GNUS Stock: Genius Brands International Inc needs all of Arnold Schwarzenegger's help

- Genius Brands International Inc's shares are dropping as investors are concerned warrant handouts.

- The signing of Arnold Schwarzenegger seems to terminate the previous rally.

- Critical support awaits at $3.45 and resistance is at $4.52.

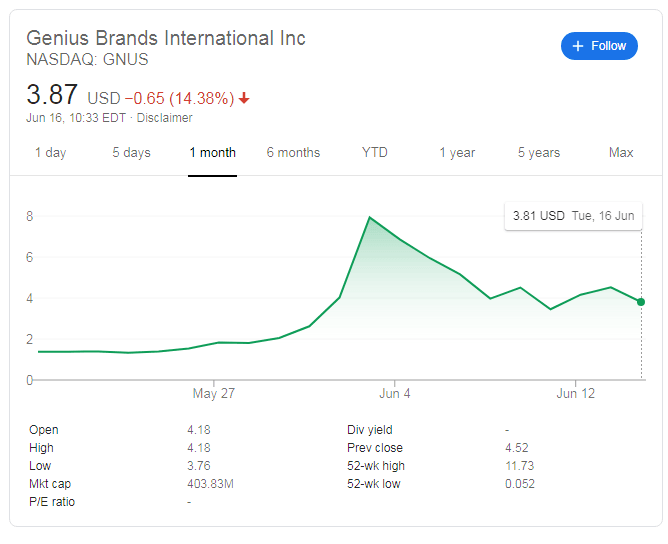

Hasta la vista baby – Arnold Schwarzenegger's famous punchline may reflect the end of the rally for Genius Brands International Inc. NASDAQ: GNUS is trading around $3.80, down some 16% while broader stock markets are enjoying a rally.

The entertainment company is launching its Kartoon Channel with Arnie as the co-executive producer of "Superhero Kindergarten" alongside Stan Lee. The famous actor – and also the former governor of California – will contribute his voice as well as join the team.

Genius CEO Andy Heyward told investors that Schwarzenegger will be compensated with warrants – and that is causing worries among investors. The firm has been diluting existing shareholders and increasing its gamble.

GNUS stock price

The stock is situated between the recent peak of $.52 and trough of $3.45 that were seen in recent days. These battle lines are the immediate ones. Tumbling below $3.45 would open the door to a free-fall toward $2 while surging above $4.52 could pave the ground for another attack on $8.

The coronavirus crisis has raised the need to keep kids entertained while they are at home and have more spare time. Launching a cartoon network seems like having significant potential, especially with the specter of a second wave of coronavirus in the US.

However, Genius – and any competitor – need robust execution and to convince shareholders they have a business case.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.