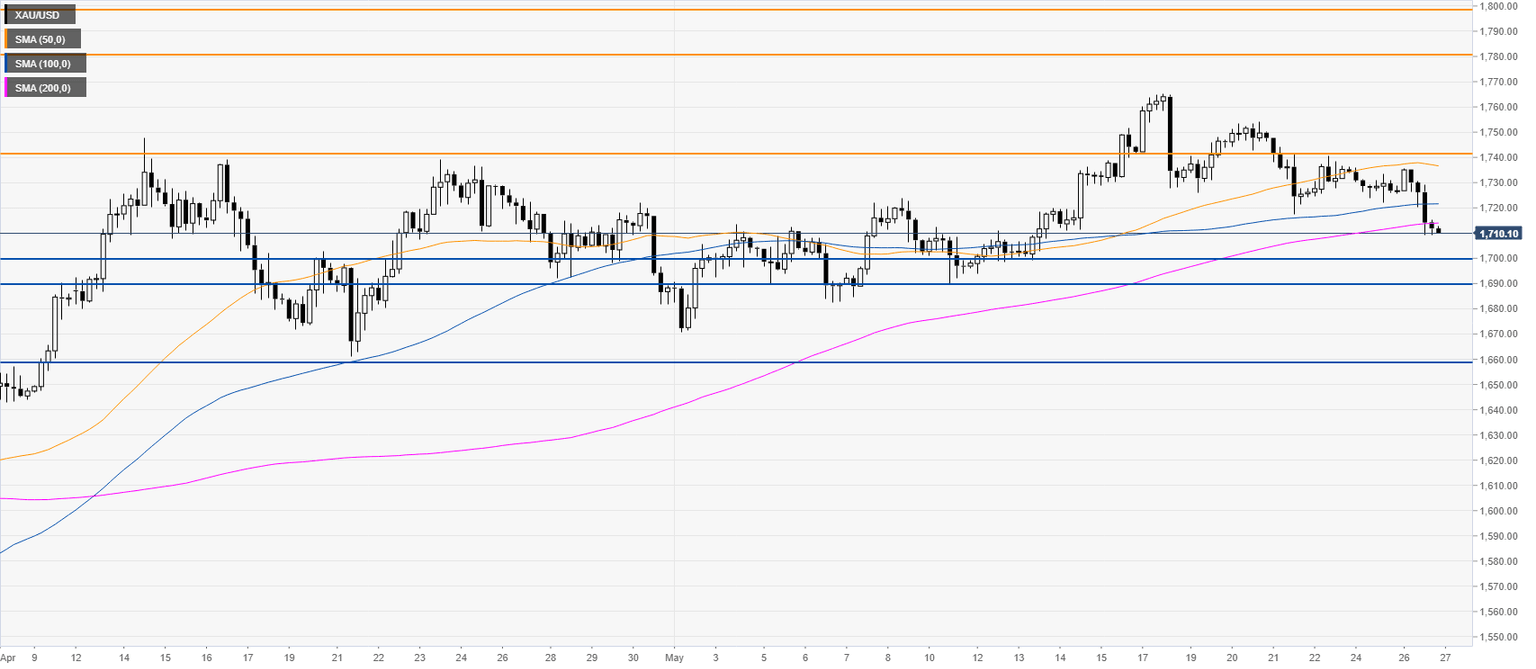

Gold Asia Price Forecast: XAU/USD consolidates gains, trades above $1700/oz mark

- XAU/USD is consolidating gains in the first half of the trading week.

- The level to beat for bulls is the 1740 resistance.

XAU/USD four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst