GBP/USD Technical Analysis: Breakdown into 1.2500 signalling further declines

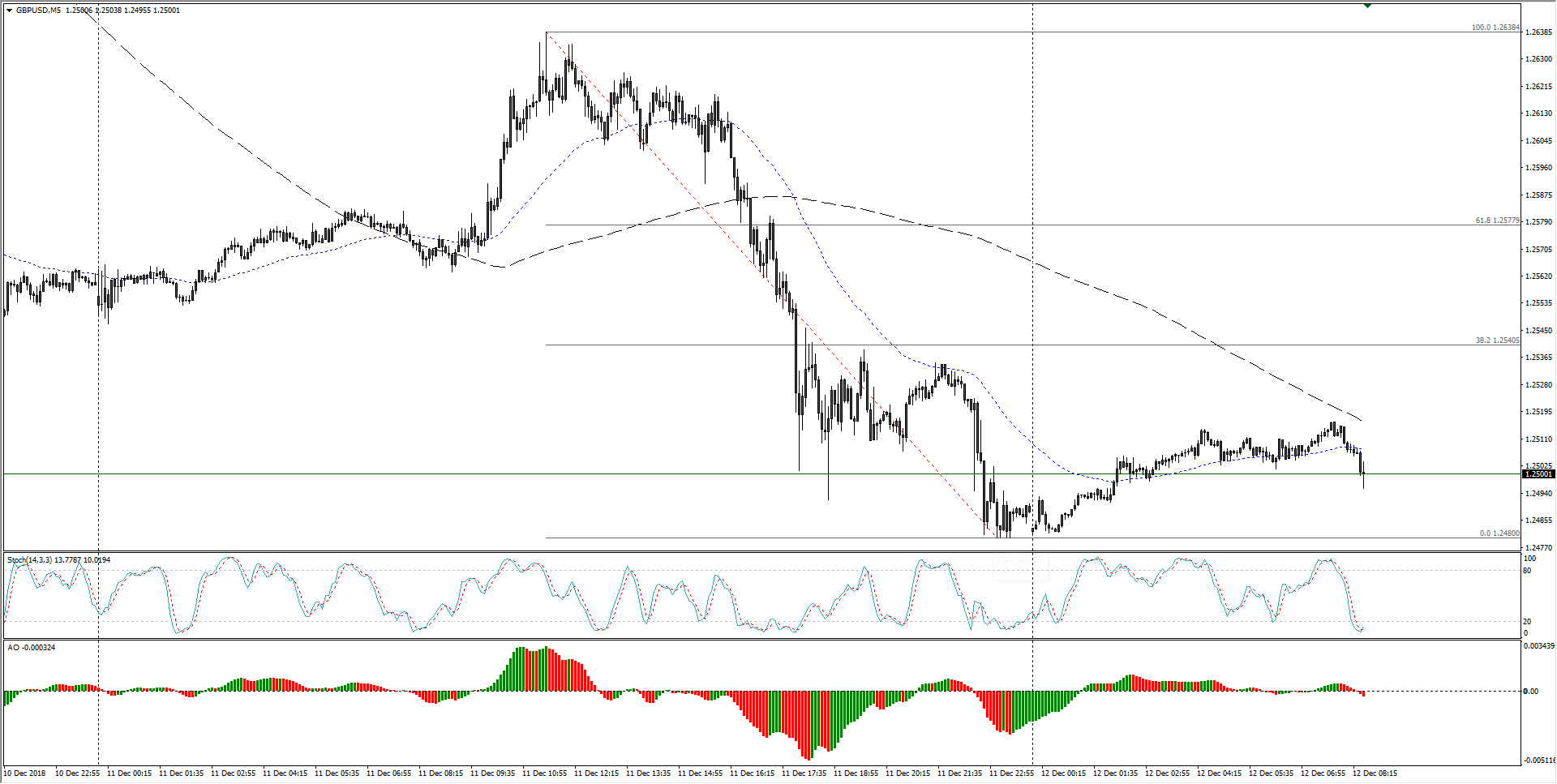

- The last twenty-four hours see the GBP/USD pairing testing the downside of the 1.2500 major handle, and intraday support rests at Tuesday's bottom of 1.2480 with intraday resistance priced in at the 38.2% Fibo retracement of 1.2540.

GBP/USD, 5-Minute

- The Cable has crossed a critical inflection point after pricing in a near-term lower high below the 1.2650 zone after the pair's floor collapsed, and now the pair is challenging into a new region.

GBP/USD, 30-Minute

- Looking to the medium-term, linear regression suggests that the Cable could be due for a retracement to the midline, but with this key level also falling below the previous 1.2650 support level, a move back into the range is likely to see a reload on short positions for a break lower.

GBP/USD, 1-Hour

GBP/USD

Overview:

Today Last Price: 1.2509

Today Daily change: 12 pips

Today Daily change %: 0.0960%

Today Daily Open: 1.2497

Trends:

Previous Daily SMA20: 1.2769

Previous Daily SMA50: 1.2913

Previous Daily SMA100: 1.2946

Previous Daily SMA200: 1.3275

Levels:

Previous Daily High: 1.2639

Previous Daily Low: 1.2481

Previous Weekly High: 1.284

Previous Weekly Low: 1.2659

Previous Monthly High: 1.3176

Previous Monthly Low: 1.2723

Previous Daily Fibonacci 38.2%: 1.2542

Previous Daily Fibonacci 61.8%: 1.2579

Previous Daily Pivot Point S1: 1.2439

Previous Daily Pivot Point S2: 1.2381

Previous Daily Pivot Point S3: 1.2281

Previous Daily Pivot Point R1: 1.2598

Previous Daily Pivot Point R2: 1.2698

Previous Daily Pivot Point R3: 1.2756

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.