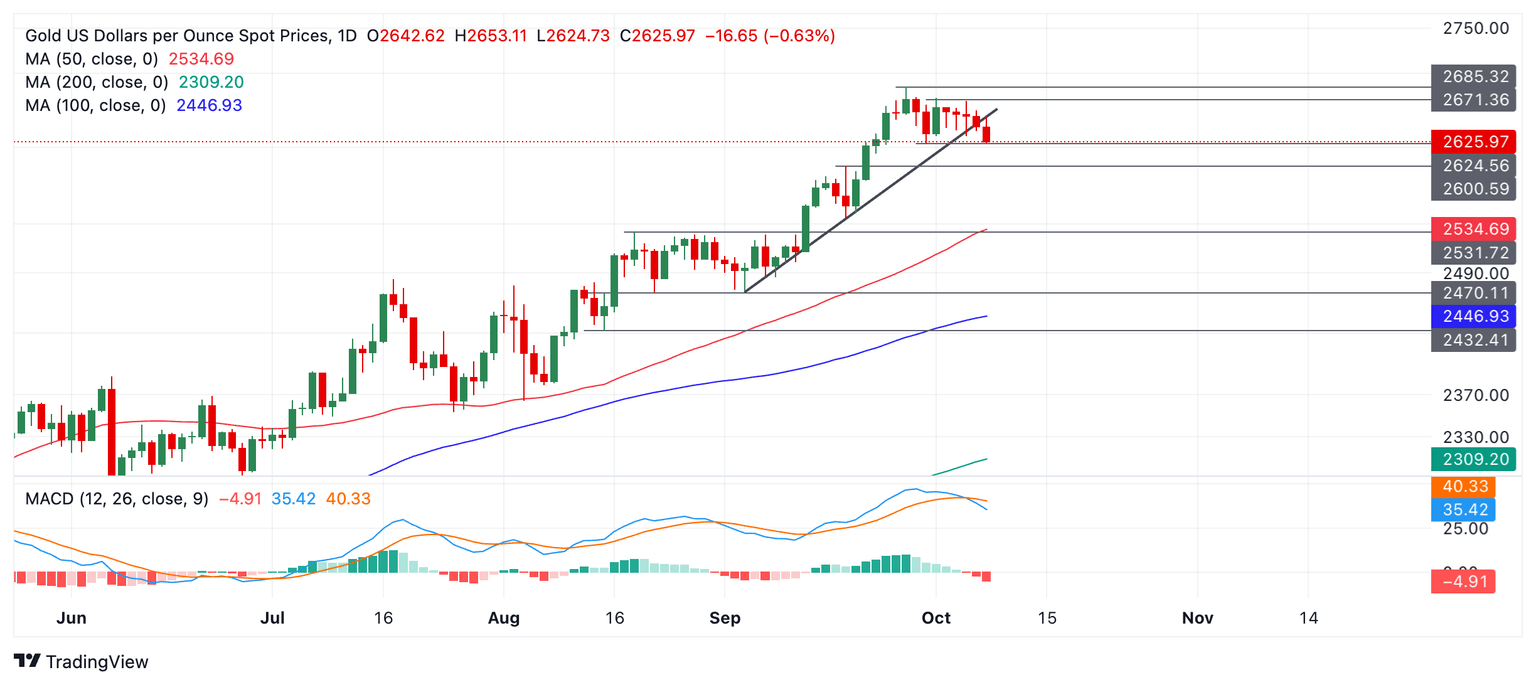

Technical Analysis: Gold tests floor of range

Gold tests the floor of its narrow week-long sideways range. The range has a ceiling at around $2,673 (October 1 high) and a floor at $2,632 (October 4 low).

XAU/USD Daily Chart

The short-term trend is sideways, and given the technical analysis principle that “the trend is your friend,” it is more likely than not to endure with price oscillating between the aforementioned poles.

A break below $2.632 would lead to a move down to at least the swing low of $2,625 (September 30 low). A break below that level would likely see prices give way to support at $2,600 (August 18 high, round number).

A break above $2,673 would increase the odds of a resumption of the old uptrend, probably leading to a continuation up to the round-number target at $2,700.

On a medium and long-term basis, Gold remains in an uptrend, with the odds favoring an eventual resumption higher once the current period of consolidation has ended.

It would require a breakout either above the top of the range or below the bottom to confirm a new directional bias.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.