GBP/USD Technical Analysis: Hampered by resistance, aiming below 1.2600

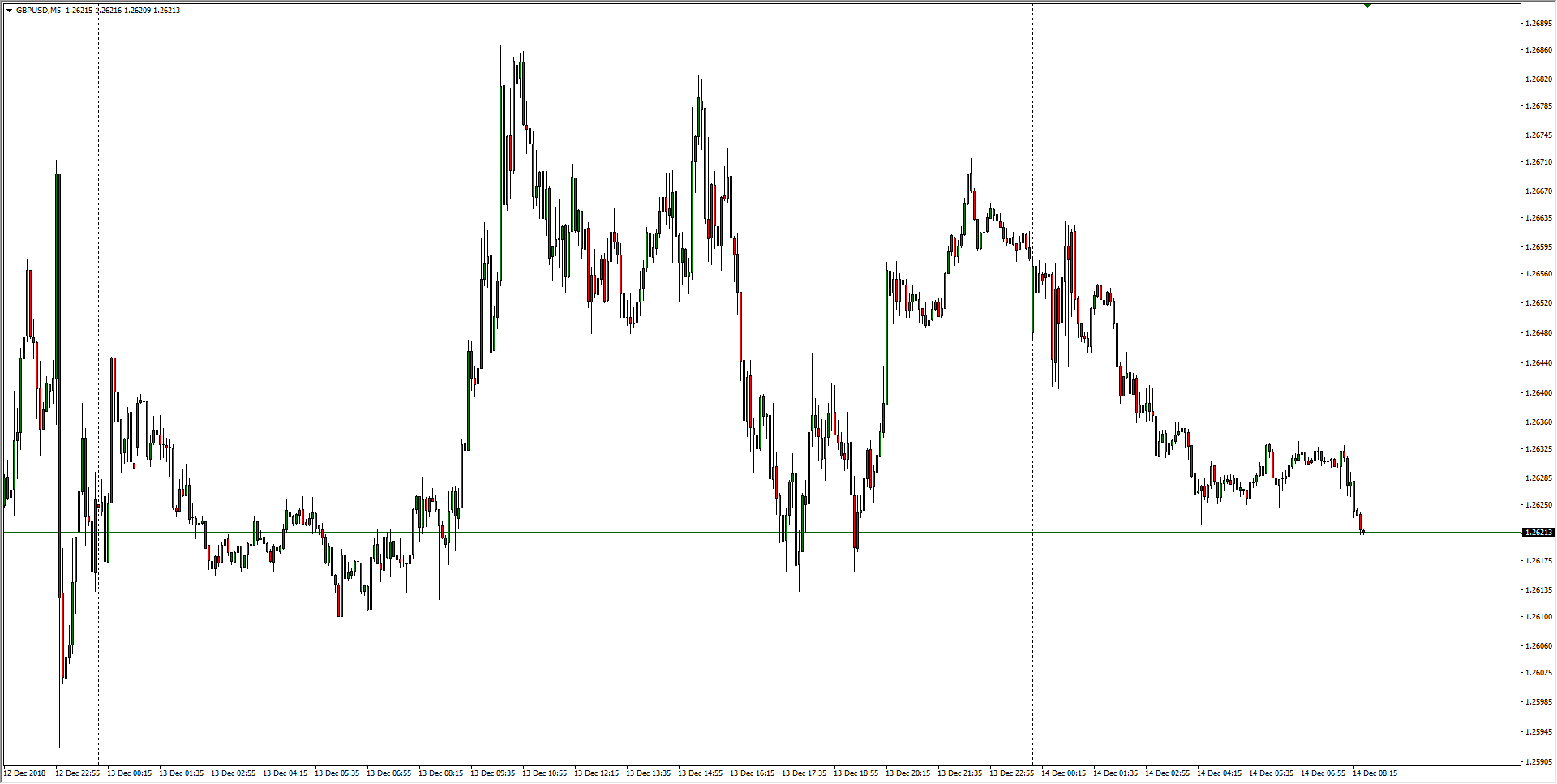

- Intraday action on GBP/USD remains underpinned by soft support from the 1.2600-12615 zone, and swings higher continue to fail to develop meaningful momentum as the Sterling continues to be cowed by Brexit headlines.

GBP/USD, 5-Minute

- The past two weeks have seen the Cable break near-term consolidation to mark in a new 20-month low at 1.2477, and the bullish recovery saw stiff new resistance priced in at the previous support level of 1.2670.

GBP/USD, 30-Minute

- The past two months sees the GBP/USD pairing stuck in a bearish cycle, accelerating out of the regular selling zone, and the bullish bounceback has seen the Cable return to a nominally bearish cycle as bidders get pushed back into the overarching bear-trend.

GBP/USD, 4-Hour

GBP/USD

Overview:

Today Last Price: 1.2628

Today Daily change: -37 pips

Today Daily change %: -0.292%

Today Daily Open: 1.2665

Trends:

Previous Daily SMA20: 1.2746

Previous Daily SMA50: 1.29

Previous Daily SMA100: 1.2937

Previous Daily SMA200: 1.3263

Levels:

Previous Daily High: 1.2688

Previous Daily Low: 1.2593

Previous Weekly High: 1.284

Previous Weekly Low: 1.2659

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2629

Previous Daily Fibonacci 61.8%: 1.2651

Previous Daily Pivot Point S1: 1.2609

Previous Daily Pivot Point S2: 1.2554

Previous Daily Pivot Point S3: 1.2515

Previous Daily Pivot Point R1: 1.2704

Previous Daily Pivot Point R2: 1.2743

Previous Daily Pivot Point R3: 1.2798

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.