GBP/USD tumbles below 1.2700 as Fed officials push back against rate cuts

- GBP/USD extended its losses below 1.2650, with bears gaining traction toward 1.2600.

- Several Fed policymakers crossed the wires and suggested the central bank remains focused on inflation but in a more balanced way.

- On Wednesday, the UK economic docket will feature the release of inflation data, followed by growth on Thursday.

The GBP/USD extended its losses for the second straight day, spurred by the rise in US Treasury bond yields, while the Greenback (USD) trimmed some of its earlier losses on the day. The major is trading at 1.2641, down 0.31%.

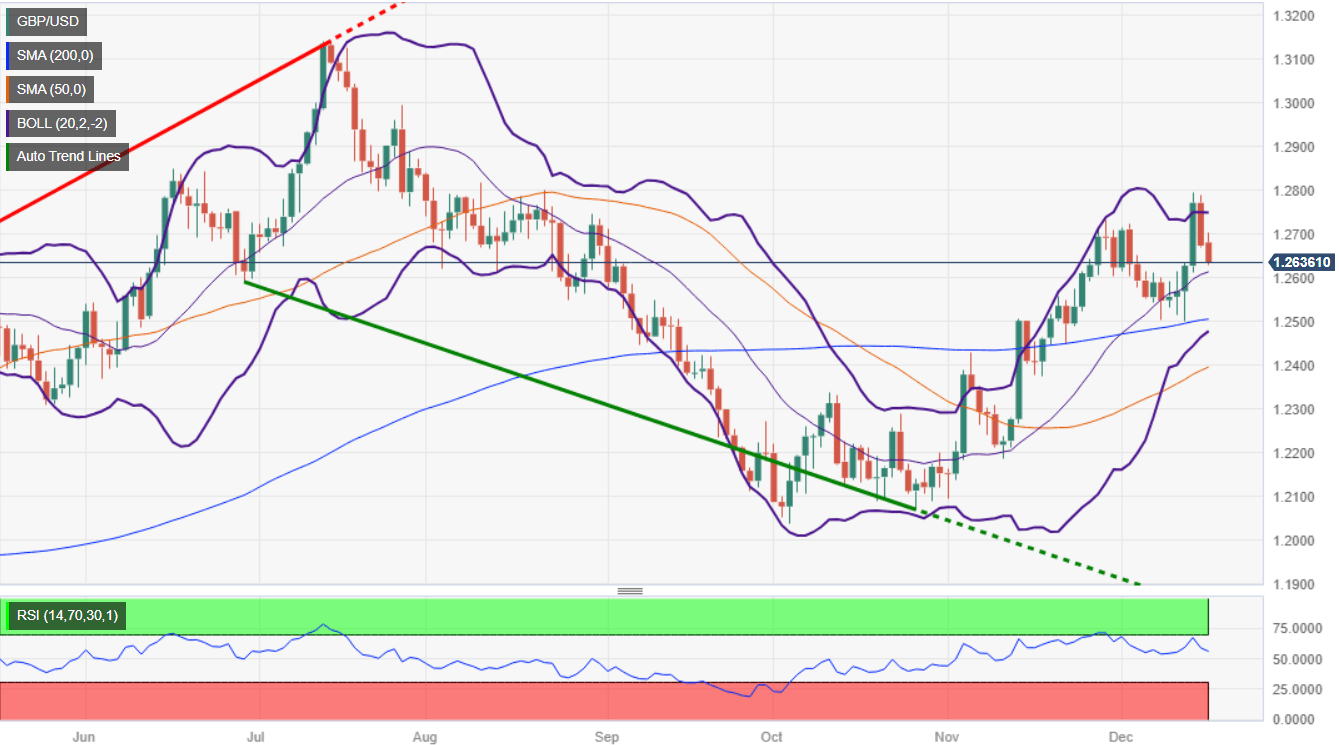

GBP bears eye a drop below 1.2500 to extend its losses below 1.2400

In the last week, the US Federal Reserve (Fed) and the Bank of England (BoE) held their latest interest rate decisions, with both central banks maintaining the reference rates unchanged but striking the financial markets with different messages. The Fed Chairman Jerome Powell delivered a dovish message, sponsoring the GBP/USD rally from around 1.2500 to 1.2793.

Contrarily, BoE’s Governor Andrew Bailey, pushed back against easing monetary policy. It should be said that once the Fed shifted toward keeping rates steady, speculators began to price in lower interest rates in central banks across the globe.

Meanwhile, traders are betting the Fed will begin to cut rates in May, as shown by data from the Chicago Board of Trade (CBOT). Fed Funds futures estimate the Fed will lower borrowing costs to 4% by the end of next year. Across the pond, the BoE is also expected to cut 80 basis points, but it would be more slowly.

Since last Friday, Federal Reserve officials have pushed back against Powell’s dovish message, led by the New York Fed President John Williams, saying that rate cut discussions are off the table. Meanwhile, Atlanta’s Fed President Raphael Bostic said they must remain resolute on fighting inflation despite projecting two rate cuts and a soft-landing next year. Recently, the Chicago Fed President, Austan Goolsbee, stated he sees an improvement in inflation and added the Fed would not want to recommit to what they will do at future meetings.

In the meantime, the US economy posted solid data, showcasing its resilience. Across the pond, the UK economy so far has dodged a recession, but Tbursday’s data could paint a stagflationary scenario of high inflation and an economy in recession. That could be US Dollar positive and trigger a leg-down towards the 200-day moving average (DMA) at 1.2504.

GBP/USD Price Analysis: Technical Levels

The pair is bullish-biased, sitting above the DMAs, with the 50-DMA about to cross above the 100-DMA, suggesting the formation of a golden cross is looming. Once the 50-DMA surpasses the 1.2449, that would pave the way to register a golden cross at around 1.2504. On the other hand, the pair could turn bearish if it breaks key support level at 1.2504, the 200-DMA, followed by the November 14 swing high turned support at 1.2505.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.