Gold dips under $4,200 as rising yields and Fed jitters hit bullion

- Gold falls below $4,200 as surging US Treasury yields cap upside momentum before the Federal Reserve’s rate decision.

- Geopolitical tensions, especially the Russia-Ukraine conflict, continue to support Gold’s safe-haven appeal.

- Technical analysis shows Gold’s uptrend intact, but buyers struggle to keep prices above $4,200.

Gold (XAU/USD) retreats on Monday as traders brace for the Federal Reserve (Fed) meeting, where the central bank is expected to deliver its third consecutive rate cut, ahead of 2026. At the time of writing, XAU/USD trades at $4,195, down 0.27%, after hitting a daily high of $4,219,.

US Treasury yields pressure Gold; Fed decision and geopolitics drive outlook

The rise of US Treasury yields is capping bullion’s advance, with sellers driving spot prices below $4,200. A Fed cut on Wednesday could pump Gold prices up, with the non-yielding metal tending to fare well in low-interest-rate environments, meaning that further upside is seen in the near term.

The outcome of the meeting could set the tone for Gold’s direction, as a 'hawkish cut' could cap Gold’s advance. On the other hand, the lack of progress of a peace deal between Russia and Ukraine could underpin the yellow metal, which so far is poised to end the year with gains of close to 60%.

On Tuesday, the US data docket will feature the ADP Employment Change 4-week average, alongside the Job Openings and Labor Turnover (JOLTS) report for September and October.

Daily digest market movers: US Treasury yields, pressure Gold prices

- US Treasury yields are rising. The 10-year benchmark note rate is up nearly three basis points at 4.168%. US real yields, which correlate inversely with Gold prices, are also rising three bps to 1.908%, a headwind for bullion.

- The US Dollar Index (DXY), which tracks the American’s currency performance against other six, is up 0.11% at 99.09

- Geopolitics continued to play its role with Gold prices as newswires revealed that Ukrainian President Volodymyr Zelenskiy met with European leaders in London, as Washington pressures Kyiv to agree to a proposed peace deal with Russia. Zelenskiy said that China is not interested in forcing Russia to end its war on Ukraine.

- Last week’s US inflation data, although it was unchanged near the 3% threshold, stabilized, setting the stage for another 25-basis-point rate cut. Money markets' odds for a Fed cut of that magnitude sit at 86%, according to Capital Edge data.

- Meanwhile, Morgan Stanley sees more upside in Gold, due to the falling US Dollar, demand for ETFs, central bank purchases and safe-haven demand.

- In the meantime, an earthquake hit Northeastern Japan, reported Nikkei Asia. They wrote, “A powerful quake with a preliminary magnitude of 7.6 struck northeastern Japan late Monday night, with the weather agency issuing a tsunami warning for coastal areas of Hokkaido as well as Aomori and Iwate prefectures.”

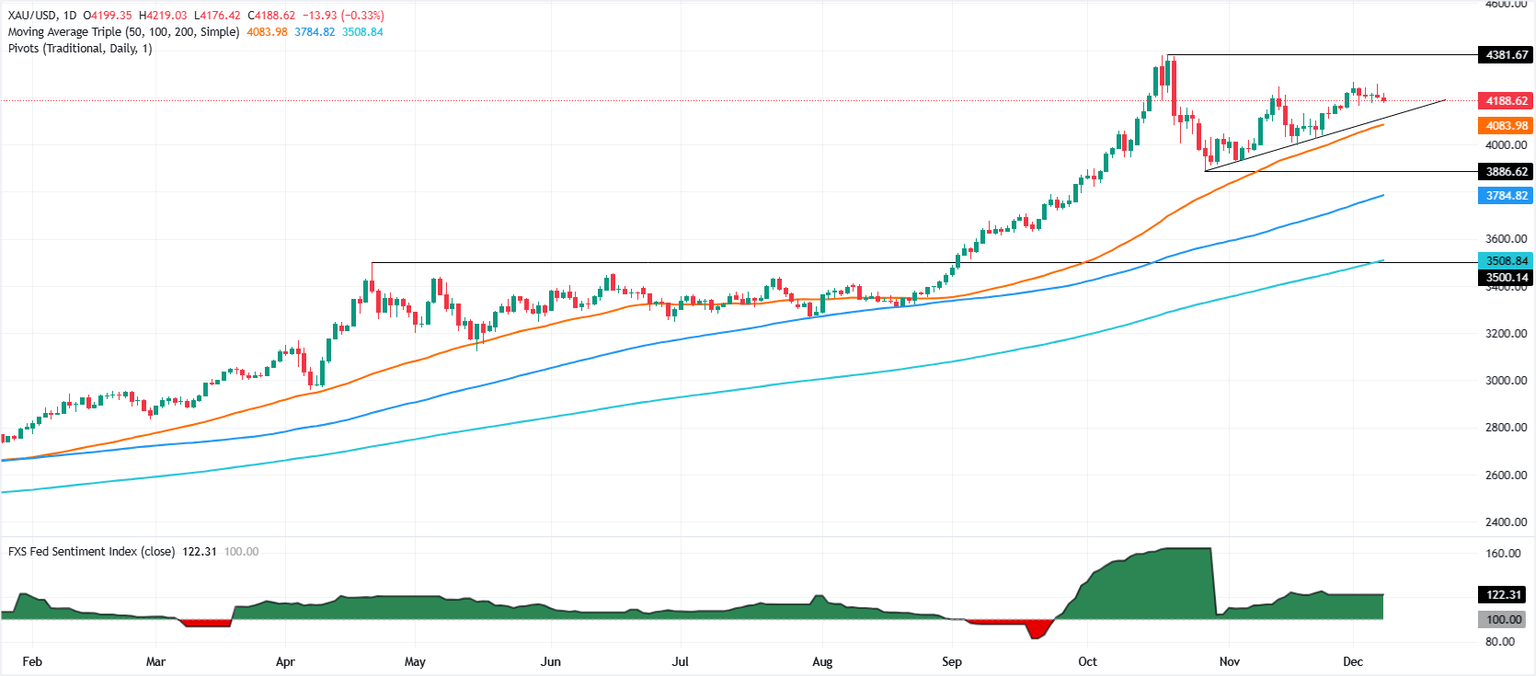

Technical Analysis: Gold price slides below $4,200

Gold’s uptrend remains intact, yet buyers were unable to keep spot prices above $4,200, which could open the door to test lower prices. Bullish momentum faded as depicted by the Relative Strength Index (RSI), which so far turned flattish, showing signs of buyer fatigue ahead of the FOMC’s decision.

If XAU/USD rises back above $4,200, expect a test of the $4,250 and $4,300. A breach of the latter exposes the all-time high of $4,381. Conversely, a drop below the 20-day Simple Moving Average (SMA) near $4,144, clears the path towards $4,100 and the 50-day SMA at $4,076.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.