Gold record-setting run remains uninterrupted; bulls eye $3,900 ahead of US data

- Gold touches a fresh all-time high on Wednesday amid a combination of supporting factors.

- The US government shutdown, geopolitical risks, and dovish Fed underpin the commodity.

- The USD touches a one-week trough and further acts as a tailwind for the precious metal.

Gold (XAU/USD) continues to scale new record highs through the first half of the European session and has now moved well within striking distance of the $3,900 mark amid a supportive fundamental backdrop. Rising geopolitical tensions, along with the US government shutdown, weigh on investors' sentiment and underpin the safe-haven precious metal. Apart from this, the growing acceptance that the US Federal Reserve (Fed) will lower borrowing costs two more times by the end of this year turns out to be another factor driving flows towards the non-yielding yellow metal.

Meanwhile, the US Dollar (USD) selling bias remains unabated for the fourth consecutive day amid dovish Fed expectations and offers additional support to the Gold. The strong move up seems rather unaffected by extremely overbought conditions on the daily chart, suggesting that the path of least resistance for the XAU/USD pair remains to the upside. That said, it will still be prudent to wait for some near-term consolidation or a modest pullback before positioning for any further gains. Traders now look to the US ADP report and the US ISM Manufacturing PMI for a fresh impetus.

Daily Digest Market Movers: Gold prolongs uptrend amid Fed rate cut bets and safe-haven buying

- Gold has risen by an impressive 45% since the beginning of 2025 and recorded gains exceeding 11% in September as profound market uncertainty continues to drive investors globally to seek refuge in traditional safe-haven assets.

- A Republican spending bill failed to pass through the Senate on Tuesday, setting the stage for a partial government shutdown from midnight. A prolonged shutdown could have an adverse effect on economic performance.

- This could further encourage more easing from the US Federal Reserve, which, in turn, is seen driving flows towards the non-yielding yellow metal and contributing to the recent strong positive move to a fresh all-time high.

- According to the CME Group's FedWatch Tool, traders are currently pricing in a nearly 95% chance of an interest rate cut at the next FOMC meeting in October and an over 75% probability of another rate reduction in December.

- The expectations seem unaffected by hawkish comments from Dallas Fed President Lorie Logan, saying that anchored inflation expectations cannot be taken for granted and that he plans to exercise caution in further reductions.

- The US Bureau of Labor Statistics (BLS) reported in the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday that the number of job openings on the last business day of August stood at 7.22 million vs 7.2 million estimated.

- Russian officials said on Monday that a move to supply US Tomahawk cruise missiles to Ukraine, for strikes deep into its territory, could trigger a steep escalation. This keeps geopolitical risks in play and benefits the safe-haven bullion.

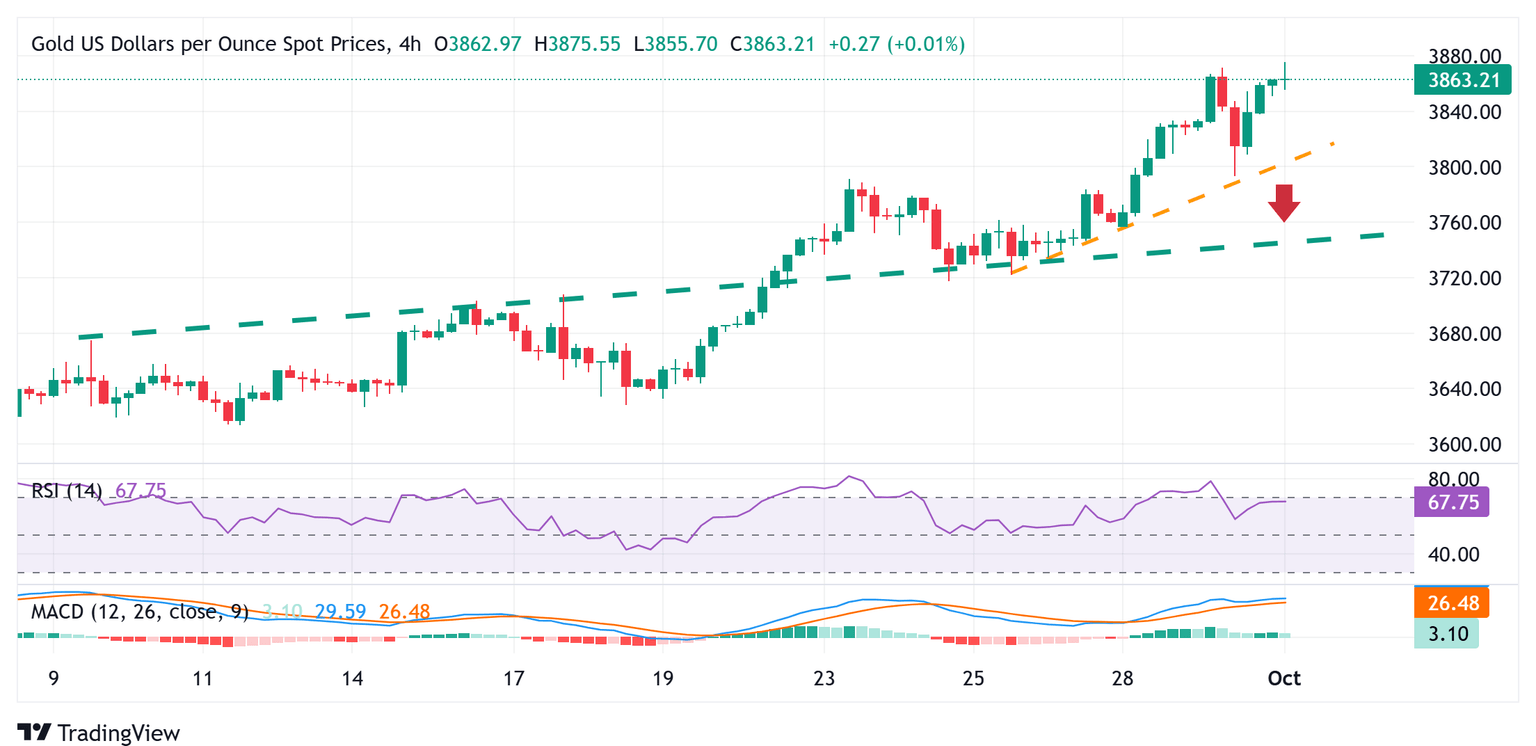

Gold bulls seem unaffected by extremely overbought conditions on short-term chart

From a technical perspective, the overnight goodish rebound from sub-$3,800 levels and the subsequent move up validate the near-term positive outlook for the Gold price. That said, the daily Relative Strength Index (RSI) remains well above the 70 mark and points to extremely overbought conditions. This, in turn, makes it prudent to wait for some near-term consolidation or a modest pullback before positioning for any further appreciating move.

Meanwhile, any corrective slide below the $3,835 immediate support is more likely to attract some buying near the $3,816 area, representing a short-term ascending trend-line. Some follow-through selling, leading to a subsequent breakdown and acceptance below the $3,800 mark, could pave the way for deeper losses and drag the Gold price to the next relevant support near the $3,758-3.757 region. The downfall could extend further towards the $3,735 support before the XAU/USD eventually drops to the $3,700 round figure.

Economic Indicator

ISM Manufacturing PMI

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The indicator is obtained from a survey of manufacturing supply executives based on information they have collected within their respective organizations. Survey responses reflect the change, if any, in the current month compared to the previous month. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). A reading below 50 signals that factory activity is generally declining, which is seen as bearish for USD.

Read more.Next release: Wed Oct 01, 2025 14:00

Frequency: Monthly

Consensus: 49

Previous: 48.7

Source: Institute for Supply Management

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers Index (PMI) provides a reliable outlook on the state of the US manufacturing sector. A reading above 50 suggests that the business activity expanded during the survey period and vice versa. PMIs are considered to be leading indicators and could signal a shift in the economic cycle. Stronger-than-expected prints usually have a positive impact on the USD. In addition to the headline PMI, the Employment Index and the Prices Paid Index numbers are watched closely as they shine a light on the labour market and inflation.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.