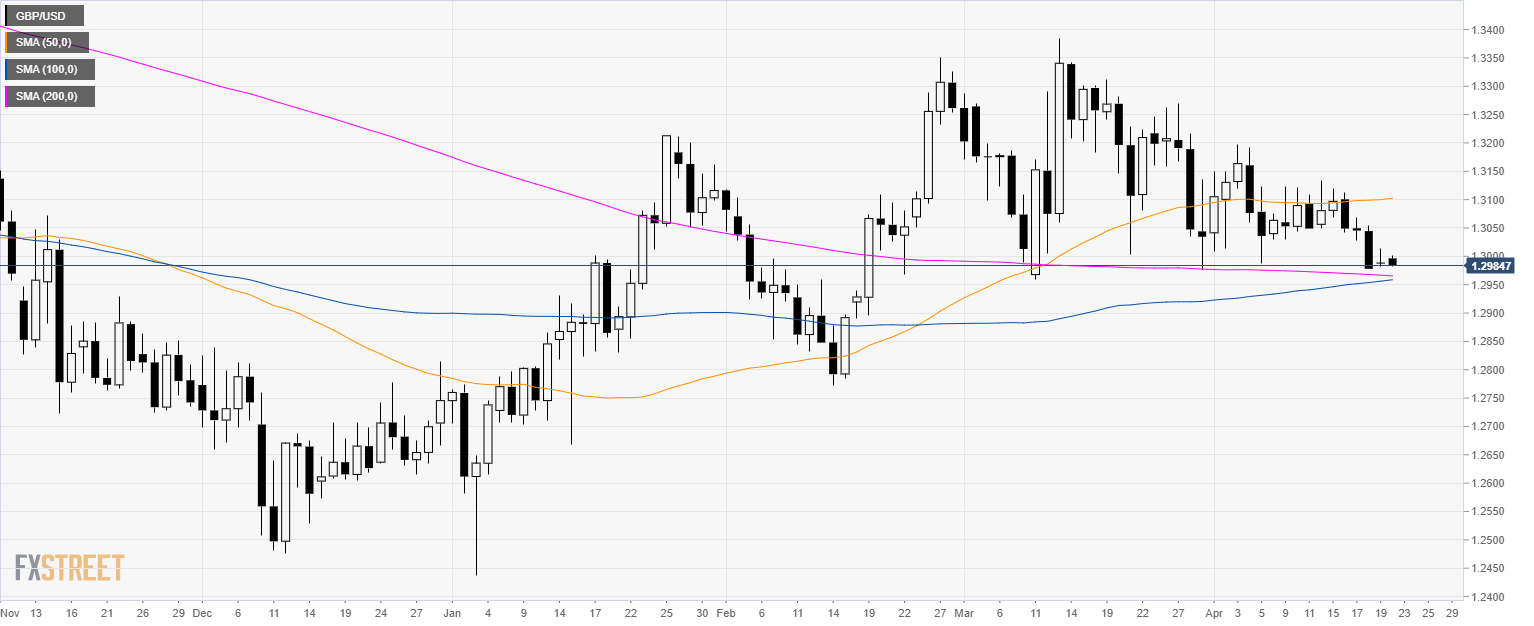

GBP/USD Technical Analysis: 1.1280 intraday support in play on Easter Monday

GBP/USD daily chart

- GBP/USD is trading in a consolidation above its 200-day simple moving average (SMA).

- Volatility is likely going to be limited on Easter Monday.

- GBP/USD is hovering above 1.2950 key support.

GBP/USD 30-minute chart

- The market is trading below its main SMAs suggesting a negative bias in the short-term.

- 1.2880 is a key intraday support and a break below would open the gates to 1.2950 level.

- Alternatively, a bounce at 1.2880 can lead to a recovery to 1.3000 and 1.3020 level

Author

Flavio Tosti

Independent Analyst